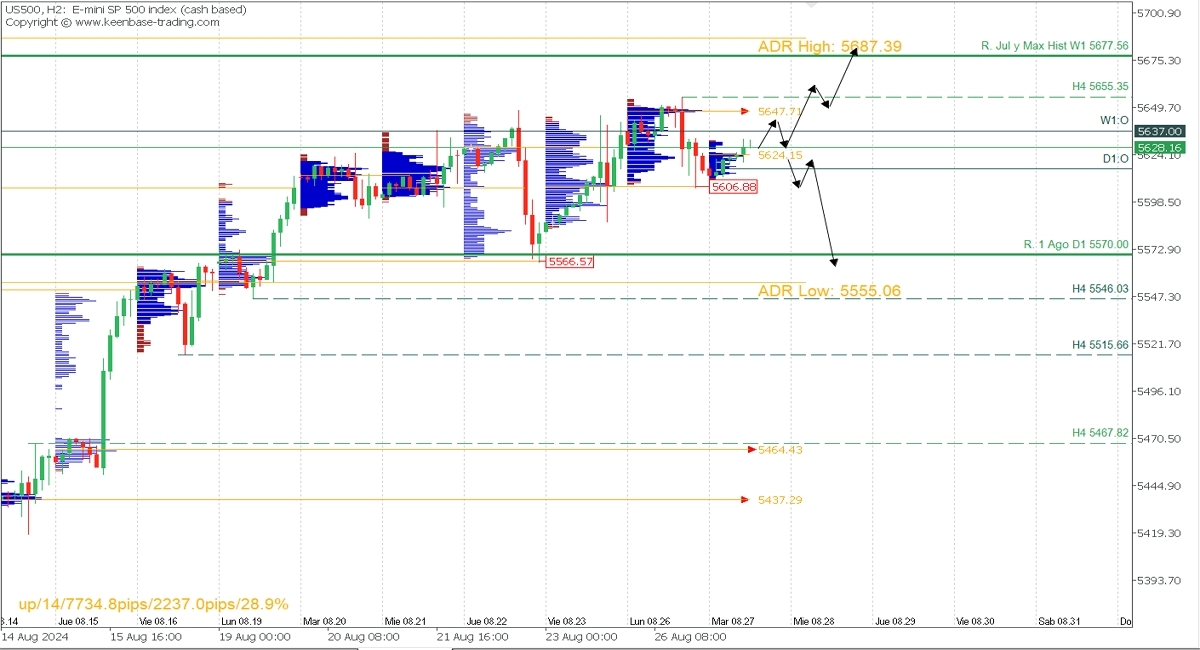

- Bullish Scenario: Buy positions above 5625 targeting TP1: 5647.71, TP2: 5656, TP3: 5677.56, and TP4: 5687 on extension. Set SL below 5606 or limit risk to 1% of account capital. Consider applying a trailing stop.

Corrective Bearish Scenario: Sell positions below 5605 targeting TP1: 5570 and TP2: 5555 with SL above 5625 or allocate no more than 1% of account capital.

Fundamental Analysis:

Since late last week, the S&P 500 has displayed mixed behaviour, pressured by Jerome Powell's Jackson Hole comments, which hinted at rate cuts, depending on labour market and inflation dynamics. However, limited economic data at the start of the week has reduced volatility, keeping the index stable.

Additionally, the market faces uncertainty from geopolitical tensions in the Middle East and rising oil prices, which could impact growth outlooks. Nevertheless, the prospect of Fed rate cuts and positive expectations for Nvidia’s upcoming results support the S&P 500, sustaining interest in defensive sectors like technology and consumer staples as investors await key economic updates.

Technical Analysis

US500, H2

- Supply Zones (Sell): 5647.71

- Demand Zones (Buy): 5624.15, 5606.88, 5566.57

Price is currently within the consolidation range from Thursday to Monday and within the narrow range between supply at 5647.71 and demand near 5606.88. A bullish intraday continuation is expected towards Monday’s uncovered POC at 5647.71, with two potential scenarios: 1. A decisive breakout or a second attempt above this supply zone could trigger further buying towards Monday’s resistance at 5655.35, aiming to surpass July’s high and current all-time high of 5677.56, and potentially reaching the bullish average range at 5687.39, marking a new record high.

However, a strong bearish reaction from Monday’s supply zone that breaks below the initial POC at 5624.15 and Friday’s demand zone at 5606.88 could lead to a correction towards 5570, the last significant intraday support, indicating a possible intraday bearish reversal or broader correction.

*Uncovered POC: POC = Point of Control: The level or zone where the highest volume concentration occurred. If a bearish move follows, it becomes a sell zone and forms resistance. Conversely, if a bullish move follows, it is a buy zone, typically found near lows and forms support levels.

@2x.png?quality=90)