The Australian Dollar (AUD) edged higher on Thursday, recovering some ground against the US Dollar (USD) after the release of US jobs data. The AUDUSD pair is trading at 0.6392, marking a 0.36% increase. Mixed US economic data impacted the Greenback. The US Bureau of Labor Statistics (BLS) reported that initial jobless claims jumped to 242,000 for the week ending December 7, surpassing expectations of 220,000. Meanwhile, November's Producer Price Index (PPI) data showed headline inflation rose 3% year-on-year, exceeding the forecast of 2.6%. Core PPI also climbed to 3.4% year-on-year, higher than the projected 3.2%. Despite this, the US Dollar Index (DXY) remained firm at 106.79.

On the other hand, strong Australian employment figures supported the AUD. Job growth in November beat estimates, with 35,600 jobs added versus the expected 25,000, while the unemployment rate dipped to 3.9%, better than the forecast of 4.2%.

Due to the optimistic employment data, the market odds for a February rate cut by the Reserve Bank of Australia (RBA) dropped from 70% to 50%. However, the RBA maintained a dovish tone, expressing confidence that inflation is steadily moving toward its target.

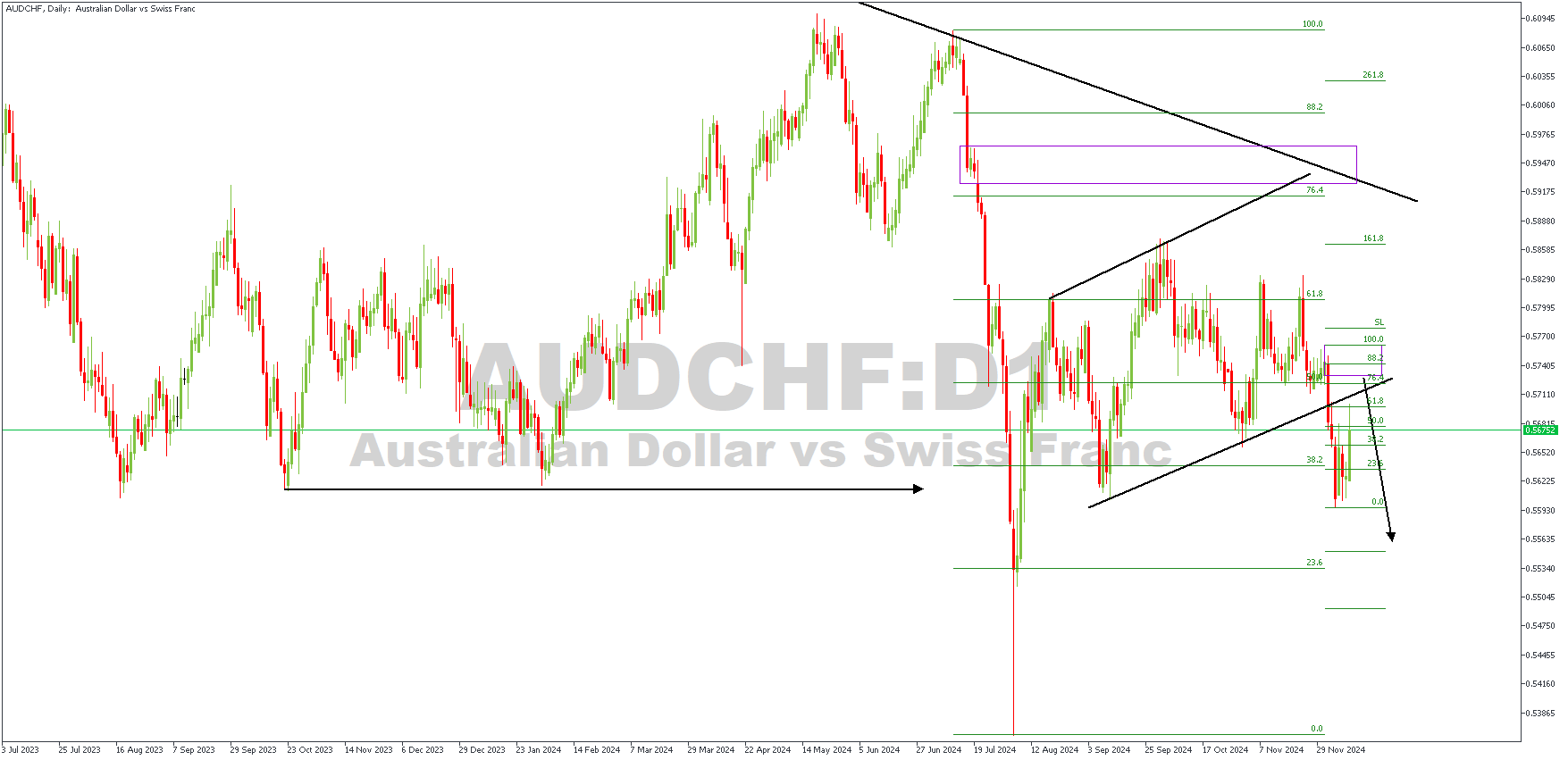

AUDCHF – D1 Timeframe

On the daily timeframe price chart of AUDCHF, we see that the price has recently broken below the trendline support of a channel pattern and is currently retracing toward the trendline for a retest. The trendline enjoys confluence from factors like the rally-base-drop supply zone and the 76% Fibonacci retracement level.

