If you want to become a Forex trader, and are trying to find out the best amount to start Forex trading, you have come to the right place. In this article, we explain the minimum amount of money you will require to trade currencies.

Trade for free on a demo account.

To begin with, remember that there are demo accounts that allow you to practice trading without investing a single dollar. The size of an FBS demo account can be up to $1 million. The demo account will allow you to practice opening orders and setting position sizes.

If you are ready to trade using a real account and make real money, you should know that the amount of money you need to start trading depends on your chosen account type.

For example, to trade on a real trading account, you must deposit at least $5. You’ll be able to open orders, the volume starting from 0.01 lots, and you’ll have amazing leverage.

Your deposit determines your trade size

The minimum trade size with FBS is 0.01 lots. A lot is a standard contract size in the currency market. It equals 100 000 units of a base currency, so 0.01 lots account for 1000 units of the base currency. If you buy 0.01 lots of EURUSD and your leverage is 1:1000, you will need $1 as a margin for the trade. If you deposited $5 on the standard account, your deposit would cover this margin, and you can open another four trades of this size.

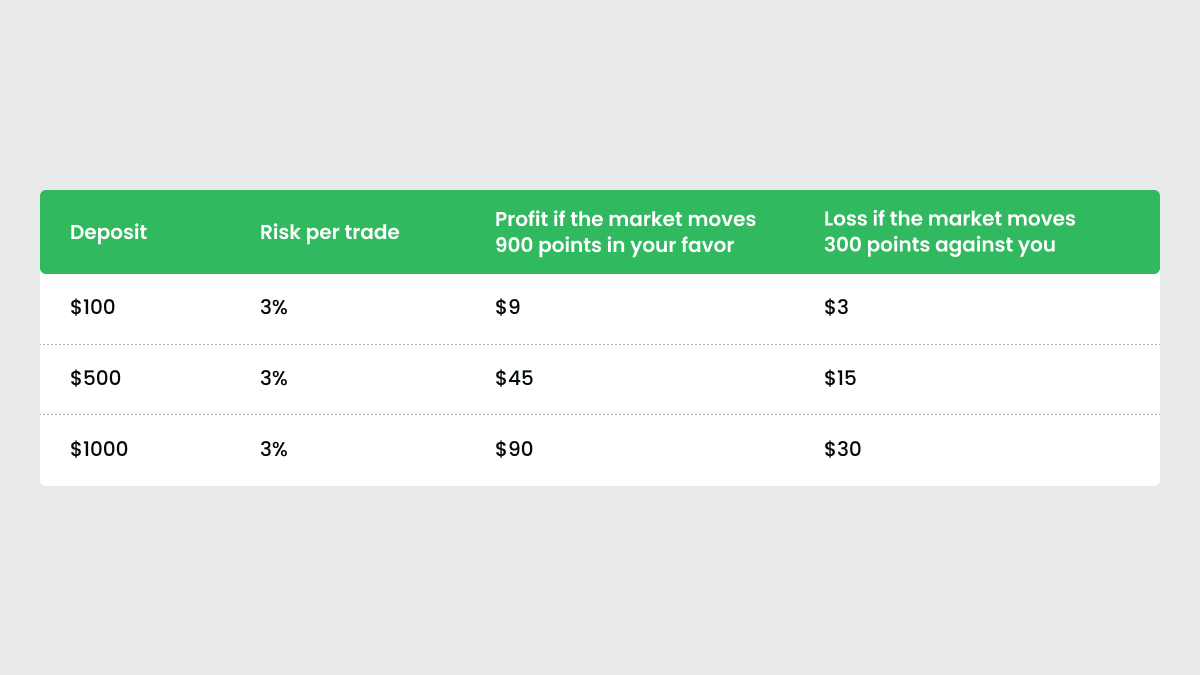

Let’s consider some good options for a beginner trader. The examples we bring here are safe from a risk management point of view.

How much can you make with $100 on Forex?

Trading with only $100 may seem impossible. The risk for a single trade should be below 5%, no matter how big your deposit is. Let’s go with a 3% risk ($3). If you trade 0.01 lots, you can have a Stop Loss of up to 300 points – more than enough for an intraday position. The recommended risk/reward ratio is ⅓, so the potential profit for this trade will be 900 points ($9).

How much can you make with $500 on Forex?

Let’s consider the case when you’re trading with 500 dollars. With a 3% risk ($15), your trade size can be 0.15 lots. In that case, each point of profit/loss will account for $0.15. With a more significant position size, you’ll be able to earn money faster. There will be 100 points for a stop-loss. If you need a wider stop, you can trade a 0.1 lot, making each point cost $0.1. The stop-loss will be 150 points. With 5% risk ($25), you can allow a 250-point SL. The profit in that case (if your take-profit is three times bigger) will be $75.

