The EU plans to intervene in markets directly to curb rising energy costs, threatening to push the Euro area's economy into a deep recession.

2021-08-03 • Updated

4H Chart

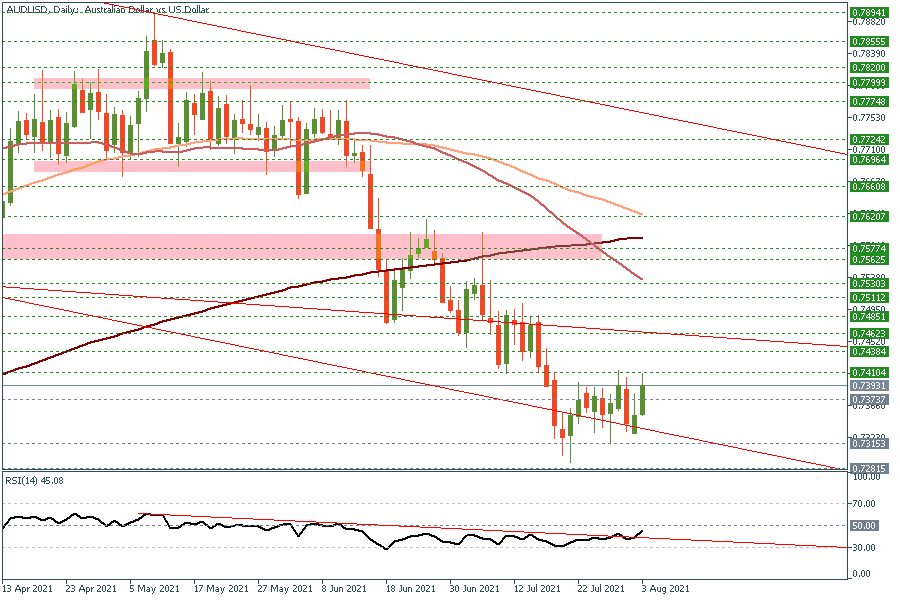

Daily Chart

The Reserve Bank of Australia decided to keep the current policy unchanged as widely expected. However, and against all odds, the bank took the first steps toward winding back emergency monetary stimulus for an economy that’s exceeded forecasts. The BRA made this move even though many saw the bank hinting for a possible increase in asset purchases amid partial lockdown in parts of the county due to the high rate of covid19 cases. Yet, the plan to taper by 1B in September could be a message that the RBA is seeing some inflation pressure on the horizon. In the meantime, AUD/USD is still in a retracement mode, which may target 0.7470 and 0.7530’s before the downside trend resumes. Therefore, I would long some AUD/USD around here 0.7380’s with a stop at today’s low only.

| S3 | S2 | S1 | Pivot | R1 | R2 | R3 |

| 0.7252 | 0.7305 | 7333 | 0.7358 | 0.7386 | 0.7411 | 0.7464 |

The EU plans to intervene in markets directly to curb rising energy costs, threatening to push the Euro area's economy into a deep recession.

The past two years have seen the biggest swings in oil prices in 14 years, which have baffled markets, investors, and traders due to geopolitical tensions and the shift towards clean energy.

Yes, oil prices are burning right now, and inflation is getting hotter along with it worldwide. However, the oil's bullish momentum is under threat.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!