Earlier this Monday we had a remarkable time breaking down the price action across several commodities with the aim of catching a few profitable trades during the course of the week. The following trade ideas are presented based on the outcome of the livestream on YouTube earlier; you can catch-up on these and several other trade ideas here.

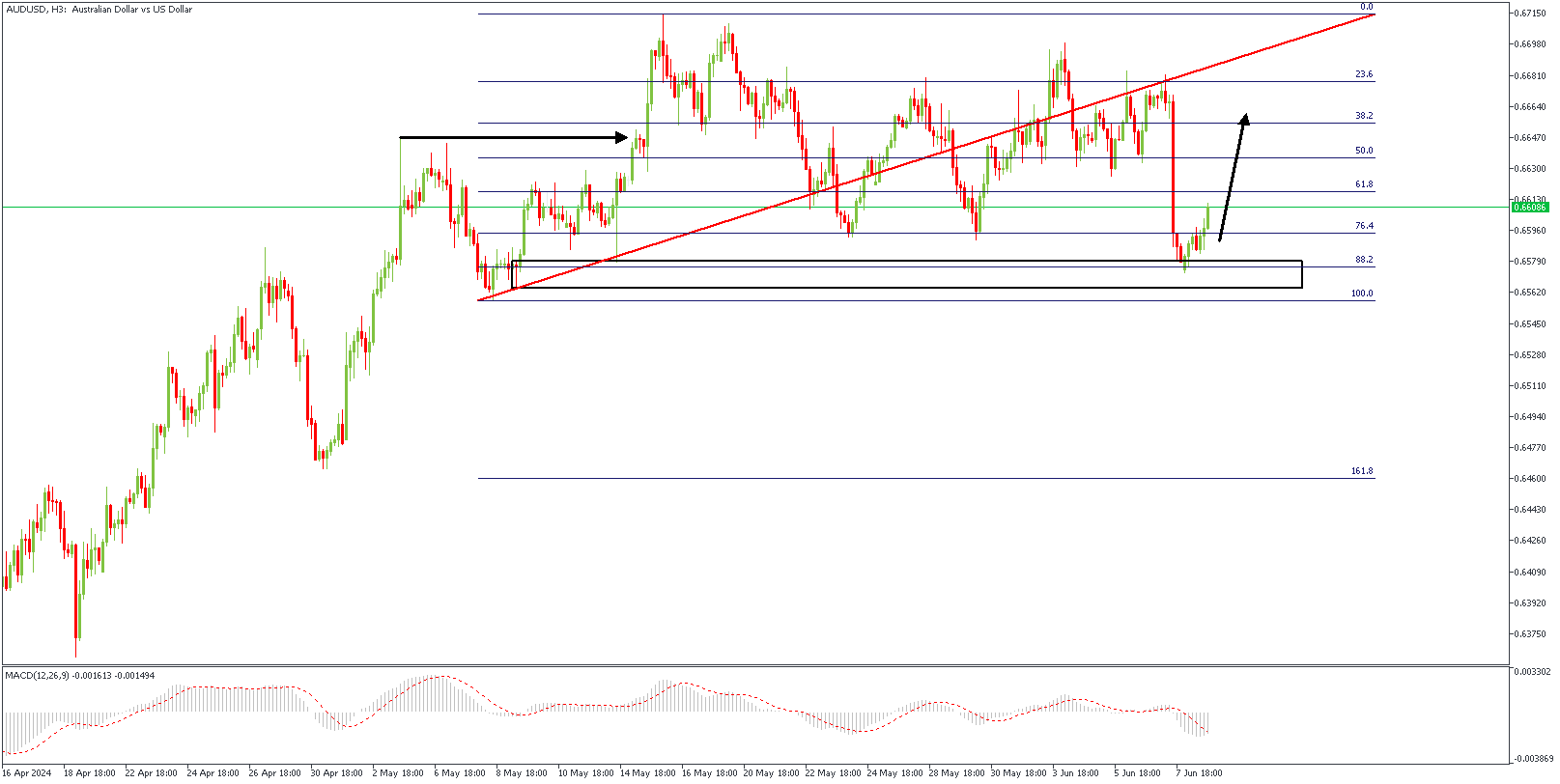

AUDUSD – H3 Timeframe

During the livestream, I highlighted the daily timeframe pivot zone (based on the daily timeframe’s line chart), and the demand zone that was within the daily timeframe pivot on the 4-hour chart of AUDUSD. Following this, I plotted the Fibonacci retracement tool, which provided an area of entry around the 88% of the impulse move. My confluences once again are; the 88% Fibonacci region, daily timeframe pivot zone, and the 4-hour timeframe demand zone.

