Bu kursun önceki derslerinde Japon mum çubuklarının ne olduğunu öğrendik ve en ünlü Japon mum çubuğu formasyonlarını öğrendik. Dördüncü derste, mum çubuğu formasyonlarını tanıma ve onlarla işlem yapma konusunda dedektif becerileri gerektiren iki stratejiye bakacağız!

Kayan Yıldız Stratejisi

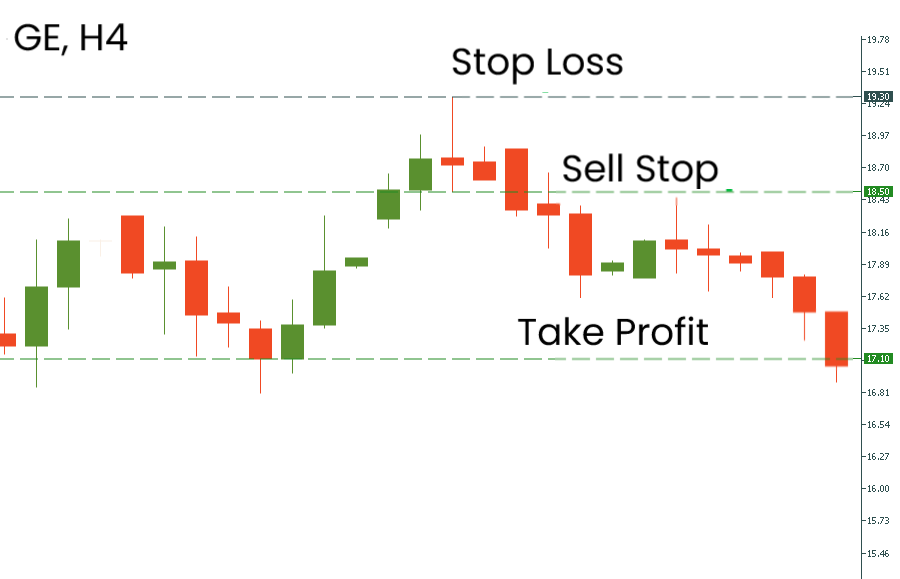

İlk strateji için, kayan yıldız formasyonunun nasıl göründüğünü hatırlayalım. Aşağıda, GE’nin H4 çizelgesindeki 'Kayan Yıldız' formasyonunun bir örneğini sağladık.

Klasik Kayan Yıldız:

- Uzun bir üst gölgesi ve kısa bir alt gölgesi vardır.

- Seansın düşük kısmına yakın yerleştirilmesi gereken küçük bir gerçek gövdeye sahiptir.

- Boğa mum çubuğundan sonra yükseliş trendi sırasında görünür. Aşağıdaki büyük ayı mum çubuğu kayan yıldızın kapanışının altında kapandığında sinyal onaylanır.

- Yeşil veya kırmızı olabilir.

Bir 'Kayan Yıldız' formasyonu bulmakta hala sorun yaşıyorsanız, bu kursun ikinci dersine göz atabilirsiniz.

Şimdi bu stratejinin işlem algoritmasına geçelim:

- Kayan Yıldız’ın görünmesini bekleyin. Fiyatın bir yükseliş trendi içinde hareket etmesi gerektiğini unutmayın.

- Kayan Yıldız’ın oluşumunu fark ettiğinizde, bir sonraki mum çubuğunun az önce bulduğunuz kayan yıldızın düşük seviyesinin altına hareket etmesini bekleyin. Girişinizi tam olarak Kayan Yıldız’ın en altına yerleştirmek için bir Satışı Durdur emri kullanabilirsiniz.

- Zararı Durdur’unuz Kayan Yıldız’ın tepesinde bulunmalıdır.

- Kârı Al’ınızı bir sonraki önemli destek seviyesine yerleştirin.

Aşağıda bu stratejinin bir örneğini verdik. General Electric’in H4 çizelgesinde Kayan Yıldız modeli oluşturuldu. 18.50’de Kayan Yıldız formasyonunun en düşüğüne bir Satışı Durdur emri verdik, Zararı Durdur bu mum çubuğunun tepesindeydi ve Kârı Al önceki önemli destek olan 17.10’a yerleştirildi. Bu şekilde, bir işlemde 140 puan alırdık.

