The aussie has been climbing up for the second day amid the ongoing risk-on sentiment. Tomorrow the Reserve Bank of Australia will make a financial stability review. It’s released only twice a year, that’s why it will grab a lot of attention. More optimistic outlook will push the Australian dollar upwards, while more negative – downwards. The RBA has already shown its interest in lowering interest rates, which in turn will lead to the depreciation of the AUD. That’s why it’s significant to pay close attention to this release.

Besides, Chinese PMI will be out a little bit later and will impact not only the Chinese yuan, but also the aussie due to the close trade relationship between Australia and China. Better-than-expected reading will push AUD/USD higher, while worse-than-expected numbers will drive the pair lower.

Technical tips

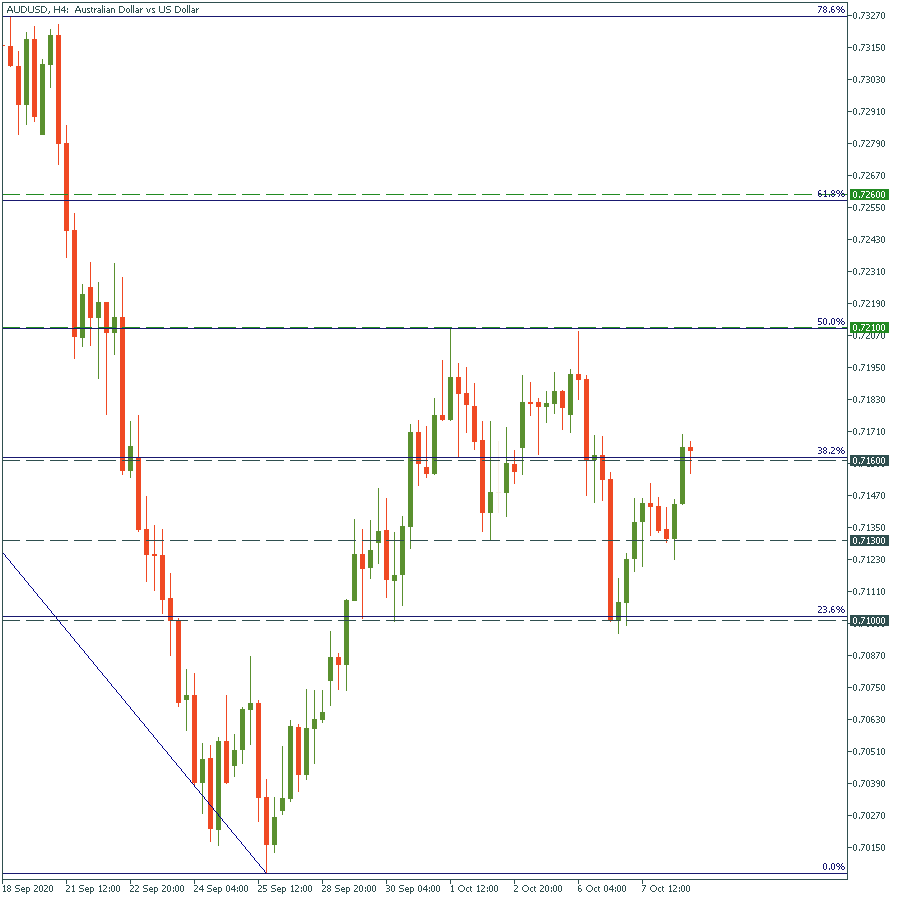

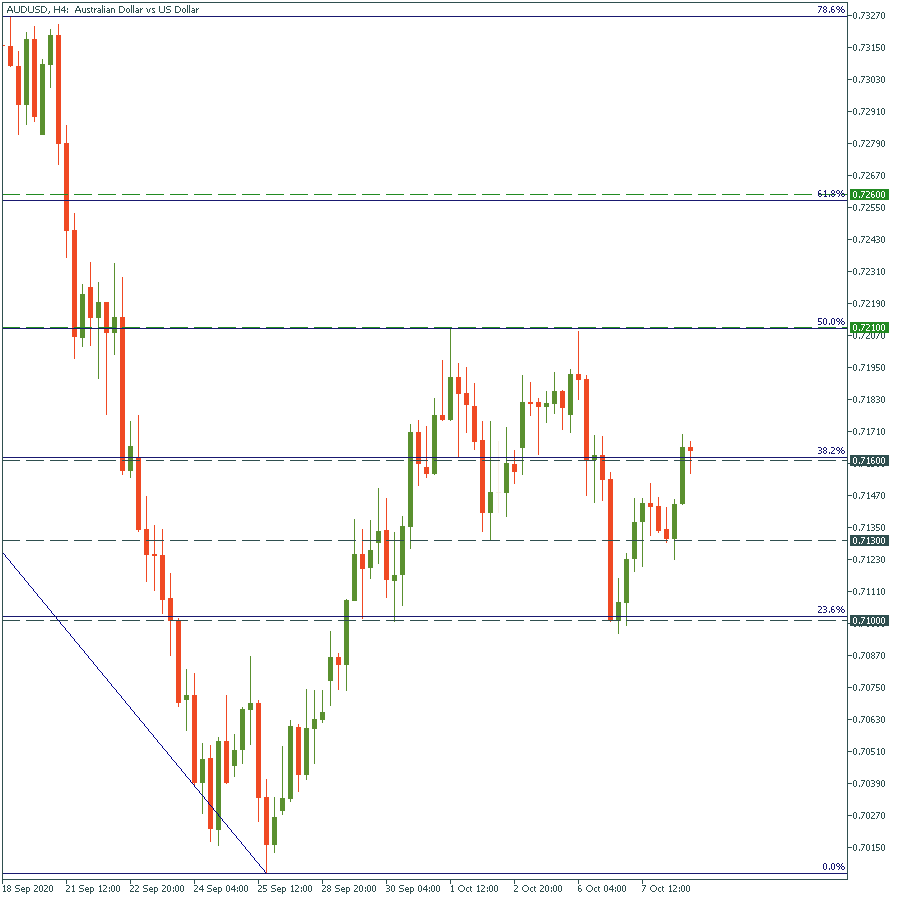

AUD/USD has just broken through the 38.2% Fibonacci level of 0.7160 and pulled back to it. It should be just a natural short selling after the breakout. Therefore, it’s likely to bounce off this level and after that surge to the next resistance at the 50% Fibonacci retracement level of 0.7210. On the flip side, the move below this level will drive the price to the intraday low of 0.7130.

TRADE NOW