Disposition

So, we have Alphabet (Thursday, 2330 MT), Amazon (Friday, 0030 PT), and Facebook (Friday, 0100 MT) reporting at the end of this week. This will surely have an impact on the stock market. Remember that the recent advance of the S&P was largely based on the tech stocks rally, and mostly those giants. Therefore, if the market is pleased with the Q2 results, we are likely to see another rally – at least, for those stocks. If not – well, the stock market is already cooling down after the rally in the middle of July.

In general, the results of the second quarter of 2020 are supposed to be relatively weak. They will reflect the performance that took place in March, April, and May – the months that suffered the most from the virus. So the question will be how correct the market will in predicting the weakness of these results. However, this weakness is expected to be exactly relative as some indicators for some companies may as well grow: in the end, Google, Amazon, and Facebook have been significantly outperforming the S&P.

So what do we have in store for each of those companies?

Alphabet

Google’s stocks already surpassed the pre-virus high and currently trade at $1 500 per share. Being in a local dropdown, the trajectory hasn’t broken the overall uptrend yet – rather, slowed it down. Wall Street expects to hear $37.4bln in revenue and $8.23 in earnings per share on Thursday night – that would make a 4% and 42% decrease respectively for each indicator compared to 2019.

If the actual information matches these expectations, the stock price will easily make it back up to the ranges of $1 600 in a few days. If not – the rise will slow down and may even convert into something more bearish.

Amazon

This is definitely the best performer among the three. There is no need to justify it – it is easily visible. The growth of this stock was the least damaged and the most boosted by the virus. It currently trades at $3 000 experiences a consolidation similar to the other two.

A 28% increase in the revenue up to $81bln is predicted by Wall Street observers, while the EPS is expected to fall by 75% down to $1.32 compared to 2019. Judging the actual results will not be as straightforward as for Google and Facebook, but one thing is for sure: if Amazon beats these results, it may go really aggressive getting up to $3 500 in no time.

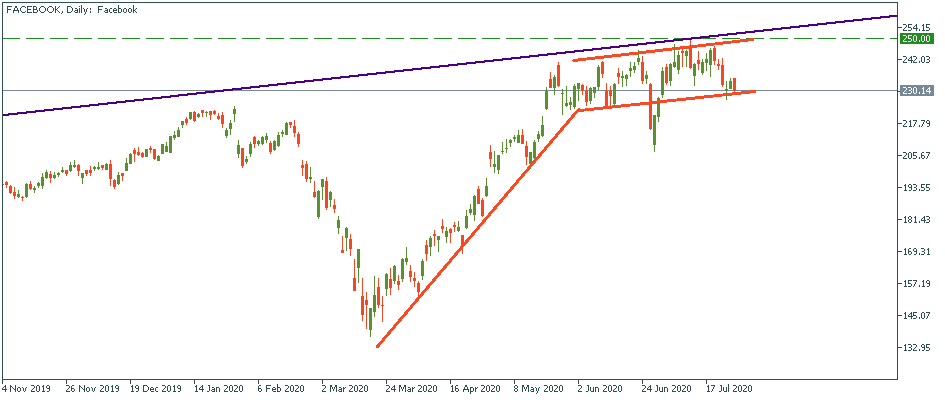

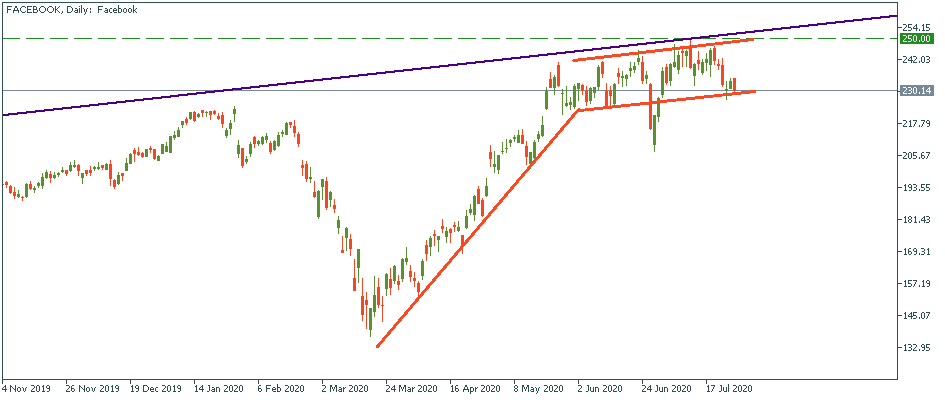

Facebook

From the technical perspective, the situation with Facebook resembles that of its peers but is a bit different. This stock not only surpassed the pre-virus level but already took the same march upwards it was in until February. On the other hand, it has been in a slowed down channel longer than Google, for example, and appears to have more volatility, especially recently. In general, the emotional surrounding of Facebook appears to be more tense and susceptible to shifts.

On the other hand, Facebook is expected to show some good results: $17.4bln of revenue and $1.39 earning per share are a forecast for the Q2. As long as the company meets these expectations, its stock will take a stronger march upwards again.

LOG IN