"Kayan Yıldız’ın sahte olduğu ortaya çıktığında durumlardan nasıl kaçınılır?"

Onay için beklemek çok önemlidir. "Kayan Yıldız"dan bir sonraki mum çubuğu düşüş eğiliminde olmalıdır. Ayrıca, Zararı Durdur’u da unutmayın! Sizi talihsiz işlemlerden korur.

Bir sonraki strateji, 'Üçüncü Mum Çubuğu' formasyonu olarak bilinir. "Üç Kara Karga" veya "Üç Beyaz Asker" formasyonlarına benzeyebilir. Aralarındaki temel fark, "Üçüncü Mum Çubuğu" formasyonunun her bir mum çubuğunun açılış fiyatıyla ilgili daha az kısıtlamaya sahip olmasıdır.

Üçüncü Mum Çubuğu Stratejisi

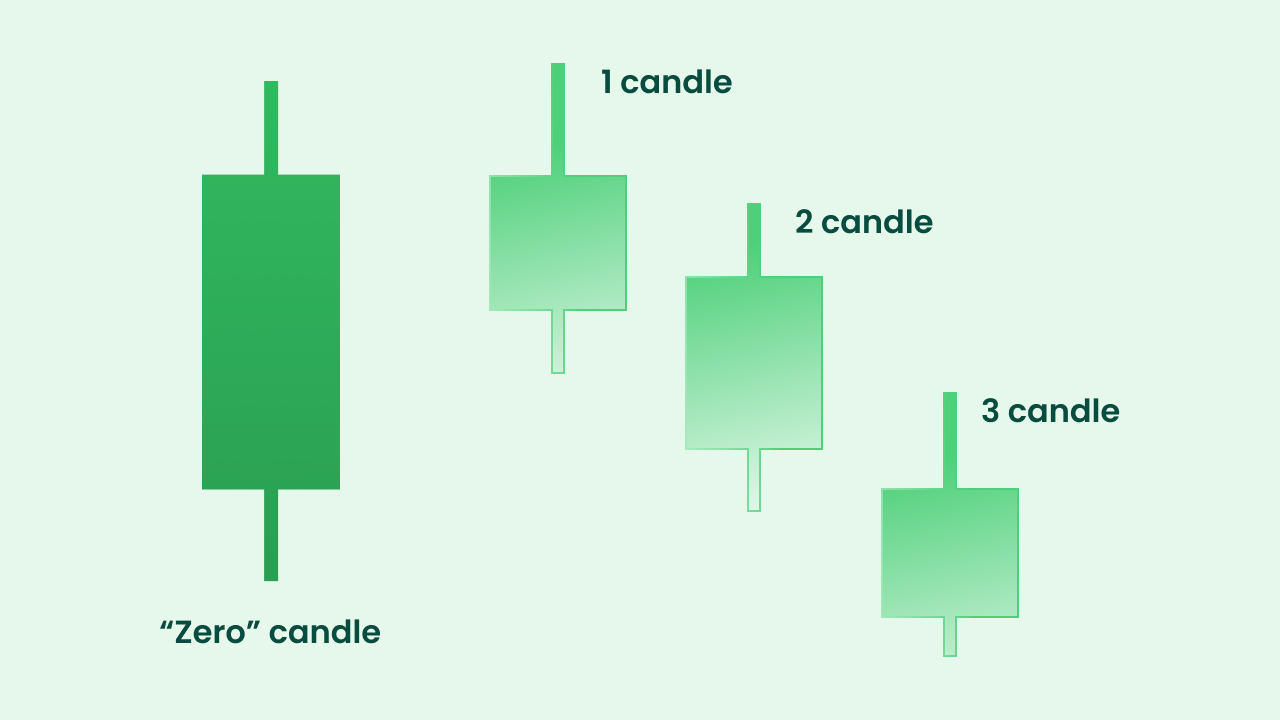

Bu formasyonun iki türü vardır: boğa ve ayı. Ayı formasyonuyla başlayacağız.

