Dua tahun terakhir mencatat perubahan terbesar minyak dalam 14 tahun terakhir, yang telah membingungkan pasar, investor, dan trader karena masalah geopolitik dan pergeseran menuju energi terbarukan.

Diperbarui • 2022-12-16

The current demand in the growth stocks is hard to underestimate. Some analysts wonder whether the uptrend for this type of equities will continue. According to Morgan Stanley, it will. In the latest report, Morgan Stanley listed the companies which it expects to grow greatly in the future. It is called “Secular Growth Stocks” and it includes the companies that can deliver strong and sustainable growth, good competitive advantages, effective product cycles, gains in market share or pricing power. The researchers applied both fundamental and quantitative practices to choose the best stocks.

From a quantitative perspective, they paid attention to the following metrics:

Companies that entered the top 1,500 in market capitalization during the last year were also considered as candidates.

Fundamentally, analysts took into account overweight or equal weight stocks, attractive annual growth rate, and earnings-per-share forecasts from 2019 to 2022.

At the same time, analysts added some stocks which did not meet the criteria but had the best growth potential.

Below, we describe the top ideas chosen by Morgan Stanley listed in descending order of forecast 2019-2022 compound annual growth rate (CAGR) for revenue.

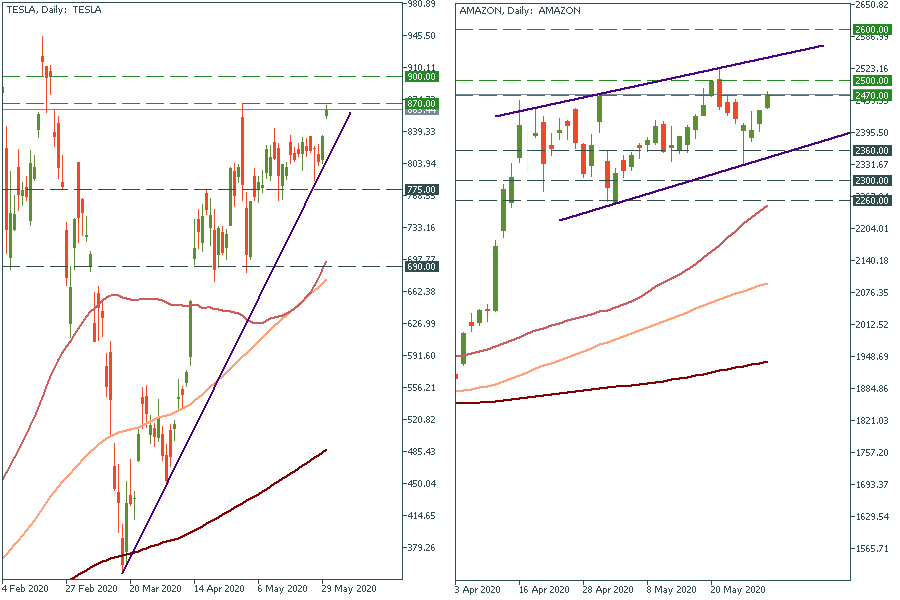

Revenue CAGR% 2019-2022 estimate: 25.5%

The company plans to sell more than 2 million electric cars per year by 2030. This is 5 times bigger than the current level. If the company continues its strong performance, the retest of the $870 level will be highly possible. The next key level on the upside will lie at $900. On the downside, bears will be targeting the lower level of the consolidation range at $775. The next support will be placed at $690.

Revenue CAGR% 2019-2022 estimate: 19.4%

The company’s advantage looks obvious. The e-commerce sector is growing amid the global switch to remote activities. Moreover, the demand is growing higher than the company’s ability to build new storages or hire workers. At the moment, bulls are pushing the price of the stock towards the $2,470 level. The $2,470-2,500 zone acts as a strong resistance for buyers. If they manage to overcome it, the rise towards a new all-time high at $2,600 will be highly possible. The downward movement is limited by the $2,360 level. In case of a breakout, bears will be targeting $2,300.

