-

How to start trading?

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

-

How to open an FBS account?

Click the 'Open account' button on our website and proceed to the Trader Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

-

How to withdraw the money you earned with FBS?

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Trader Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

Cardano

Cardano (ADA)

Cardano is one of the biggest cryptocurrencies by market cap with the native digital coin ADA. It’s designed to be a flexible, sustainable, and scalable blockchain platform for running smart contracts, allowing the development of a wide range of decentralized finance apps, new crypto tokens, games, and more.

This article describes the history of the project, pros and features that make this project unique, tools that make this project secured, and, finally, reasons to consider investing in ADA coin.

History of Cardano

Think of Bitcoin as Crypto 1.0. It's essentially digital gold, but the system has scalability issues. Ethereum, the second largest cryptocurrency, is often referred to as Crypto 2.0.

Cardano, created in 2015 and launched in 2017, is Crypto 3.0, with the goal of improving upon the functionality that Ethereum was initially missing. Charles Hoskinson founded Cardano, and he's also a co-founder of Ethereum. Hoskinson left the Ethereum team due to a dispute with co-founder Vitalik Buterin in 2014 regarding whether the Ethereum project should be commercial or not.

As a result, he moved on to launch Cardano as a more scalable, interoperable, and sustainable blockchain, intending to improve upon Bitcoin and Ethereum.

What makes Cardano unique?

There are the dozens of other PoS blockchains already present on the market. But what makes Cardano different from them?

The main feature of Cardano is that, unlike other projects, it didn't release a whitepaper. Instead, it aims to be a scientifically peer-reviewed blockchain, always using the best practices to provide the optimal crypto ecosystem. To achieve this, Cardano boasts the following characteristics:

Layered architecture

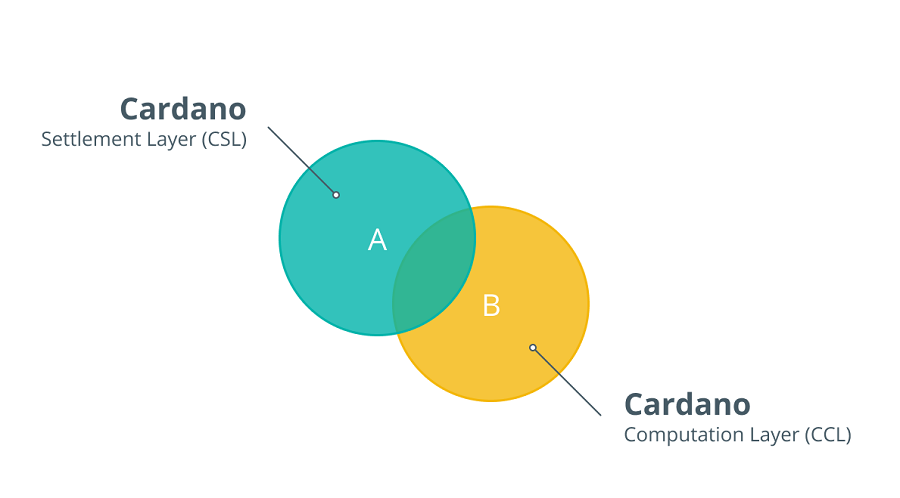

The Cardano blockchain is composed of two main elements:

- The Cardano Settlement Layer (CSL) – where all the transactions are carried on.

- The Cardano Computational Layer (CCL) – used to deploy smart contracts and govern the network.

Two layers of the Cardano blockchain

Cardano’s developers wanted to build a system that separates the value of a transaction from its computational data.

The Cardano Settlement Layer is designed to manage the movement of the value (or the currency) between the sender and the receiver. In other words, the settlement layer is the routing layer for all the control layers and systems.

The CSL uses two dedicated scripting languages, Plutus and Marlowe, for moving the value and enhancing support for overlay network protocol.

The Cardano Computation Layer helps Cardano to replicate the Bitcoin (BTC) ecosystem’s smart contract platform, Rootstock (RSK blockchain). The reasoning behind CCL’s implementation lies in its ability to help scale specialized protocols over the years. This involves adding hardware security modules (HSM) to the existing stack of protocols as technology advances.

The two layers of the Cardano blockchain allow the ecosystem to proactively implement changes to support faster and more secure transactions while eliminating any user metadata that proves to be irrelevant to the process.

