3 types of sandwich generation people and their characteristics

The sandwich generation isn’t one-size-fits-all, and people experience it differently based on their situations. Let’s look at three specific types:

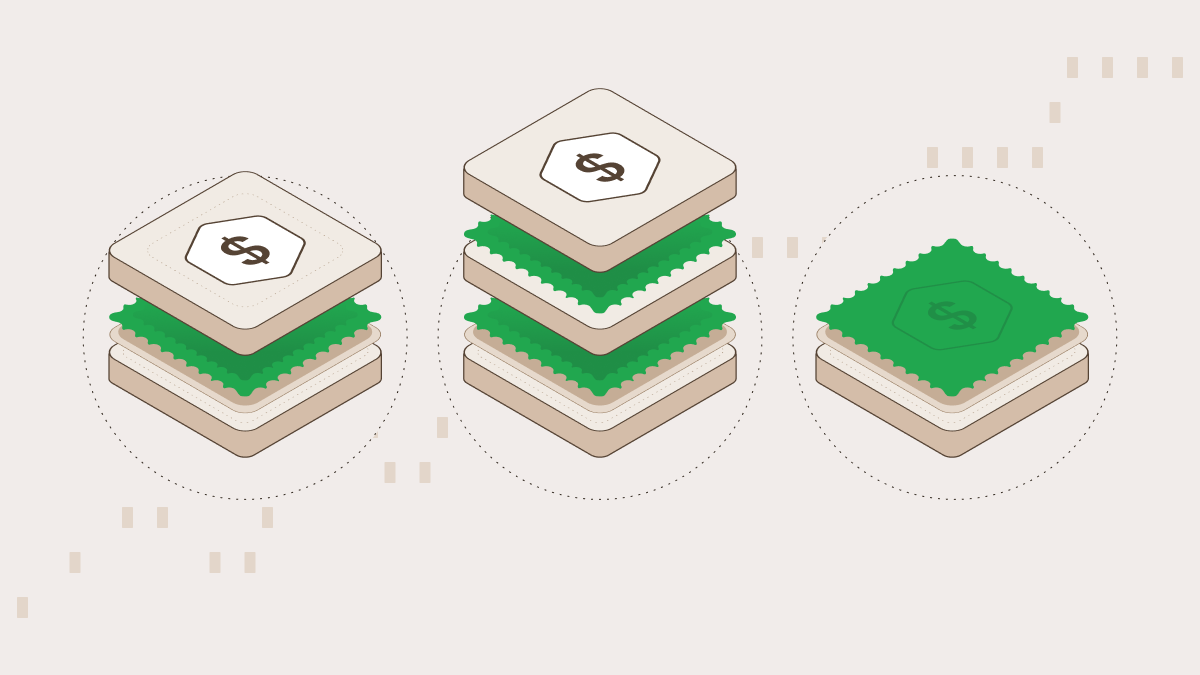

| Traditional sandwich generation |

Club sandwich generation |

Open-faced sandwich generation |

| This group matches the usual meaning of sandwich generation — juggling the responsibilities of raising their kids while also caring for aging parents. |

This type takes the traditional model a step further. The meaning of sandwich generation, in this case, is that not only are they looking after their children and parents, but they might also be caring for grandparents or other relatives. With so many layers of caregiving, the emotional and financial pressures really pile up. |

Here, the meaning of sandwich generation is individuals focusing more on caring for their older relatives or parents without having young children at home. However, they may still be involved with adult kids or younger family members. Their main challenge is managing the healthcare and living arrangements for their aging loved ones. |

Challenges of the sandwich generation

Now that you understand what the sandwich generation is, let’s look at a couple of problems and possible solutions to them.

Difficulty in self-care

Unexpected visitors that disrupt your schedule and personal time are a common problem for the sandwich generation. Set clear visiting hours to maintain your routine. If someone drops by unannounced, feel free to ask for their help!

Also, with a packed schedule, you might feel like you’re always busy, which leads to burnout. Make time for regular breaks — whether it’s a quick meditation, a workout, making some financial moves, or just some quiet time. Treat these breaks as must-do appointments.

Focusing so much on caregiving can make you feel lonely. Make an effort to connect socially and schedule outings with friends or join community activities. These interactions will provide a much-needed emotional boost and a break from your responsibilities.

Health issues from caring for parents and kids

The stress we mentioned above can be linked to serious health issues because people neglect their own needs. They skip doctor’s appointments, opt for takeout instead of preparing healthy meals, or miss out on exercise altogether. Even though these choices save time, they can result in fatigue and health issues like obesity and diabetes.

Make sure to schedule regular check-ups and incorporate small, manageable forms of exercise into your daily routine, like a short walk or stretching. Meal prep can also make a difference.

Balancing personal life and career

Sandwich generation caregivers dedicate billions of hours each year to providing unpaid care. Still, many of them often feel invisible and unappreciated both in their places of work and in their personal lives.

Difficulty concentrating on household and office work

Many people in the sandwich generation struggle with a poor work-life balance. Caregivers usually find it hard to concentrate, which affects their productivity at home and work.

What can help is establishing separate, designated times for work and family responsibilities. Also, use tools like calendars or to-do lists, and ideally, seek support from family or friends to lighten the load.

Impact of stress and inability to prioritize

As priorities become muddled, caregivers may miss deadlines, forget appointments, or neglect their lives in general. This only exacerbates feelings of burnout and frustration from financial burden. Don’t ignore these feelings. Instead, tackle them using some of the strategies mentioned earlier.