- Bullish Scenario: Long positions above 615 with TP: 620, TP2: 629, and TP3: 632, with S.L. below 610 or at least 1% of account capital. Apply trailing stop.

- Bearish Corrective Scenario: Short positions below 613 with TP1: 606 and TP2: 604, with S.L. above 616 or at least 1% of account capital.

Netflix will announce its first-quarter (1Q) earnings at the close of the American session today, April 18th. According to the economic calendar, the estimates are as follows:

- Earnings per Share (EPS): $4.51. A significant increase from $3.06 in the previous year's first quarter.

- Revenue: $9.27B. A jump from the $8.16 billion recorded in the first quarter of 2023.

- Market Capitalization: $265.58B

Key Drivers of Netflix's Performance:

- WWE Partnership: Netflix is partnering with WWE, an American media and entertainment company primarily focused on professional wrestling, bringing its flagship weekly show "RAW" to the platform in 2025.

- Global Content and Advertising: Netflix's successful strategy of global content creation and its potential for further growth, including advertising revenue from WWE, expansion into licensed IP gaming, and increased viewership on the ad-supported tier.

- Financial Performance: Netflix is expected to announce earnings surpassing the same period in 2023, as indicated at the beginning of the article.

- Subscriber Growth: New subscriber numbers are expected to surpass the fourth-quarter figures of 2023, with 260.28 million paid memberships globally, representing a 12% year-over-year increase.

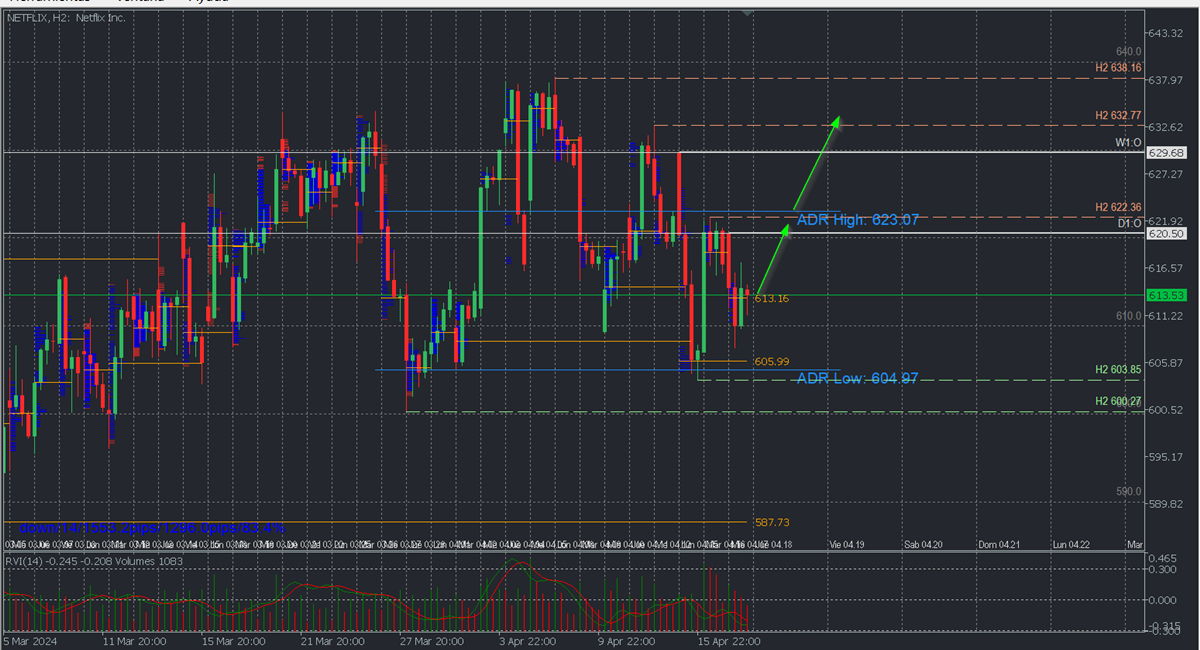

Technical Analysis, H2:

Daily Pivot Point (POC): 622 (Sell Zone) / 606 / 613 (Buy Zone)

Netflix's stock has been in a corrective downtrend, with the last support level at 603.85, forming a buy zone along with Monday's uncovered POC at 605.99 and the daily bearish average range at 604.97. Thus, a new uptrend towards 620 and 623 is expected as long as this zone limits sales.

It's also necessary to consider the possibility of an earlier breakthrough above yesterday's POC around 613.16, implying intraday purchases above 614/15 with targets at 620 and 623 intraday, paving the way to renew the bullish phase aiming to surpass 632.77 in the coming days.

On the other hand, with disappointing results, a further decline below the indicated buy zones towards 603 and 600 is possible, suggesting a trend weakness signal and a potential bearish reversal. Decreasing vertical volume signals sales weakness.

*Uncovered POC: POC = Point of Control: It's the level or zone where the highest volume concentration occurred. If a downward movement occurred from it previously, it's considered a sell zone and forms a resistance zone. Conversely, if an upward impulse occurred previously, it's considered a buy zone, usually located at lows, forming support zones.

Disclusure

This analysis does not constitute investment advice or an offer to participate in financial transactions. Although all investments involve risks, trading forex and other leveraged assets can involve significant losses. A full understanding of the risks is recommended before investing.

@2x.png?quality=90)