How much can you make with $1000 on Forex?

If you are trading with $1000, you can open even bigger trades. Let’s find the optimal risk size for Forex trading with $1000. A risk of 3% for a trade ($30) and 1:1000 leverage will allow you to trade 0.3 lots with a stop-loss of 100 points. A risk of 10% ($100) will allow you to trade one lot. In this case, 300 points of profit will account for a gain of $300. The optimal risk of $30 a trade will allow you to trade 0.1 lots with an SL of 300 points. The potential growth will be $90.

Depending on the percentage of your account you want to assign for a trade, there may be different combinations and the size of stop-loss in points you need for your trade may differ. For your account’s safety, keeping the risk per trade (calculated as % of your account) at roughly the same level is recommended. As a result, you can multiply your gains in a single trade by choosing a bigger deposit.

Another important thing to remember is margin calls and stop outs. A margin call is an allowed margin level of 40% and lower. At this point, the company is entitled but not liable to close all open positions of a client due to a lack of free margin. Stop-out is a minimum allowed level of margin (20% and lower) at which the trading program will close the client's open positions one by one to prevent further losses that lead to a negative balance (below $0).

Both the margin call and stop-out are essential for you as a trader because they keep your risks always limited. FBS provides negative balance protection to ensure that you will never find yourself in debt to the company.

If you abide by risk management rules and don’t put your entire deposit into trading action at once, you’ll be safe from margin calls and stop-outs.

The capital you need for trading

As you see, the minimum Forex trade size is $5. The rest is up to you. Estimate your knowledge and experience, and also think about your goals. How much money would you like to earn? How often will you trade? The bigger the deposit, the bigger the position size, and the more you earn from one trade. All of that should be weighed against the background of risks.

Please ensure that you spend only your spare money on trading, not the money that covers your basic life needs. Trading offers excellent opportunities to profit, but it’s risky and losses are possible.

Tips for Forex trading with small trade size:

After you read the advice on the deposit/risk balance and decide to trade, read these tips - they will help you succeed. These tips are handy for those who want to start trading with a small trade size.

-

Good risk management is a must. Always use stop-loss and take-profit orders to control the results of your trade. Remember that the recommended risk percentage for beginners is 3% of your account on any single trade.

-

Maintain an appropriate risk/reward ratio. Make sure the potential reward of a trade is at least equal to or greater than the potential risk. Aiming for a 1:3 or higher risk/reward ratio is a great rule of thumb

-

Have realistic income expectations. Most likely, you won’t get rich overnight. Try to focus on making consistent profits over the long term;

-

Avoid margin calls. If you're using leverage, be careful not to overextend yourself. Ensure you have enough margin to cover your trades and avoid margin calls.

-

Try out the Demo account. Practicing your trading skills on the Demo account that copies the natural market environment before risking real money is good. This will help you to get a feel for the market and develop your skills.

-

Keep learning. The Forex market is constantly changing, so staying up-to-date with the latest news and trends is important. FBS helps you do that with the Guidebook and educational articles on its website.

-

Choose a broker that you can trust. Look for a broker that is regulated and has a good reputation in the industry. Avoid brokers with high fees or poor customer service.

By following these tips, you can enrich your approach to trading even with a small trade size. Remember to stay strongly disciplined and patient, and never risk more than you can afford to lose.

Strategy for traders with small trade size

Having a proper understanding of your actions in the market is necessary, especially when your trade size is small. Below we present the rules of a strategy with small trade size.

In the first step, decide how much time you can dedicate to trading. Remember that the busiest trading hours are usually when two sessions overlap. For example, you can consider the juncture between the London and New York trading sessions.

Secondly, you need to select the timeframes you will follow while trading. We recommend selecting three timeframes to focus on throughout the day, such as D1, H4, and H1. On the highest timeframe, you check the general trend. On H4, you check the setups and wait for the entry on H1. It’s not recommended that you hold your position for more than one day if you decide to trade with a small trade size because your trade will be susceptible to swaps.

In the third step, no matter what your account size is, you must keep your risks at 3%. As mentioned previously, this is the optimal risk size. Also, remember the risk/reward ratio (⅓ is recommended).

In the fourth step, decide what technical tools you need to implement. These can be trendlines, support and resistance levels, and technical indicators. You can also trade without them if you are familiar with price action techniques.

Finally, be sure to have clear conditions for exiting a trade. This could include reaching a certain profit level or hitting a predetermined stop-loss level. By having a clear plan for exiting a trade, you can help reduce the impact of emotions and stick to your trading strategy.