The EURJPY pair hit a new 14-week high near 164.50 during the European session on Wednesday. This rise comes even as some European Central Bank (ECB) officials hint that the Deposit Facility Rate, currently at 3.25%, might drop below neutral levels due to worries about low economic growth in the Eurozone. Officials believe inflation could stay below 2%, and Germany's economy is expected to shrink by 0.2% this year, marking the second year of contraction.

While traders have already factored in another ECB rate cut in December, this has weakened the Euro against other major currencies. However, the Euro has strengthened against the Japanese Yen amid uncertainty around whether the Bank of Japan (BoJ) will raise interest rates this year. BoJ's next meeting is set for October 31, but many expect no rate hikes, especially with upcoming U.S. elections adding to global economic uncertainty.

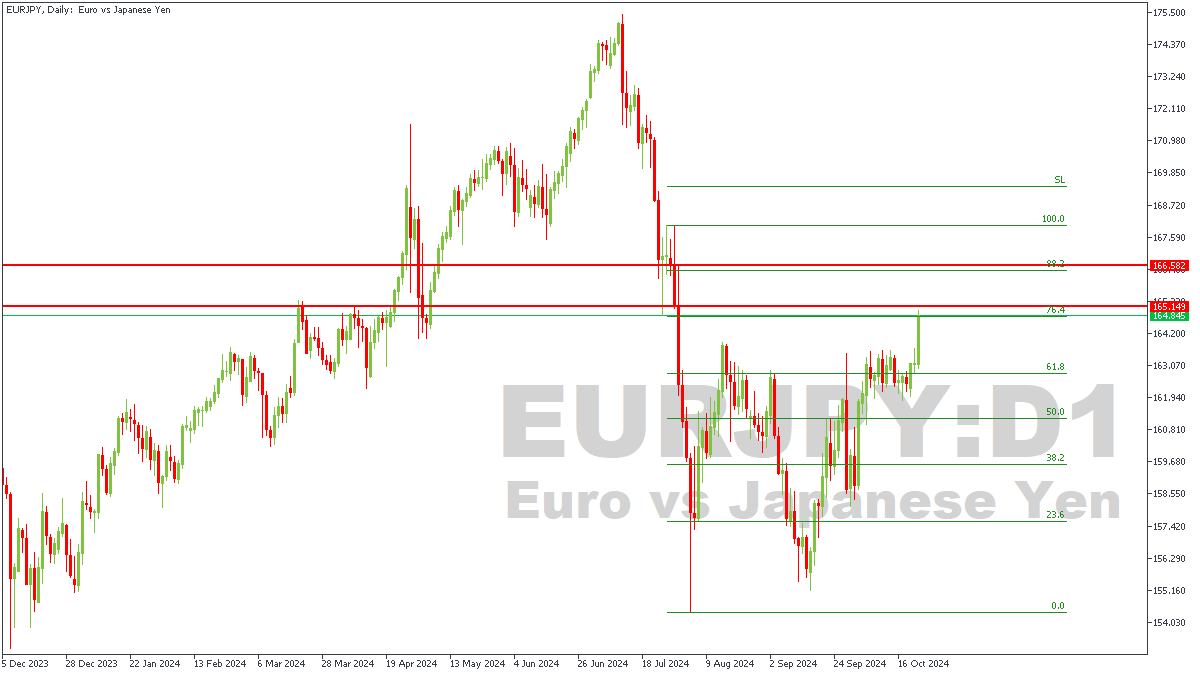

EURJPY – D1 Timeframe

Price recently broke below the previous low, and has reached the pivot zone on the daily timeframe of EURJPY, with an impulsive move over the last couple of hours. The pivot zone falls within the 76% of the Fibonacci retracement, which is another crucial confluence in favor of the bearish continuation. The pivot zone also overlaps a critical rally-base-drop supply zone; a change of character on the lower timeframe would be an optimal entry for a bearish movement.

Analyst’s Expectations:

Direction: Bearish

Target: 159.667

Invalidation: 166.709

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.