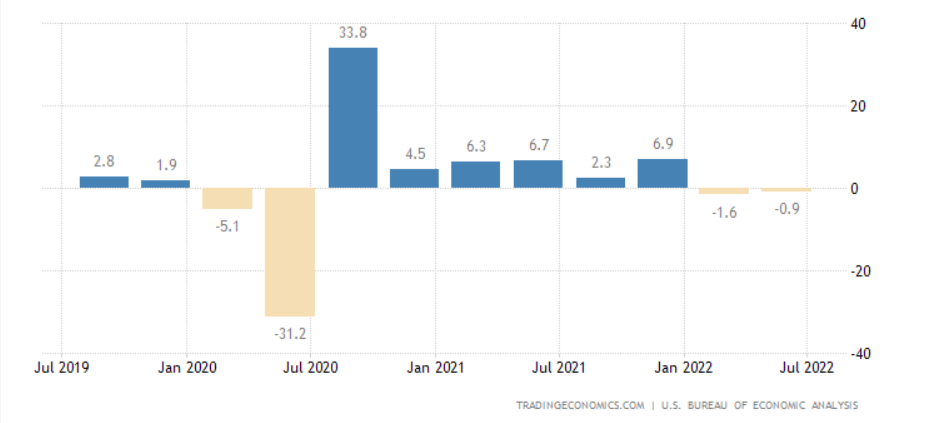

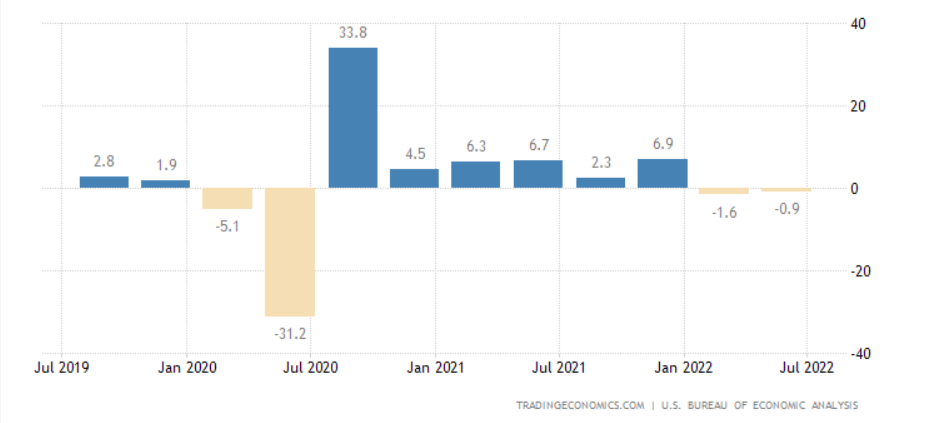

The bad news is that the US economy slowed for the second consecutive quarter in 2022, entering a technical recession. That's two consecutive quarters of gross domestic product (GDP) contraction. However, the good news is a slowing economy may be what the US needs to win its fight against inflation.

As the US economy reopens to recovery from the pandemic, economic growth rebounded fiercely, supported by consumers spending their savings and the stimulus that was pumped into the markets. But this insane support has driven prices so strongly that inflation got out of control (9.1%, the highest in 40 years), with strong demand and modest supply.

Were the Fed's rate hikes helpful in dampening demand?

The Fed's intervention to bring inflation back to its 2% target, after raising interest rates four times since March 2022, two of them in a row by 75 basis points, is reflected now in the economy. While the US central bank relies on its favorite tool - the interest rate - to cool demand and inflation by making borrowing more expensive, it risks plunging the economy into a recession.

It seems that the sharp rate hikes are starting to show their results. The US economy contracted by 0.9% in the second consecutive quarter, reflecting the economy's weakness with slowing consumer spending amid rising prices, declining investment and economic activity, and a damp housing market. The Fed wants to see demand fall for "a sustained period" to give inflation a chance to come down without entering a deep recession, Fed Chair Jerome Powell said.

While Powell thinks the US economy isn't in a recession right now, he admitted that the economy is slowing and will likely need to slow more to bring inflation back to earth. The Federal Reserve said it wouldn't be easy in its fight against the highest inflation in 40 years, even if it means a shrinking economy and a slowing job market.

How is a slowdown in the US economy good?

The more the economy slows down, the inflationary pressures will fall, and prices will calm down. Subsequently, this may prompt the Fed to ease the aggressive rate hikes and will head for smaller increases in the upcoming meetings. The danger is that with a shrinking economy, demand could fall so dramatically that the economy would be pushed into recession.

Will the contraction of the US economy affect the Fed's rate hikes?

We don't think the GDP decline should affect the Fed's rate hike cycle. The reason is that evidence of a slowdown has yet to appear in US employment data or a rise in layoffs, which economists also use to gauge whether a country is in a recession. The unemployment rate stabilized at 3.6%, the lowest from pre-pandemic levels.

The upcoming labor market data will be the best ground for whether we're heading into a recession or not. Jerome Powell dismissed questions about whether the US economy is in or on the cusp of a recession, arguing for the labor market's strength because US companies continue to add more than 350,000 jobs each month.

LOG IN