Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

2021-06-02 • Updated

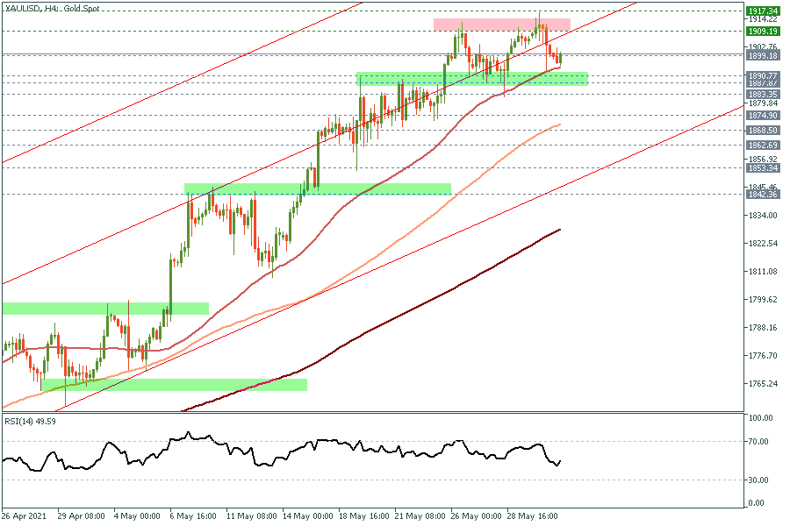

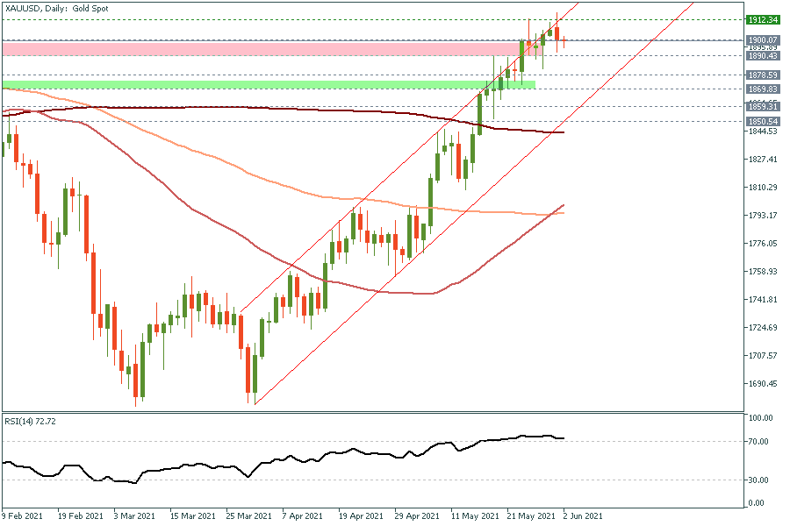

As warned over the past few days, gold is not in a position to keep on rising. Yesterday gold managed to rise all the way to $1,916. However, it failed to sustain these gains and dropped back below $1,900/Oz. The technical indicators are heavily overbought and starting to turn lower again, which keeps the possibility for further declines ahead. Such a downside move is only a short-term retracement, and it does not mean that the upside trend is over. Therefore, we still prefer to wait for the downside retracement to conclude before adding new long positions, while we maintain the long positions that we issued back in April at $1,725 and $1,715/Oz for now, but it's wise to raise the stop loss to $1,835 for now.

| S3 | S2 | S1 | Pivot | R1 | R2 | R3 |

|

1854.80 |

1878.99 |

1889.71 |

1903.18 |

1913.90 |

1927.37 |

1951.56 |

Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

The e-commerce giant has recently faced a lot of pressure, starting from global uncertainty in China amid lockdowns and geopolitics. The company has been added to the US SEC (Securities and Exchange Commission) delisting queue. Finally, there’s an earnings report coming on August 4. Let’s discuss everything and prepare for the next move.

US stocks have delivered their worst first half of a year in more than 50 years triggered by the Fed's attempt to control inflation and growing concerns about recession.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!