The month of July is gradually wrapping up, and what this means for traders like you and I, is that the weekly and monthly timeframe candles are prepping for their final moves before closing. This usually results in some last-minute pressure and induced volatility in the markets. On that note, here is my most-anticipated trade for the week.

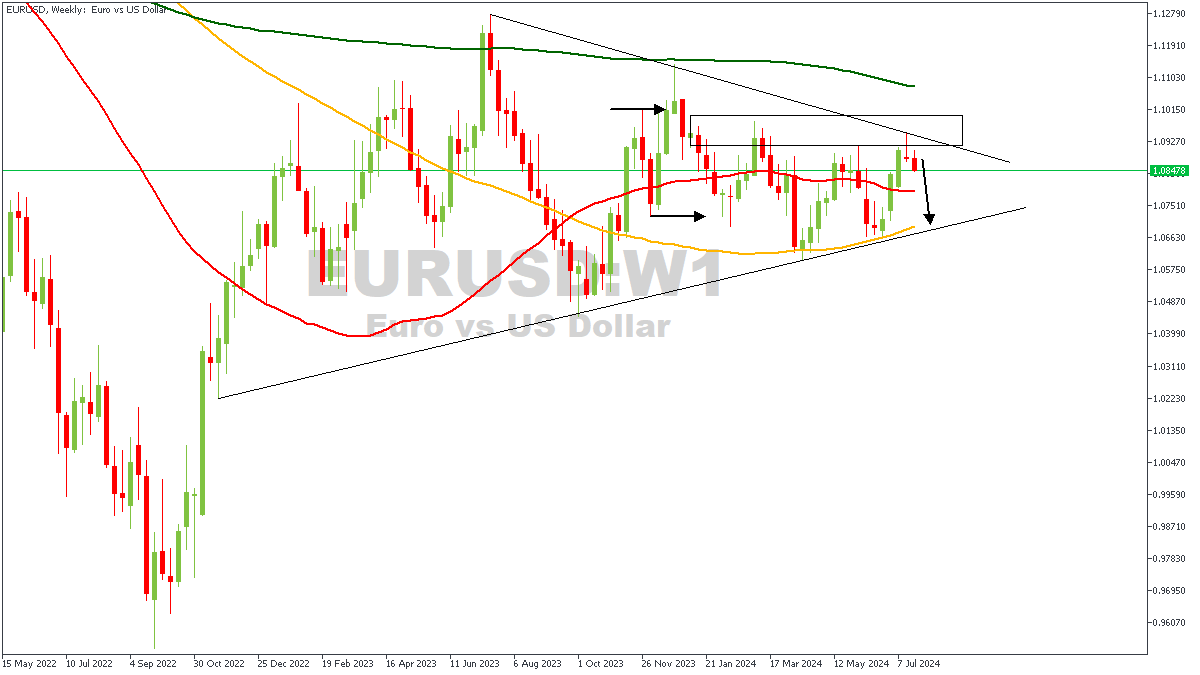

EURUSD – W1 Timeframe

By now you’re probably familiar with the Sweep-Break-Retest (SBR) price action pattern, which is something currently playing out on the Weekly timeframe of EURUSD at the moment. A close look at the price action reveals that the rejection on EURUSD began from the confluence of the trendline resistance, drop-base-drop supply zone, and the 76% of the Fibonacci retracement from the swing high. What this means is that we can expect the bearish outcome from the rejection to last much longer.

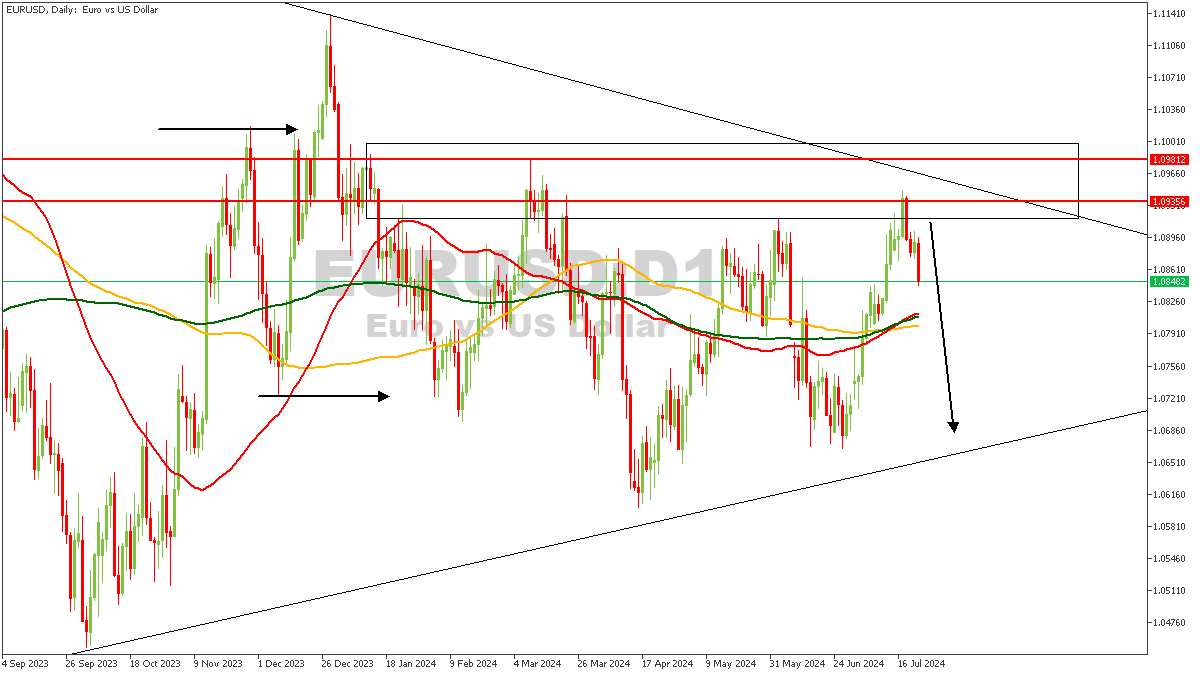

EURUSD – D1 Timeframe

Whilst the SBR pattern is clear on the Weekly timeframe, the Daily timeframe also has its own story to tell. From the Daily timeframe of EURUSD, we can see the demand zone that may serve as an initial target for the bearish movement as price continues to slide even further down. The confluence area of the moving averages may provide a bit of dampening effect for price, but I do not think it would be sufficient to alter the direction entirely.

Analyst’s Expectations:

Direction: Bearish

Target: 1.07390

Invalidation: 1.09267

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.