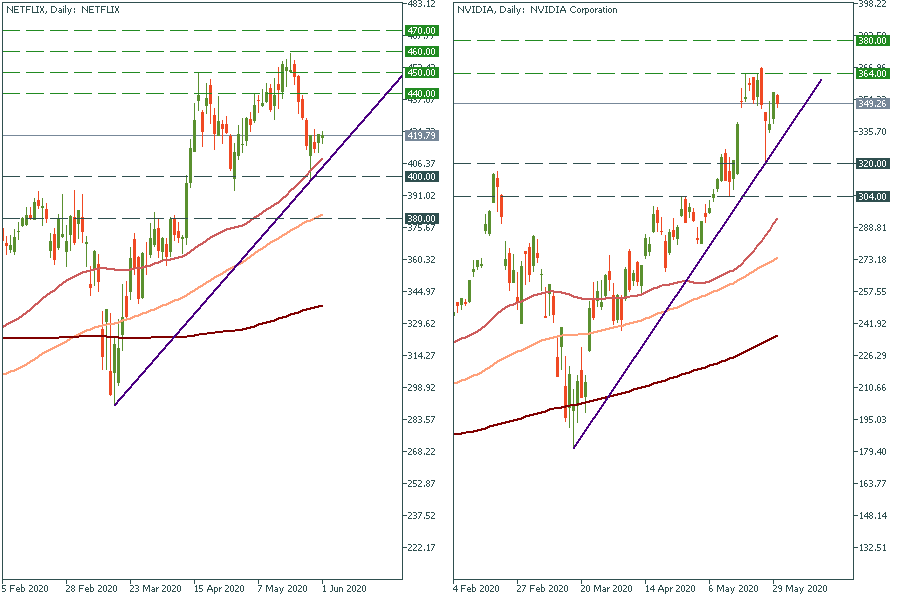

Revenue CAGR% 2019-2022 estimate: 17.6%

Of course, one of the interesting choices by Morgan Stanley is Netflix. The streaming service is developing due to its rapidly growing subscription pool. Therefore, analysts expect the stock of Netflix to stabilize towards $440 and $450 levels. In that case, the retest of the $460 level will be highly possible. At the same time, this kind of bullish momentum may push the price of the stock to the $470 level. The support levels lie at $400 and $380 (100-day SMA).

Revenue CAGR% 2019-2022 estimate: 17.1%

For the first time in three years, Nvidia presented a new processor Ampere, which can significantly increase its revenue. For now. The price of the stock is moving within an uptrend. The first resistance for buyers is placed at $364. After that, they will be targeting the $380 level. For bears, the first support will be placed at $320. If this level is broken, the next level will lie at $304.

If you want to trade these stocks with FBS, follow the simple rules:

Dua tahun terakhir mencatat perubahan terbesar minyak dalam 14 tahun terakhir, yang telah membingungkan pasar, investor, dan trader karena masalah geopolitik dan pergeseran menuju energi terbarukan.

Setelah berbulan-bulan tekanan dari Gedung Putih, Arab Saudi mengalah dan setuju dengan anggota OPEC+ lainnya untuk meningkatkan produksi.

Semakin banyak analis percaya bahwa minyak Brent akan melampaui $100 per barel. Jadi, seberapa kuat minyak akan menggerakkan pasar, dan bagaimana arah pergerakannya? Mari kita cari tahu!

Yen Jepang gagal memikat para investor pada perdagangan Selasa (02/04/2024) meski ada peluang atas kemungkinan intervensi dan..Sentimen penghindaran risiko masih berpotensi memberikan kekuatan pada safe-haven

XAUUSD naik ke rekor tertinggi baru pada perdagangan Senin (01/04/2024), di tengah meningkatnya spekulasi penurunan suku bunga..melanjutkan kenaikan kuat minggu lalu hingga membentuk level puncak baru sepanjang masa

Pasar saham Asia sebagian masih libur dan sebagian lagi menguat pada perdagangan Senin (01/04/2024), karena optimisme data pabrikan Tiongkok mendukung..potensi intervensi otoritas Jepang terhadap yen Jepang diperkirakan berada di zona 152 – 155 yen.

FBS menyimpan catatan data Anda untuk menjalankan website ini. Dengan menekan tombol "Setuju", Anda menyetujui kebijakan Privasi kami.

Permintaan Anda diterima.

Manajer kami akan menghubungi Anda

Permintaan panggilan balik berikutnya untuk nomor telepon ini

akan tersedia setelah

Jika Anda memiliki masalah mendesak, silakan hubungi kami melalui

Live chat

Internal error. Silahkan coba lagi

Jangan buang waktu Anda – tetap awasi dampak NFP terhadap dolar dan raup profitnya!