Analyst’s Expectations:

Direction: Bullish

Target: 0.66623

Invalidation: 0.65548

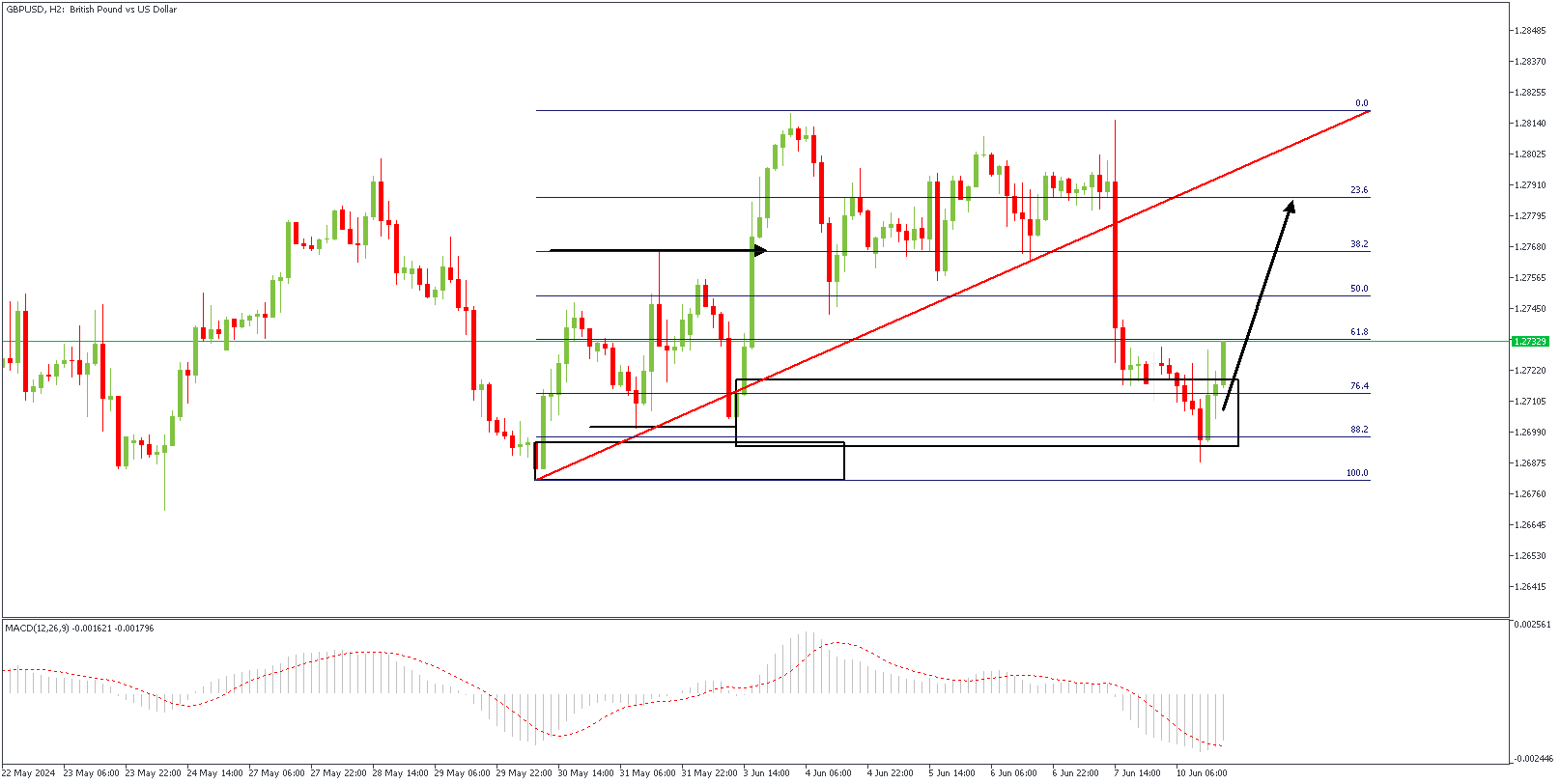

GBPUSD – H2 Timeframe

In the case of GBPUSD, we can see the break of structure above the previous high, the demand zone region, as well as the Fibonacci retracement levels. As usual, we had price retrace into the 88% of the original bullish swing, forming the basis of my expectation of a bullish reaction – which I believe has already begun. Do review this using your preferred trading methodology to scan for entries.

Analyst’s Expectations:

Direction: Bullish

Target: 1.26814

Invalidation: 1.27889

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.