RBNZ rate statement: what lies ahead for the NZD?

The Reserve bank of New Zealand holds a meeting on Wednesday at 3:00 MT time. As usual, we await an update on the monetary policy and interest rate. Currently, the regulator keeps the rate at 0.25%. Analysts don’t expect any change to it, given current performance of New Zealand’s economy. Still, a dovish surprise is seen as a possible outcome.

Why the RBNZ may be dovish?

New Zealand has been showing pretty impressive post-Covid results. The country successfully handled the pandemic and released better-than-expected inflation figures for the fourth quarter of 2020 (0.5% vs. the forecast of 0.2%). These facts diminished the need in negative interest rates and took the NZ economy on track to a quick recovery. Still, the country has only just started the vaccination process, and the travel industry remains under pressure. Additionally to that, the RBNZ does not like rising bond yields and surging kiwi. The New Zealand dollar is trading at the highs of 2018 against the US dollar. Combined with the booming housing market, skyrocketing NZD worries policymakers.

Thus, the RBNZ may try to hold rising kiwi by highlighting existing risks from closed borders and late vaccination.

According to JP Morgan analyst, "We’ll hear from the RBNZ tonight and the risk for me is a dovish surprise, I will be looking to be short NZD into the meeting”

Another problem that might be in the focus of the RBNZ board is the QE limit. The bank might have bought as many government bonds as permissible. That’s why it might need to take unusual actions during the upcoming meeting.

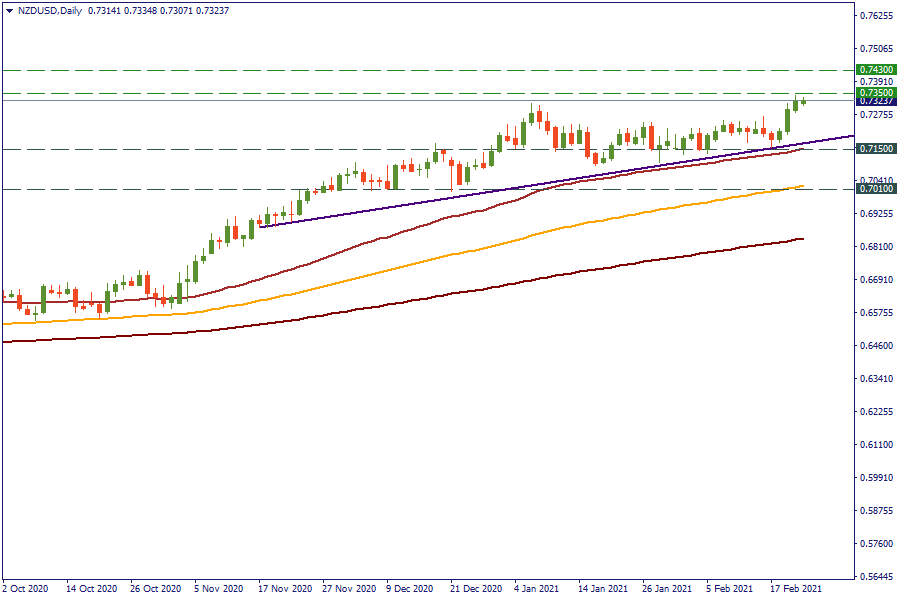

The technical outlook for NZD/USD

The kiwi has been implementing a bullish pattern. Right now, it is trading near the resistance at 0.7350. If the RBNZ provides a dovish surprise, the pair will slide to 0.7150 with a high potential of a breakout. The next support will lie at 0.7010. If the resistance at 0.7350 is broken, the next key level will lie at 0.7430.