The British pound fell against the dollar in the past week as the UK data indicated that manufacturing, industrial and construction output declined in May. A slightly stronger USD which was brought about by an upbeat NFP release resulted in a swift correction towards 1.2865.

The economic figures pointing to an economic slowdown released in the course of the past week may prevent the Bank of England from rising its borrowing costs. UK average hourly earnings and unemployment data are due on Wednesday. An indication of wage growth would slightly raise the probability of a rate hike this year and provide a modest support to sterling. Towards the end of the week, traders will be focused on the Fed Chair Yellen’s testimony as well as on the spate of the US economic data. If traders qualify Yellen’s statement as hawkish, the USD will gain some strength. The US inflation report, retail sales, and industrial production data will be released on Friday. Strong readings could also accord some support to the US dollar.

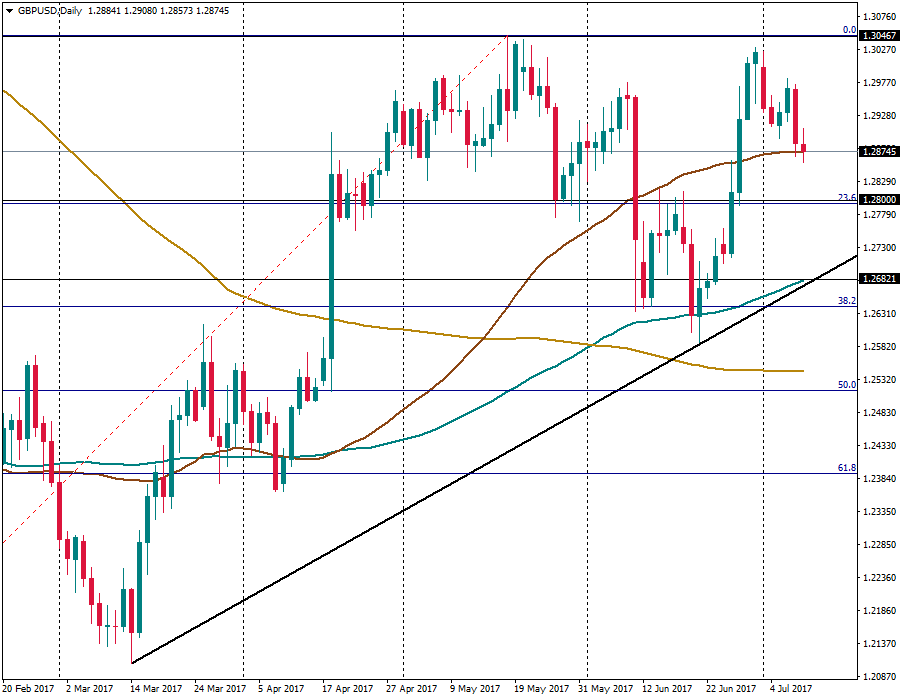

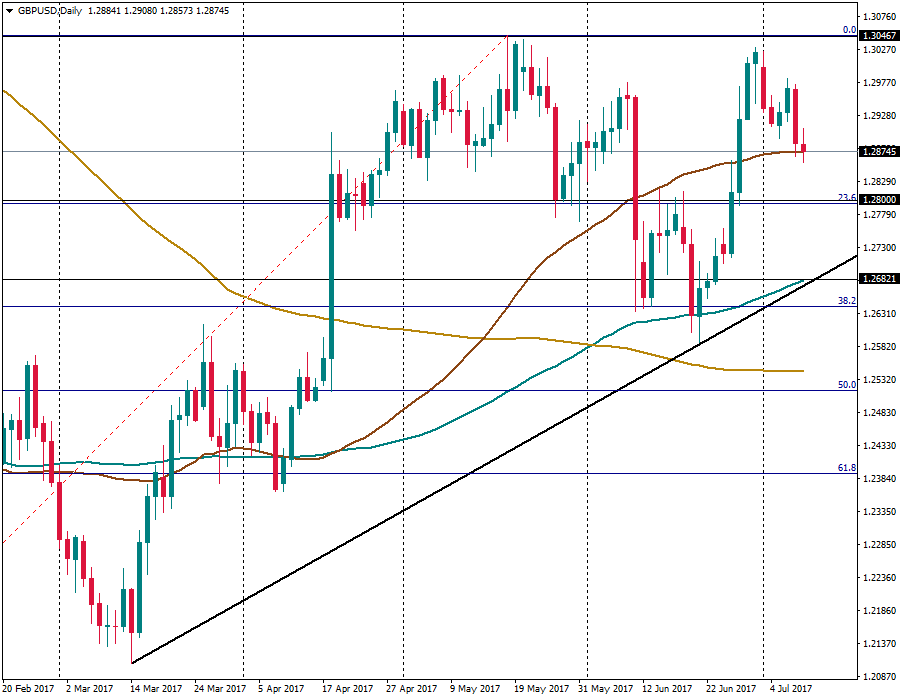

GBP/USD has recently dropped below 1.2875 (50 day MA). The technical outlook is still neutral though. The pound has likely moved into a consolidation phase. In the upcoming sessions, it will be trading within the broad range of 1.2800 (23.6% Fibo traced from this year low) and 1.3045 (this year high). The immediate bias is to probe lower levels. A break of the lower border of consolidation range will likely lead to the continuation of the downward movement towards 1.2682 (100-day MA), 1.2640 (38.2% Fibo level).