The world’s top oil producers pulled off a historic deal to cut global petroleum output by nearly a 10th, and they considered this deal as an end to the devastating price war that brought the energy industry to its knees. However, crude oil isn’t inspired by the news much as its price has been drifting lower since the beginning of the Asian session.

Is the price war over?

In short, no it’s not. Today, Saudi Aramco announced that it cuts all May oil pricing to Asia. In addition it raises May oil pricing to the US by $2.50-$4.20/BBL.

Why crude oil did not rally?

- The deal has been already priced in since few weeks back, when there were multiple statements by some producers that a deal is needed. Back then, Brent already rallied to $36, while WTI Crude traded near $30.

- The decision is disappointing somehow. The market expected over 15 million barrel cut including OPEC+ and G20. OPEC couldn’t even cut production by the 10 million they had been talking about as Mexico opposed such decision.

- Despite the deal and the timing of it amid the global crisis of coronavirus, the global economy is not in shape to handle high oil prices by any means, especially as the global recession is here to stay.

What does it mean for crude oil prices?

Reading the history is very important when it comes to crude oil trends. Everyone is asking the same question now: will the price of oil skyrocket again? In short, the answer is no.

The deal that was signed after Saudi Arabia called for an emergency meeting to discuss oil prices will lead to some stabilization and/or will at least stop the crash, but it won’t necessarily help crude oil skyrocket.

This is exactly what happened back in 2015 and 2016 when the prices crashed and OPEC was forced to stop the crash by cutting the output after verbal statements failed to stop the crash.

Brent crude outlook

From a technical point of view, Brent crude has been trading within a tight range after retracing 23.6% from the latest crash as shown on the chart and failed to continue with its retracement. Yet, the current declines might continue all the way back to 27.28 key support, which likely to hold over the next few weeks.

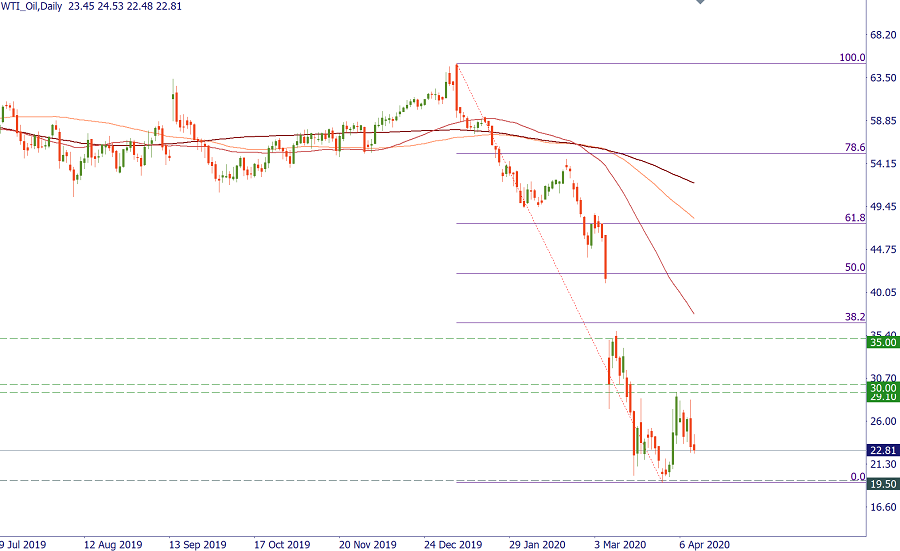

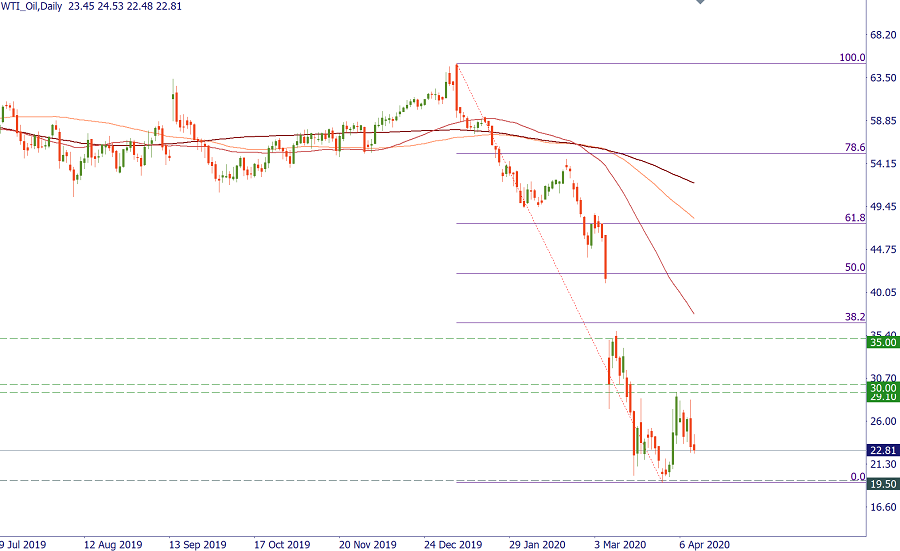

WTI crude outlook

WTI has almost the same scenario, but WTI technical outlook is more bearish than Brent for now. WTI failed to retrace by 23.6% and declined before testing it all the way back to $23 earlier today. We believe that the key support for WTI stands at $21.50. A break below this support would lead to another leg lower once again back to 19.27.

Final note

Traders needs to be careful over the next few days and weeks. There is no need to overestimate the next move whether it’s higher or lower. The deal that was announced is supposed to stabilize the market, it doesn’t mean that oil will skyrocket once again especially as the global economy is suffering amid the global lockdown due to the coronavirus pandemic. Therefore, if the prices stabilize, it will be a perfect opportunity to pick up some trades from the technical analysis point of view.

LOG IN