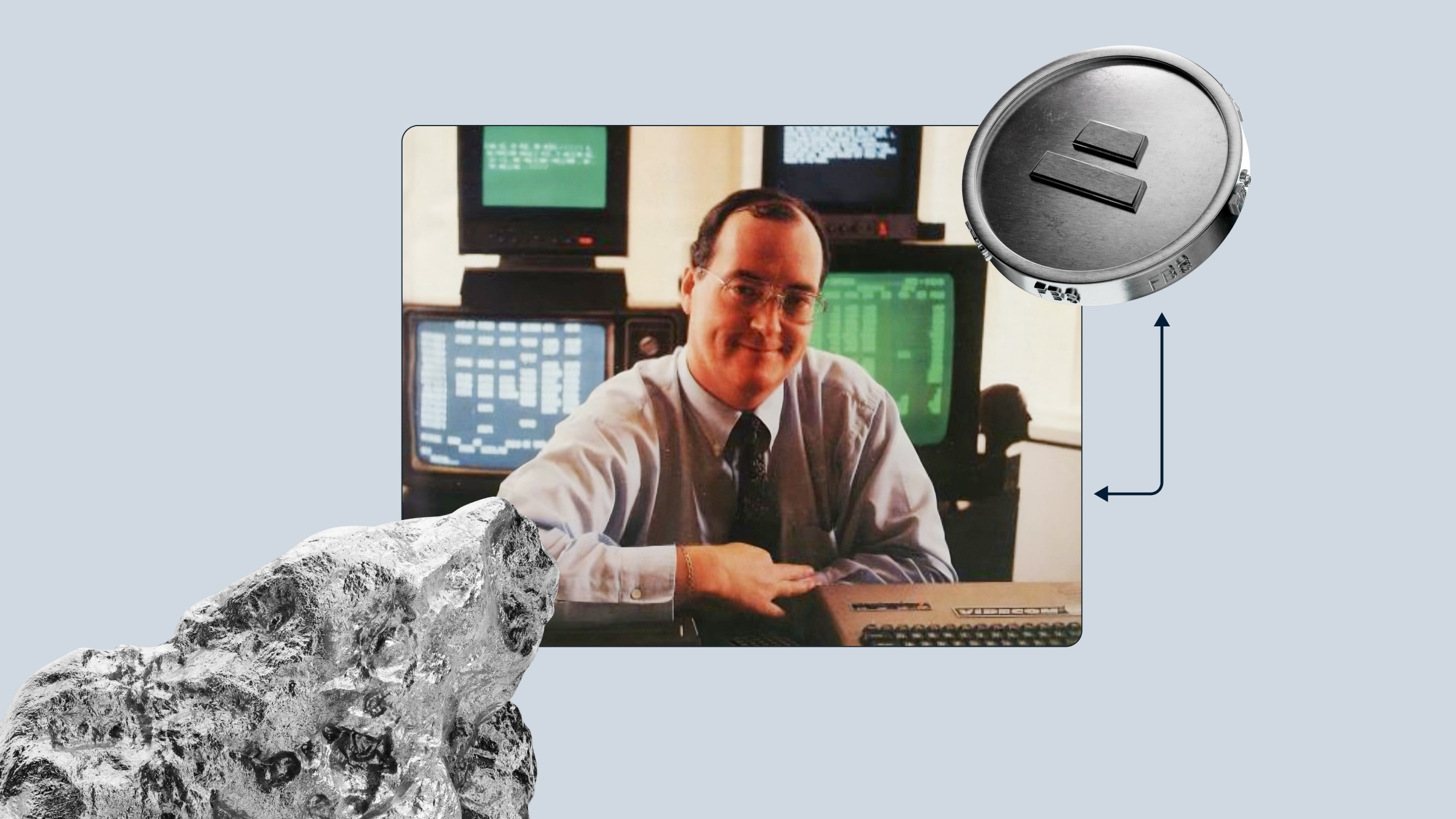

The so-called “Prince of the Pit” was born on the South Side of Chicago in 1949 in a poor Irish Catholic family, where only the father worked as utilities cleaner. Dennis became an order runner on the trading floor of the Chicago Mercantile Exchange at age 17. A few years later, he began trading for his own account at the MidAmerica Commodity Exchange, an entry-level floor where "mini" contracts were traded. To circumvent a rule requiring traders to be at least twenty-one years of age, he worked as his own runner, and hired his father, who traded in his stead in the pit. That’s how he got his moniker.

Dennis earned a bachelor's degree in philosophy from DePaul University, then accepted a scholarship for graduate study in philosophy at Tulane University, but then changed his mind, and returned to trading. He borrowed $1600 from his family, which after spending $1200 on a seat at the MidAmerica Commodity Exchange, left him with $400 in trading capital. In 1970, he increased this to $3000 by trading, which he described as "compared to $400... a real grubstake." By 1973 his capital was over $100 000. He made a profit of $500 000 trading soybeans in 1974, and by the end of that year he was a millionaire.

The freshly baked millionaire believed that successful trading could be taught. To settle a debate on that point with William Eckhardt, a friend and fellow trader, Dennis hired and trained 21 men and 2 women, in two groups — one from December 1983, the other from December 1984. Dennis trained these groups, known as “turtles,” for only two weeks, to use a simple trend-following system, trade a range of commodities, currencies, and bond markets, buy when prices increased above their recent range, and sell when they fell below their recent range.

Newbie traders were taught to cut position size during losing periods and to pyramid aggressively — up to a third or a half of total exposure, although only 24% of total capital would be exposed at any one time. This type of trading system will generate losses in periods when the market is range bound, often for months at a time, and profits during large market moves. Then, he gave each of them a million dollars of his own money to manage. When his experiment ended five years later, his “turtles” had reportedly earned an aggregate profit of $175 million. Fantastic result, isn’t it?

Alongside training the turtles, Dennis began managing capital for private clients. He withdrew from this area in 1988, however, following heavy client losses during the crash of 1987 known as Black Monday. The year after the crash, Dennis decided to pack up his diminished fortune, estimated at $200 million, and move on to another pursuit: politics. He said he aimed to invest in causes and candidates that reflected a philosophy he described as "an idiosyncratic mix of economic free markets and liberal social policies."

Richard Dennis trading strategy

These are not the exact buy and sell rules of Richard Dennis’s strategy. There are books or websites out there that have details of his exact trading strategy, but the overall methodology of how he trades are listed below:

1. Markets – What to buy or sell

The first decision is what to buy or sell, or essentially, what markets to trade. If you trade too few markets you greatly reduce your chances of getting aboard a trend. At the same time, you don’t want to trade markets that have too low a trading volume, or that don’t trend well.

2. Position sizing – How much to buy or sell

The decision about how much to buy or sell is absolutely fundamental, and yet is often glossed over or handled improperly by most traders.