Forex (FX) or Foreign Exchange is the marketplace for buying and selling the currencies of different countries against each other. Forex is one of the largest global financial markets for trading various currencies.

The Forex market works 24 hours a day, five days a week. That means that anyone around the globe has access to currency trading – they can buy and sell currencies at any time of the weekday.

In today’s age of electronic markets, there is no need to be physically present at the currency exchange. Buying and selling currencies of a particular country against another country’s currency happens online. Traders open a specific currency position and expect the price to go up or down depending on the market situation. Traders can make a profit from these price movements.

There is no way to trade a currency unilaterally. Trading is a relative process – when someone buys, someone sells. Due to the difference between these transactions, some traders benefit, and others lose money.

How FX works

One of the most important aspects of the Forex market is that it operates as a decentralized structure. In other words, there is no physical location where investors go to trade currencies.

Market players are located all over the world. They use the internet to check the quotes of various currency pairs from different places. The biggest global financial centers accumulate the largest Foreign Exchange markets. London, New York, Singapore, Tokyo, Frankfurt, Hong Kong, and Sydney are cities where these centers are located.

People who want to trade Forex can’t just start trading real currency pairs because this market is for big players: banks, governments, and financial institutions. To access the currency market, traders choose a Forex broker who connects them with international flows.

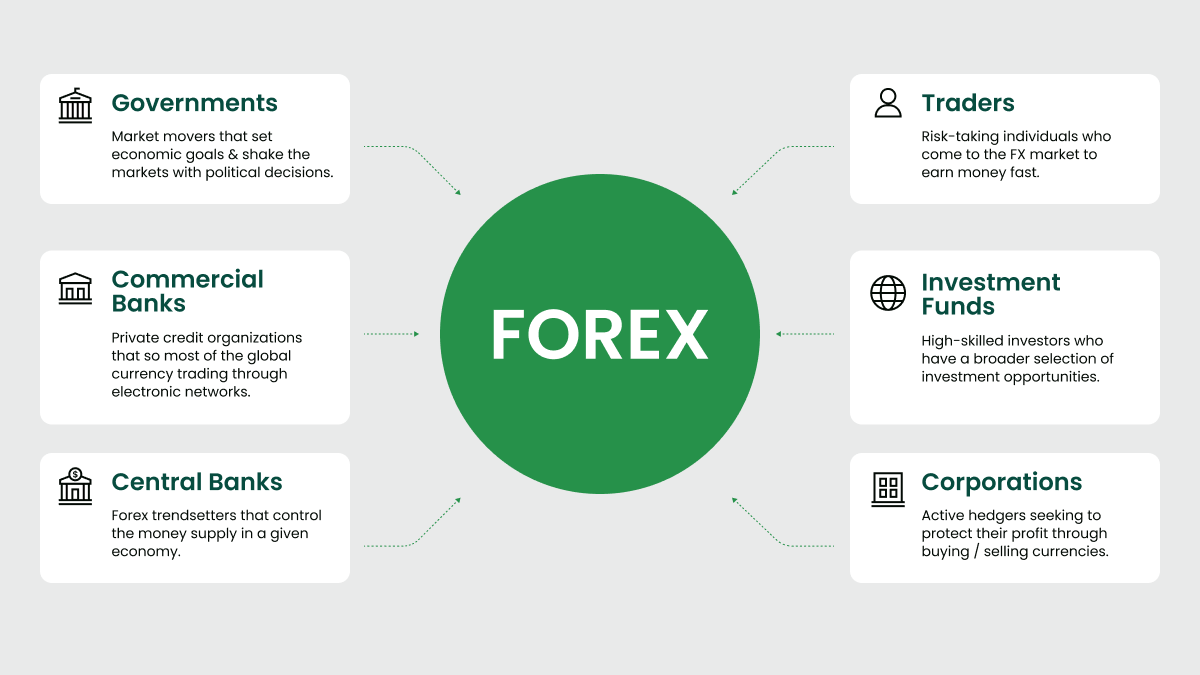

The major Forex players

Forex trading involves many people and organizations. Some of them trade to make profits. Others trade to hedge their risks. Moreover, some traders use foreign currencies to pay for needed goods and services. However, that’s a real-life example, rather than the case for trading.

The leading FX players are the biggest banks like Citi, UBS, Barclays, Deutsche Bank, Goldman Sachs, and Bank of America. These and other banks, collectively known as the interbank market, manage many financial transactions daily.

Large commercial companies are also taking part in the Foreign Exchange for the purpose of business. These companies include Apple, Facebook, and Microsoft. Mergers and acquisitions between these companies can create fluctuations in the currency exchange rate. Due to these international cross-border mergers and acquisitions, many currency conversions happen and move the prices. However, the effect is usually weak.

Apart from banks and large commercial companies, constant Forex market participants are governments and central banks such as the ECB (European Central Bank), the BoE (Bank of England), and the US Federal Reserve.

National governments participate in the Forex market to handle foreign exchange reserves and provide different trading operations. Central banks affect the market with their policy and statements. They can control inflation and use interest rates for this purpose.

In addition to numerous banks, multinational companies and governments, as well as many risk-seeking investors are always ready to engage in different speculations.

It is best to concentrate on the real purpose of market trading and remain clear on what that is: the buying and selling of currencies with the intention of making a profit.

The typical retail trader is a risk taker. This group includes individuals who trade daily or weekly to earn as much money as possible. They study economic and political news, bank statements, statistical releases, and public announcements to predict potential future price movements.

Other traders prefer to rely on technical indicators and pay less attention to the news.

How to operate on Forex

A broker gives traders access to the Forex market. Brokers are the companies that connect people and the interbank market where all the trading processes happen. Any person can trade in the markets with the help of a Forex broker.

Brokers provide services for secure and safe trading and software programs, where traders can see real-time currency quotes and place orders for buying or selling positions (currencies) in just a few clicks.

If you want to start a trading career, all you have to do is open an account with a Forex broker you like. FBS is perfect for that role.

How to choose the right Forex broker

When choosing a broker, pay attention to these three primary parameters:

- Years of expertise;

- Regulations;

- Reputation.

Why are these characteristics reliable? The answer is simple – all of them prove that a broker is trustworthy enough to provide financial services. Experience in the market means that a broker is qualified enough to organize the trading process with all its peculiarities. As for regulations, this parameter is aimed at making the workflow transparent and secure for the company and its clients. Licensed brokers guarantee protection for traders and their funds. Finally, reputation is responsible for the goodwill of the company and the general outlook. It asserts how friendly and supportive a broker is with the clients.

FBS is a licensed broker, providing high-quality services to its clients since 2009, and is widely recognized as one of the market leaders. The company has numerous international recognitions and awards. For more than 14 years of market expertise, the company has always been extremely customer-oriented. Despite its worldwide success, FBS meets the needs of every single trader. The team is always ready to help – the support chat is available 24/7.

Last but not least, variety of trading conditions is one of the key factors to consider when choosing a broker. Look at the executions, spreads, and commissions that a broker offers. Check whether there is a swap-free option. FBS is famous for its split-second execution, starting from 0 pip spreads, a 100% deposit bonus for trading, and many other great services for excellent trading. We aim to give traders the best of Forex!

This tutorial gives you some central points of Forex and foreign exchange. Please check out the next course and improve your trading skills.