-

How to start trading?

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

-

How to set a Stop Loss?

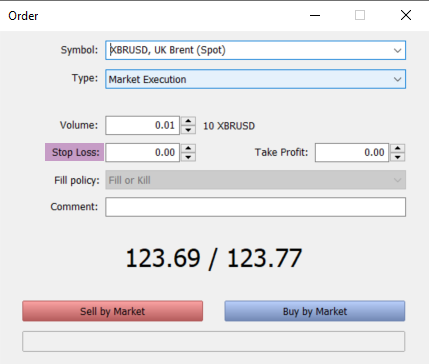

After clicking “New order” on your trading platform, you’ll see the available settings. Stop loss is one of them. The Stop Loss order settings depend on your trading strategy. SL shouldn’t be equal to your starting price. Typically it’s a little lower or higher that it (depending on if it's buy or sell order), but the exact number of points depends on your strategy.

-

How to set a Take Profit?

After clicking “New order” on your trading platform, you’ll see the available settings. Take Profit is one of them. TP should be higher than the starting price. The Take Profit settings depend on your trading strategy. The most common ratio of Stop Loss and Take profit is 1:3.

-

How to avoid Stop Loss hunting?

Stop Loss hunting is a strategy that attempts to drive some market participants out of their positions by pushing the price of an asset to a level where many people decide to set a Stop Loss. The simultaneous triggering of multiple stop losses usually creates high volatility and can provide a unique opportunity for investors who wish to trade in such conditions.

To avoid it, don’t put stop loss randomly. Reckless SL setting can lead to money loss. Study everything in advance.

Stop-Loss Order

Stop-Loss Order

What is a stop-loss order?

A stop-loss order is a tool that allow traders to limit the potential losses from their trades. It is a crucial element in trading. Once the price of an asset gets too low or too high, a stop-loss order is set off and automatically exits the trade.

Stop-loss orders can also be used as a way to close the position when traders meet their profit goal for this particular trade.

How stop-loss orders work

A stop-loss order can be set below (for bullish positions) or above (for bearish positions) the current market price. When you place this order, you set a limit called a stop price on an asset you’re currently holding. When the asset price reaches this stop price, the stop-loss order gets triggered and gives instructions to sell or buy the asset. This is when a stop-loss order turns into a market order and is executed when the next opportunity arises.

How does a stop-loss order limit loss?

It should be noted that stop-loss orders don’t erase the risk of a loss completely. Rather, they mitigate and limit it. Without them, you may miss the right moment to close your positions. And if asset prices continue to move in the direction that’s unfavorable for you, you may even lose quite a bit of money.

So a stop-loss order helps to avoid it. It closes your positions automatically when the prices drop to the stop price level. With this tool equipped, you don’t have to worry about the risks of bearing an uncontrollable loss.

Stop-loss order vs. stop-limit order

Another tool available to traders to limit potential losses is a stop-limit order. Both stop orders work in a similar way: a trader gets to set a stop price which sets off the orders in both cases. In MetaTrader, both orders can be placed by clicking “New Order” and selecting “Pending Order” in the box called “Type”. After this you can choose the exact type of order you want to place (“Limit” or “Stop”) and adjust its parameters.

But unlike a stop-loss order that turns into a market order when the asset price breaches the stop price level, a stop limit order works differently. Once the asset price hits the stop price, your stop-limit order turns into a limit order. Limit orders give instructions to buy the asset at or below the set price or sell it at or above this same set price. This order can help traders avoid selling their assets when there’s a chance for the price to rebound.

But it is also quite risky. The stop-limit order doesn’t automatically close the positions unless the price falls within a specified range. This means it won’t exit the trade even if the price continues to move in the direction that is unfavorable for you. Unlike a stop-loss order that serves as a cushion against such risk, a stop-limit order may actually be useless and not save you from losses.

Pros and cons of stop-loss order

There are several benefits of using a stop-loss order. Firstly, you don't have to monitor your trade every second; the system automatically closes the trade when the price reaches the stop price level. Secondly, it usually costs nothing to implement. And finally, Stop Loss also helps isolate decision making from emotional influences. Traders may maintain the false belief that if they give the stock/currency pair another chance, it will come back, but, in reality, this delay can only lead to increased losses. In addition, Stop Loss gives the feeling of security that the trader can’t lose too much.

The downside is that short-term price fluctuations can trigger a stop-loss order prematurely. It’s a common situation when the price fluctuates only for a minute and after that rebounds back. However, during the fluctuation the price may trigger Stop Loss if it’s too small, i.e. too close to the entry level. If a trade is closed automatically, a trader loses the potential profit. That’s why it’s a key skill of a trader to find a good place for Stop Loss. It shouldn’t be too extreme, because it won’t make any sense, and it shouldn’t be too small, because the trade can be closed in the wrong moment after a tiny fluctuation.

Do long-term investors need stop-loss orders?

Generally, stop-loss orders protect short- and medium-term traders from market fluctuations. So Stop Loss won’t be that useful to long-term investors as they can wait until the asset prices are back to what they prefer them to be.

Examples of stop-loss orders

Let’s imagine a trader named Festus. He wants to sell XBRUSD when the level is around $117 before the weekends (as we know, there’s no trading at the weekends) with the target at $112. He is not sure whether the price goes up or down, and of course, Festus wants the profit. He wants to make sure that he won’t miss the fluctuations when the trading begins and won’t lose too much before he checks his MetaTrader. Therefore, he uses Stop Loss at $118 to limit potential losses. If the trade is successful, Festus will get a nice profit; in the bad case, for instance, if XBR rises to $128, he will lose only the amount limited by Stop Loss and not more. For instance, if his position volume is 0.01, losses will be limited by $10. The avoided loss will be $100. The potential profit in the good case will be $50.

2022-08-29 • Updated