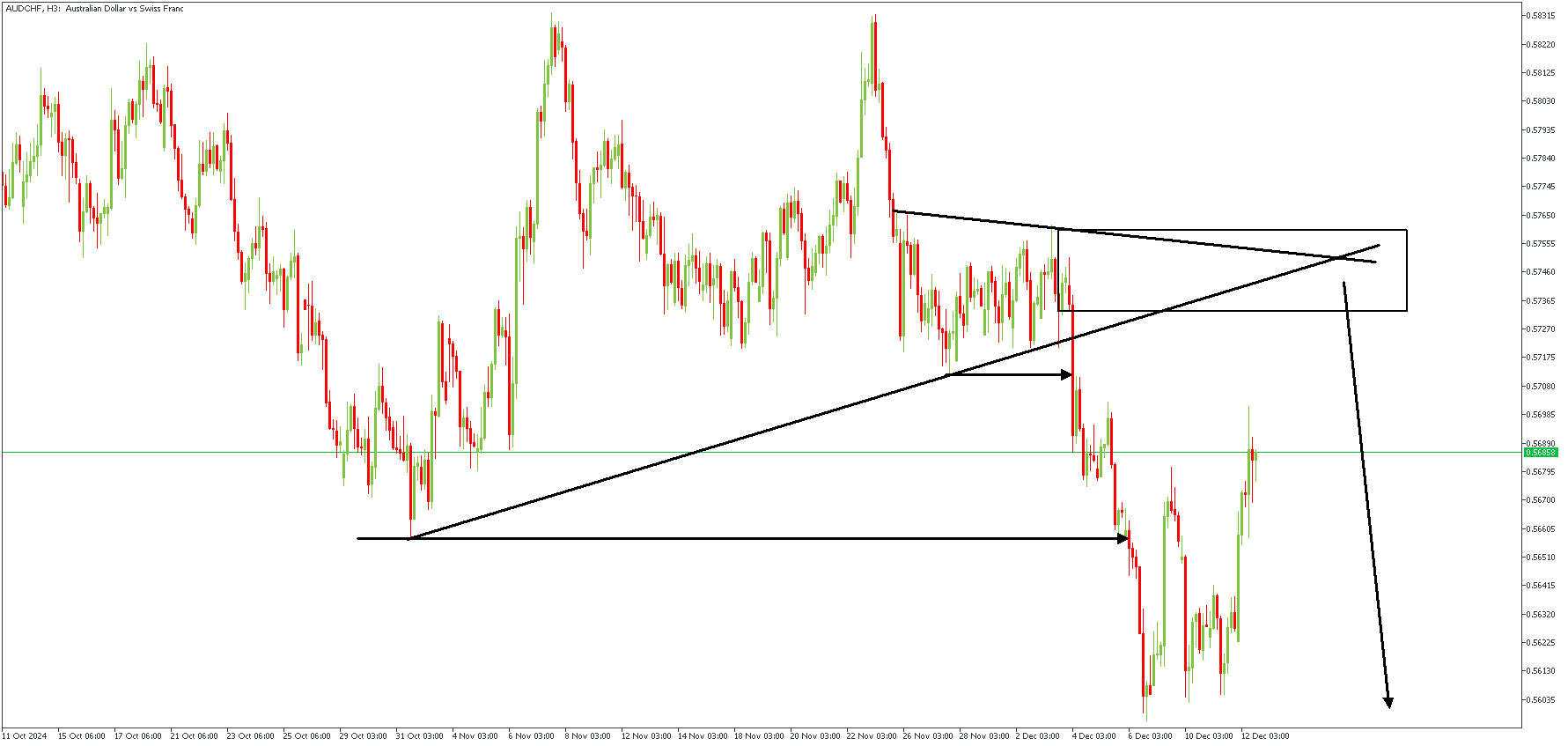

AUDCHF - H3 Timeframe

The 3-hour timeframe lends further support to the bearish argument. We see the confluence of two resistance trendlines converging within the supply zone. On this basis, a rejection from the highlighted zone can be considered a bearish entry.

Analyst's Expectations:

Direction: Bearish

Target: 0.55510

Invalidation: 0.57631

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.