Ouroboros Proof of Stake

A second unique aspect of Cardano is its proprietary consensus mechanism called Ouroboros Proof of Stake. In this validation mechanism, users can become full node validators or delegate their stake to other superusers to validate transactions on the network.

In Ouroboros, time is divided into epochs, and for each epoch, a new set of validators is voted in by the system. It allows for better diversity and decentralization of the pool of validators.

Validators are rewarded with new ADA tokens to distribute to everyone who delegated their stake, effectively creating an opportunity for passive income.

Five Advantages of Cardano

Cardano has a wide array of advantages. Below are five of the most important ones compared to competitors in the crypto sphere.

Fast transactions. Cardano was created to be highly scalable. At the moment, it provides 250+ transactions per second, compared to Ethereum's 30.

Cheap gas fees. Additionally, the PoS model allows Cardano to offer nominal transaction fees on its network. The average cost of a transaction on Cardano costs around 0.17 ADA, which equates to a couple of cents. Compare this to the price of Ethereum of $0.7 per transaction.

A higher degree of decentralization. The network becomes increasingly decentralized because everyone can become a node validator in Ouroboros. At the moment, there are more than 2500 validator pools in Cardano.

Eco-friendly. One of the main concerns in the 2021 bull run is the high amount of electricity required by PoW blockchains such as Bitcoin. Cardano, with its PoS mechanism, consumes 99% less electricity than the number one cryptocurrency.

Passive income. Finally, every Cardano holder can gain passive income by staking their ADA coins.

What is Cardano’s Vasil Hard Fork?

A hard fork is a network upgrade by adding or fixing certain features to the ecosystem. Vasil hard fork was designed to help improve the ecosystem’s scalability and general transaction throughput capacity as well as advance Cardano’s decentralized applications (DApps) development capacity.

Moreover, the hard fork bolstered the network’s stability and connectivity, which is a huge and prominent step forward for Cardano as the upgrade reduced the network’s transaction costs while increasing transaction speeds.

How Is the Cardano Network Secured?

Cardano network uses a proof-of-stake consensus mechanism, which is more secure and energy-efficient than proof-of-work algorithms used by other cryptocurrencies like Bitcoin.

In proof-of-stake, validators are selected to validate transactions and create new blocks based on the amount of stake they hold in the network. This incentivizes validators to act honestly, as they stand to lose their stake if they engage in malicious behavior.

Cardano’s consensus mechanism has been mathematically proven to be secure under the assumption that the majority (>50%) of its participants are honest. The fact that it relies on this assumption means that it’s not resistant against 51% attacks.

Additionally, Cardano's blockchain is built on a series of peer-reviewed scientific research papers, ensuring that the underlying cryptography and consensus mechanism are thoroughly vetted and secure.

How Many Cardano (ADA) Coins Are There in Circulation?

Cardano launched in 2017 with a total supply of 45 billion and a public sale of 25.9 billion ADA coins. About 5.2 billion coins were distributed privately between three entities, namely, Input Output Global (IOG), Emurgo, and the Cardano Foundation. That meant that 19.1 billion ADA coins were out of circulation.

As of February 2023, the number of ADA tokens in circulation is up to 34.6 billion, leaving 10.4 tokens inaccessible to market holders. The availability of the extra coins helps to keep its price stable when the crypto market experiences volatility.

The Bottom Line

The potential value of Cardano as a project is subjective and depends on individual opinions and perspectives. Here are a few factors that could be considered when evaluating the potential of Cardano:

Development: Cardano has a strong development team and is actively working on improving its technology, including features such as smart contract capabilities and scalability.

Community: Cardano has a growing and dedicated community of users and developers, which can help drive adoption and further development of the platform.

Partnerships: Cardano has established partnerships with various organizations and companies in the blockchain and tech industries, which can help drive adoption and increase its overall value.

Use cases: Cardano is positioned as a blockchain platform for financial applications, including stablecoins and decentralized exchanges. If these use cases gain traction, it could have a positive impact on the value of Cardano.

Ultimately, it's important to keep in mind that cryptocurrencies and blockchain projects are inherently risky, and the future value of Cardano is uncertain. Fortunately, FBS traders can trade cryptocurrencies both ways long and short, gaining capital on the rising and falling market.

Gain the experience trading cryptocurrencies with FBS crypto account!

2023-04-27 • Updated