Bu formasyonun ilk mum çubuğu boğadır (buna 'sıfır' mum çubuğu denir). Bir sonraki mum çubuğu ayı olmalıdır. Aşağı momentum, ikinci ayı mum çubuğu tarafından onaylanmalıdır. Üçüncü mum çubuğu kısa pozisyon açmak için kullanılır.

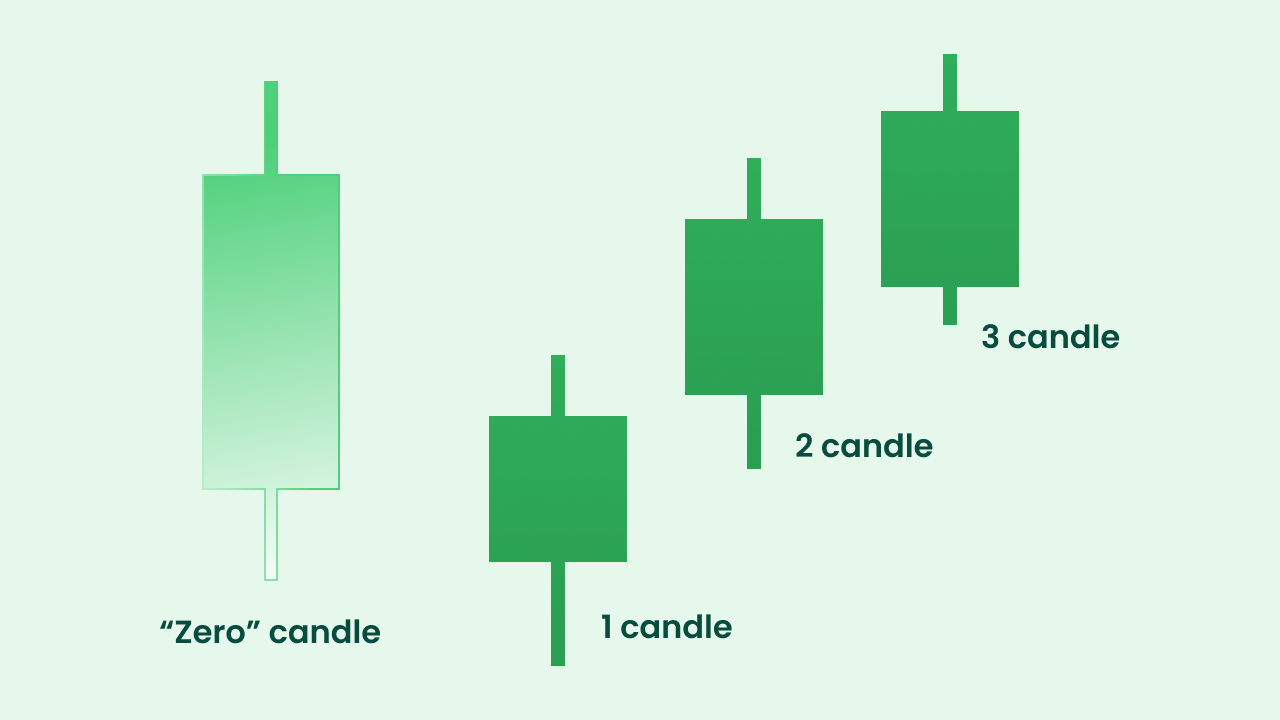

Tam tersi şekilde, boğa formasyonunu belirleriz. İlk boğa mum çubuğu, ayı mum çubuğundan ('sıfır') sonra görünmelidir. Daha düşük bir düşüğü olmalıdır. İkinci boğa mum çubuğu, yukarı dönüşün bir teyidi olarak kullanılır. Üçüncü mum çubuğunun açılış fiyatı, uzun pozisyon açtığımız seviyedir.

'Üçüncü Mum Çubuğu' formasyonunu belirledikten sonra, stratejinin ana adımlarını ele alalım.

Uzun bir pozisyon için:

- Boğa 'Üçüncü Mum Çubuğu' formasyonunun tam olarak uygulanmasını bekleyin. Eğer birinci ve ikinci mum çubuklarının gövdeleri çok küçükse piyasaya girmemelisiniz, çünkü bu boğaların güçlerini kaybettiğini gösterir.

