- Bullish Scenario: Buy above 171.20 with targets at 171.47 and 172.00 on extension. Set stop loss (S.L) below 1.3752 or at least 1% of the account's capital. Apply Trailing Stop.

- Bearish Scenario: Sell after the next rally below 1.3845 (after forming a PAR*) with TP1: 1.3830, 1.3820, and 1.38 on extension with S.L. above 1.3850 or at least 1% of the account's capital.

2nd. Bearish Scenario: Sell with a drop below the key support 1.37556 with targets at 1.3744 and 1.3720 on extension.

Fundamental Analysis

Multiple economic and monetary factors influence the USDCAD pair. The Bank of Canada (BoC) is expected to cut its interest rate by 25 basis points, which could create bearish pressure on the Canadian dollar. This decision is supported by a slowdown in inflation and a weakened labour market in Canada.

At the same time, the US dollar shows strength due to increased risk aversion but faces pressure due to expectations of Federal Reserve (Fed) rate cuts in September, in response to economic data suggesting a moderation in inflation.

The US Dollar Index (DXY) has remained around 104.50, with falling US Treasury bond yields putting pressure on the currency. With markets anticipating a Fed rate cut in September, the future trajectory of the USD could depend on upcoming economic data such as PMI, US second-quarter GDP, and PCE inflation to be released at the end of the week.

Additionally, the political context surrounding the US presidential elections adds a layer of uncertainty for investors.

Technical Analysis, H2. Intraday and Swing Outlook

USDCAD

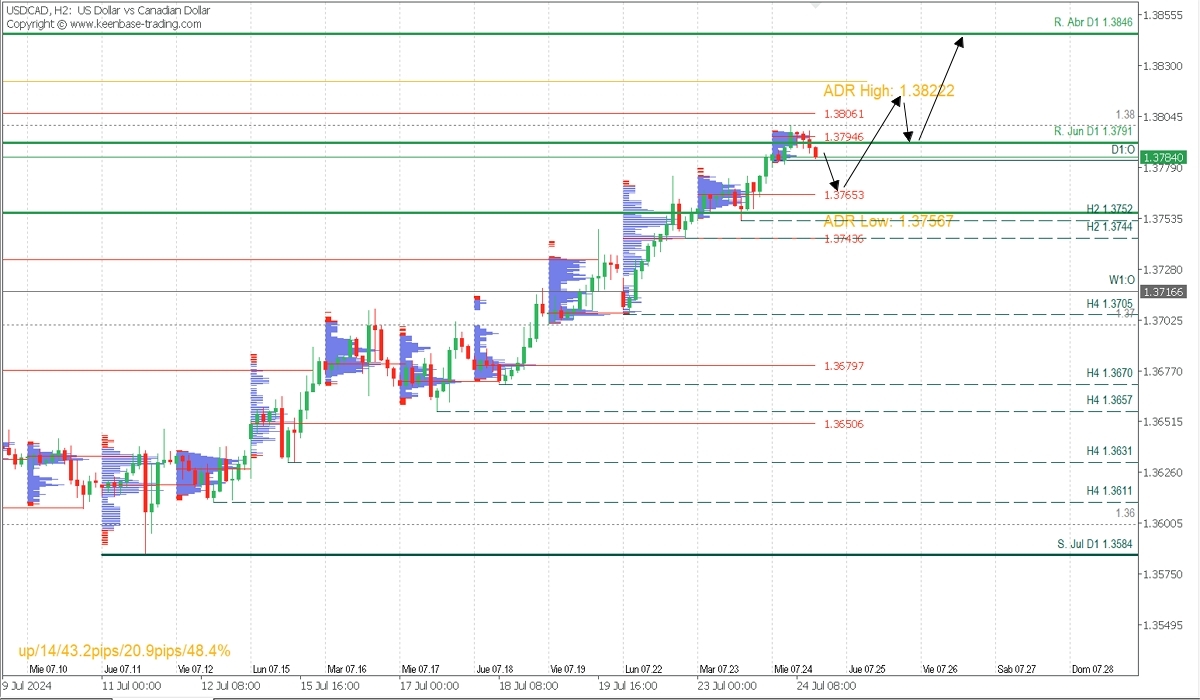

- Supply Zones (Sell): 1.3794 and 1.3806

- Demand Zones (Buy): 1.3765 and 1.3743

The USDCAD pair is in a clear uptrend, with the last relevant intraday support at 1.3752. Yesterday's Point of Control (POC) is at 1.3765, indicating significant volume and activity at this level, serving as a crucial reference point for price movements.

In the short term, the price has faced resistance near 1.38, suggesting a possible correction if this level is not surpassed with sufficient volume.

A retracement to yesterday's uncovered POC at 1.3765 could be seen as a buying opportunity, given the favourable volume profile and overall bullish trend.

In case of a breakdown of this zone, the next key level to watch would be the key support at 1.3752, with a potential intraday trend reversal and a target at the next volume zone at 1.3743, where another support level lies and converges with a significant volume area.

On the other hand, a breakout above the POC of the early sessions, 1.3794 and 1.38 could pave the way for an uptrend extension towards higher levels, with an initial target at the uncovered POC 1.3806, the bullish average range at 1.3822, and more extensively the April resistance at 1.3846. However, a lack of continuity in buying volume at these levels could lead to consolidation or even a retreat towards the aforementioned support areas.

*Uncovered POC: POC = Point of Control: It is the level or zone with the highest volume concentration. If a bearish move occurred previously, it is considered a selling zone and forms a resistance area. On the contrary, if a bullish impulse occurred previously, it is considered a buying zone, usually located at lows, forming support areas.

@2x.png?quality=90)