- Bullish Scenario: Buy positions above 5470 or on a pullback to 5450, targeting 5500 and 5551 in extension. Set a stop loss below 5430 or at least 1% of the account’s capital. Apply a trailing stop.

- Corrective Bearish Scenario: Sell positions below 5460 with targets at 5450, 5440, and only after breaking below 5430, consider extending to 5390, 5370, and 5360. Set a stop loss above 5450 or at least 1% of the account’s capital.

Fundamental Analysis

Key Takeaways:

- The S&P 500 has benefited from expectations of a Federal Reserve rate cut in September, driven by inflation data that met forecasts.

Sectors like technology and consumer goods have shown significant volatility due to regulatory developments and recent corporate earnings.

In recent days, the S&P 500 has seen moderately positive movement, mainly driven by increasing expectations of a rate cut by the Federal Reserve at its September meeting. U.S. inflation data has reinforced this outlook, boosting market confidence that the Fed will cut rates by 25 basis points in September and up to 100 basis points by the end of the year. This has generated a positive market sentiment, with the S&P 500 rising 0.2% intraday on August 15, reflecting a cautiously optimistic environment as investors anticipate a more accommodative monetary policy.

Despite this general optimism, volatility has persisted in some key sectors within the S&P 500. The tech sector has faced pressure due to regulatory concerns, particularly with Alphabet, which dropped 3% following reports of potential antitrust actions.

Technical Analysis

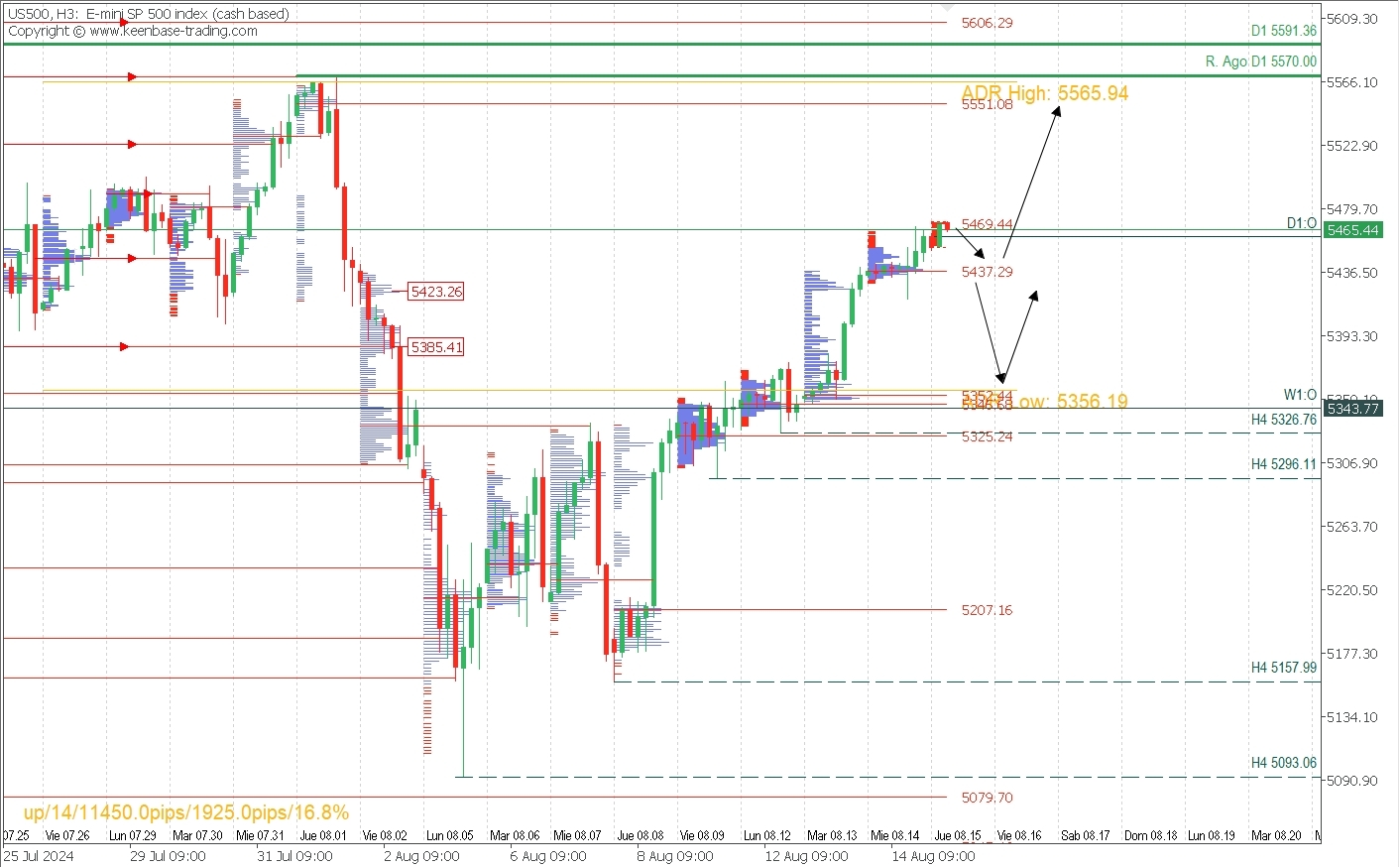

US500, H3

- Supply Zones (Sell): 5469.44 and 5551.08

- Demand Zones (Buy): 5437.29 and 5352.44

The index is recovering, surpassing the selling zones from Friday, August 2, and aiming to fill the volume inefficiency from August 1. This bullish scenario could play out directly on the Asian session volume at 5470 or correct down to 5450 or 5440, which are demand (buy) zones that could reactivate bulls, driving a new push toward the next supply (sell) zone around 5551 and the average daily bullish range at 5566.

This bullish scenario would be invalidated if prices decisively break below yesterday’s uncovered POC at 5437.29, potentially correcting toward the demand zone around 5350, where two uncovered POCs converge along with the average daily bearish range. The last relevant intraday support is at 5326.76, implying that buying opportunities remain valid as long as this support holds.

*Uncovered POC: POC = Point of Control: The level or zone where the highest volume concentration occurred. If a downward move follows from it, it is considered a sell zone and forms a resistance area. Conversely, if an upward impulse follows, it is viewed as a buy zone, usually located at lows, forming support areas.

@2x.png?quality=90)