- İkinci olarak, Stokastik osilatörü grafiğe ekleyin. Çizgileri yukarı hareket etmelidir.

- Eğer tüm koşullar karşılanıyorsa, üçüncü mum çubuğu açıldıktan sonra uzun bir pozisyon girin.

- Zararı Durdur’u ilk mum çubuğunun en düşük seviyesinin altına yerleştirin.

- Bir sonraki önemli direnç seviyesine bir 'Kârı Al' seviyesi yerleştirin.

Aşağıdaki örneğe bir göz atın! NZD/USD günlük grafiğinde 'Üç Mum Çubuğu' formasyonu uygulandı. Üçüncü mum çubuğu göründükten sonra, Stokastik osilatörün aşırı satış bölgesinden çıkıp yükselmesiyle yukarı yönlü momentumu onayladık. 0.6743’te bir Alışı Durdur emri verdik. Zararı Durdur 0.6645’te 'sıfır' mum çubuğunun en düşük seviyesinin altına yerleştirildi ve Kârı Al önceki önemli direncin yakınında 0.6817’de yer aldı. Bu sayede 740 puan kazandık.

Kısa bir pozisyon için:

Kısa pozisyon açma senaryosu yukarıda tarif edilene benzer.

- Düşüş eğilimi gösteren "Üçüncü mum çubuğu"un uygulanmasını bekleyin. Uzun işlem senaryosunda olduğu gibi, birinci ve ikinci mum çubuklarının gövdeleri küçük olmamalıdır.

- Stokastik osilatör aşağı inmelidir.

- Üçüncü mum çubuğunun açılış fiyatında kısa bir pozisyon açın.

- İlk mum çubuğunun tepe seviyesinin altına bir Zararı Durdur emri koyun.

- Bir sonraki önemli destek seviyesine bir Kârı Al seviyesi yerleştirin.

Aşağıda, satış işlemi için bir örnek verdik.

NZD/USD günlük grafiğine 'Üç Mum Çubuğu' formasyonunun uygulanmasının ardından Stokastik göstergesinin düşmesini bekledik. Satışı Durdur emrini 0.6921’de üçüncü mum çubuğunun açılış fiyatına yerleştirdik. Zararı Durdur, 0.6983’te ilk mum çubuğunun en yüksek seviyesinin üzerinde bulunuyordu. Kârı Al seviyesine gelince, 0.6833 destek seviyesine yerleştirdik. Sonuç olarak 880 puan kâr elde ettik.

"Bu strateji için Kârı Al’ı önemli destek ve direnç seviyelerinin yanına yerleştirmek önemli mi?"

Destek ve direnç seviyeleri, potansiyel geri dönüş bölgelerini temsil eder. Yani bu hedefe ulaşıldığında fiyat ters yönde hareket edebilir. Kârı Al seviyesini en yakın direncin biraz altına ve en yakın desteğin biraz üstüne yerleştirmenizi öneririz. Ayrıca, Kârı Al seviyesini takip etmeniz ve geri dönüş işaretleri gördüğünüzde (aşırı alış/aşırı satış bölgelerinde Stokastik osilatörün bir geçişi, ters mum çubuğu formasyonları) pozisyonu kapatmanız önerilir.

Artık Japon mum çubuğu formasyonları hakkında bilgi gerektiren en popüler işlem stratejilerinden ikisini biliyorsunuz. Tabii ki, onlardan çok daha fazlası var! Bir Demo hesabında bu stratejilerle işlem yapmayı unutmayın.

Ders özeti

- Kayan Yıldız stratejisi, işlemciler arasında çok popülerdir, çünkü bu formasyon grafiklerde düzenli olarak görülür.

- Kayan Yıldız formasyonu, bir yükseliş trendinin sonunda belirir. Bir ayı mum çubuğu şeklinde bir onay gereklidir.

- 'Üç kara karga' ve 'Üçüncü mum çubuğu' formasyonu arasındaki temel fark, ikincisinin her bir mum çubuğunun açılış fiyatıyla ilgili daha az kısıtlamaya sahip olmasıdır.

- 'Üçüncü Mum Çubuğu' stratejisi, momentumu doğrulamak için Stokastik bir osilatör gerektirir.