On the 22nd of July, 2023, during our routine Monday Market Outlook, we took a critical look at the price action on a few pairs, among which were a few CAD-related commodities. In this article, I present to you those trade ideas in hopes that it provides you some trading edge as you proceed into the trading week. Cheers!

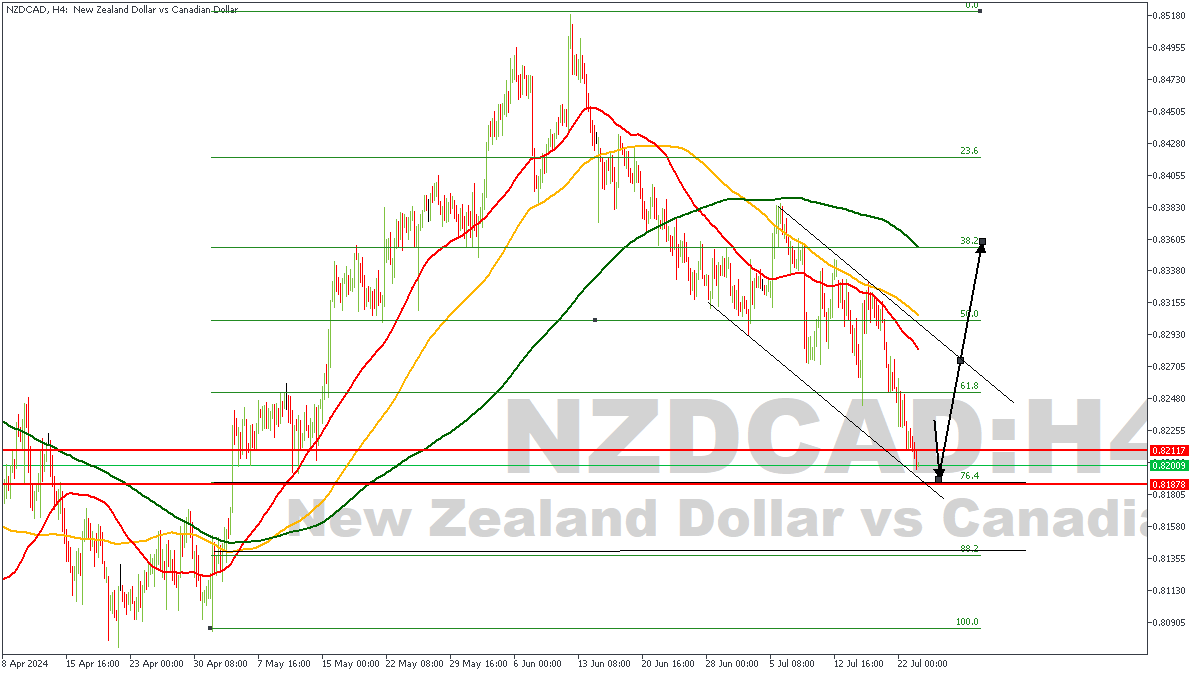

NZDCAD – H4 Timeframe

When we examined the price action on the 4-hour timeframe of NZDCAD, it was discovered that price was trading within a descending channel, and quickly approaching a critical Fibonacci retracement level. Besides this, there was also a Daily timeframe pivot zone perfectly overlaying the 76% Fibonacci retracement level – further confirming the bullish sentiment. At the moment, we see from the chart that price has entered into the pivot zone, and is currently resting on the Fibonacci retracement level, plus the support trendline of the descending channel. In summary, the conclusion from all these factors is that price is expected to make a bullish turn in the nearest future – albeit, a lower timeframe confirmation is expedient.

Analyst’s Expectations:

Direction: Bullish

Target: 0.82968

Invalidation: 0.80746

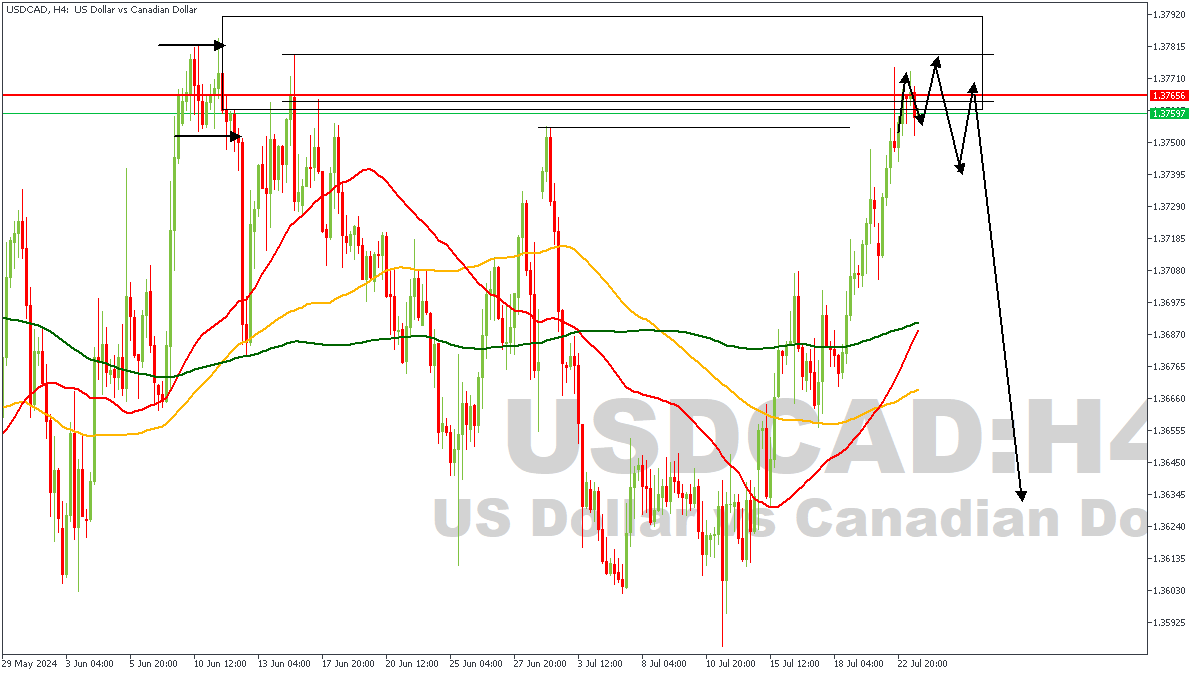

USDCAD – H4 Timeframe

As pertains the price action on the 4-hour timeframe of USDCAD, it was pretty much a clear case of an impending reversal. The reason for this sentiment is founded on the fact that price seems to have formed a SBR (Sweep-Break-Retest) pattern, with the current price action hanging from the supply zone at the head of the pattern. Also, the red line indicates that price had reached a pivot zone on the daily timeframe, leading me to the logical conclusion of a bearish sentiment. For further confirmation, a change of character on the lower timeframe can be expected.

Analyst’s Expectations:

Direction: Bearish

Target: 1.36878

Invalidation: 1.37923

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.