Gold prices are holding steady near $2,650 in Asian trading on Monday, despite positive market sentiment from China's new stimulus measures. Traders are hesitant to make any big moves before the speech from US Federal Reserve (Fed) Chairman Jerome Powell later today. Powell didn’t touch on the economy or monetary policy in his last speech, so investors are looking forward to hearing any clues on the possible interest rate cut in November.

Currently, the market sees a 52% chance of the Fed cutting rates by 50 basis points in November, according to the CME Group’s FedWatch Tool, slightly up from last week’s 50% odds. The recent US inflation data, especially the core Personal Consumption Expenditures (PCE) price index, hasn’t changed expectations. While the annual core PCE rate moved closer to the Fed's 2% target, Gold still pulled back from last week’s high of $2,686 as traders took profits ahead of key US employment data. Despite ongoing geopolitical tensions in the Middle East and fresh Chinese stimulus, Gold prices continue to face downward pressure Today.

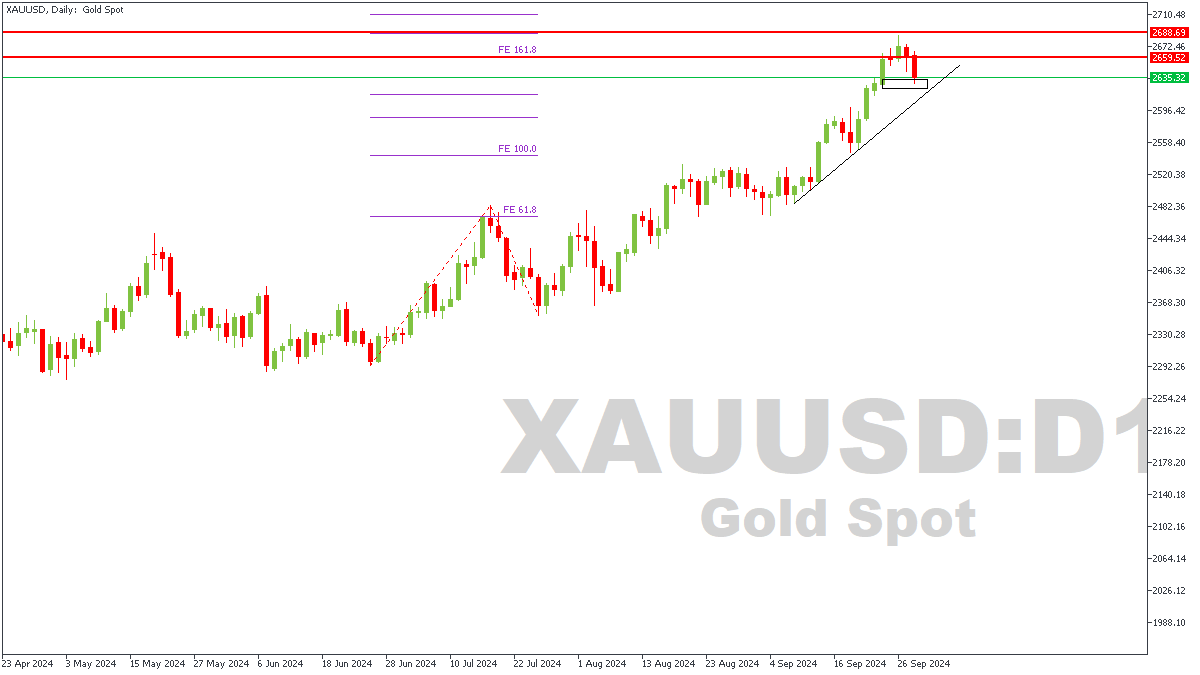

XAUUSD – D1 Timeframe

The two horizontal red lines you’re seeing on this daily timeframe chart of XAUUSD represent the pivots based on the Fibonacci expansion tool. Now, the fact that Gold is at an All-Time-High (ATH) necessitated the use of the Fibonacci expansion tool to figure out future pivots. We have also seen an initial rejection from this area, leading me to vote in favor of the ‘Bears.’

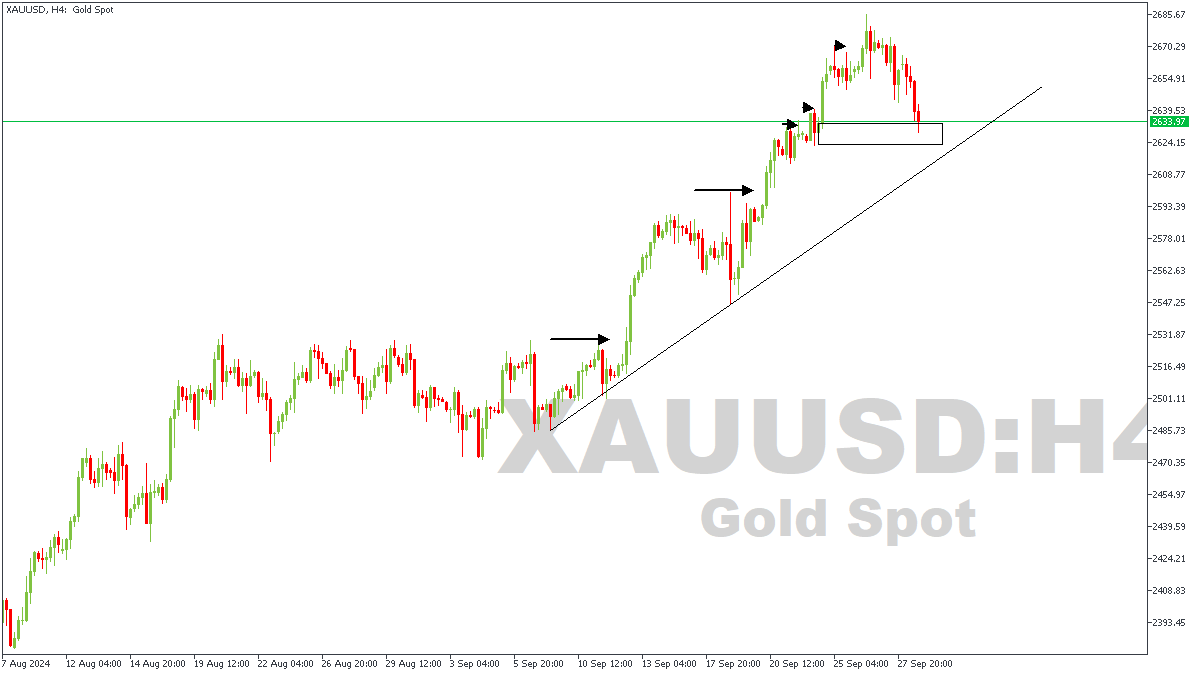

XAUUSD – H4 Timeframe

The 4-hour timeframe sheds more light into the criteria required for the confirmation of the bearish sentiment. The decider in this case being the break below the trendline support and the highlighted demand zone. Patience is advised, since a retest of the broken demand zone will provide a much safer point of entry than the aggressive approach.

Analyst’s Expectations:

Direction: Bearish

Target: $2,541.13

Invalidation: $2,675.85

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.