The EU plans to intervene in markets directly to curb rising energy costs, threatening to push the Euro area's economy into a deep recession.

2019-11-11 • Updated

The Chinese yuan continues to depreciate. In the past two weeks, the Chinese currency has declined by 5%. On June 3, the yuan declined to lows of August 2017. The reason for such a strong fall is concerns that tariffs between US and China can turn into a real trade war. On July 6, the US president Donald Trump is going to impose a 25% duty on $34 billion worth of Chinese products. To retaliate, the Chinese president Xi Jinping will impose 25% tax on US goods on the same day. Such situation leads to the risk-off sentiment where investors invest in safe-haven currencies such as the Japanese yen. In the USD/CNH pair, the US dollar is more stable. And in this case, traders will invest in the USD.

However, financial officials and state media try to calm down the market. The head of China’s foreign exchange regulator and a central-bank deputy governor said that China has the “fundamentals, capability and confidence” to keep the currency stable at a reasonable level.

The Governor of the People’s Bank of China said that the depreciation of the yuan was caused by the strong US dollar and external uncertainties. However, the Governor assures that Chinese economy is becoming a high-quality growth model with financial risks under control and capital flows balanced.

Technical side

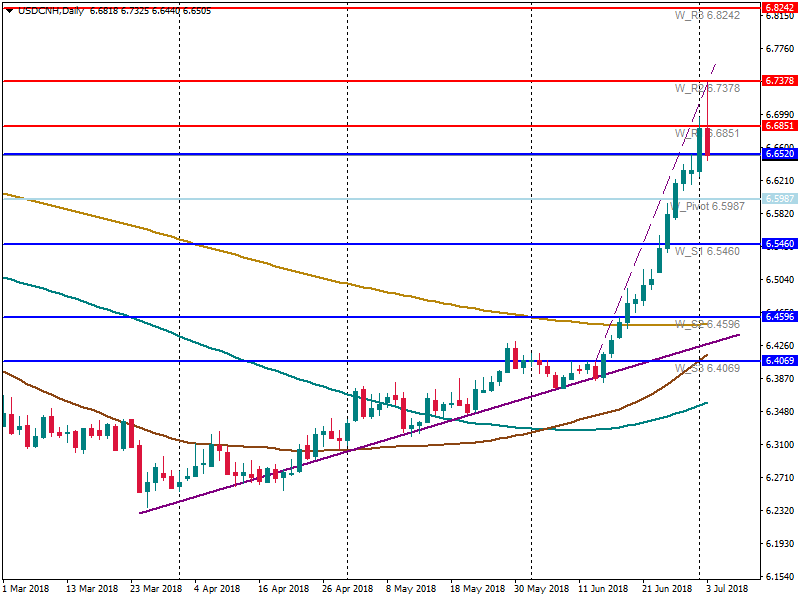

On July 3, the USD/CNH pair tested highs of the August 2017. Before the reversal, the pair tested the resistance at 6.6850 and 6.7325. However, the level of 6.7325 (100-week MA) became a resistance for the pair.

Some analysts said the Chinese Central Bank won’t let the currency to depreciate more than 2% a day as it happened in August 2015. According to Reuters, some major state-owned banks swapped yuan for dollars in the futures market and immediately sold some of them into the spot market. It helped shore up the Chinese currency.

Up to now, USD/CNH has been going down. It has tested the support at 6.6520. The next one lies at 6.60. However, as we can see, the People’s Bank of China weakens the Chinese yuan. As a result, a reversal of the pair may be anticipated. Resistances lie at 6.6850 and 6.7380.

What to expect in the future?

According to analysts at Hong Kong-based Eddid Securities and Futures, the Central Bank of China wants to see the weak yuan to prepare for the effect of the trade war. An escalation of tensions leads to a weaker trend not only for the yuan but for other emerging market currencies. Trade wars will lead to the strong USD, as a result, the Chinese yuan will trade around 6.70 for a while.

Morgan Stanley doesn’t think that the Chinese Central Bank will use the currency as a tool in the trade war. The Bank sees the Chinese yuan at 6.65 by the end of September. At the end of the year, the yuan is anticipated to trade at 6.60.

ING sees a greater depreciation of the yuan by the end of the year. According to the Bank, the USD/CNH pair will reach the level of 7.

Making a conclusion, we can say that the Chinese yuan is under great pressure because of the trade wars tensions. The Central Bank of China doesn’t do anything to support the currency now. A further escalation of the trade war will pull the Chinese yuan lower. Levels of August 2017 are anticipated to be key points for USD/CNH until the end of the year.

The EU plans to intervene in markets directly to curb rising energy costs, threatening to push the Euro area's economy into a deep recession.

The past two years have seen the biggest swings in oil prices in 14 years, which have baffled markets, investors, and traders due to geopolitical tensions and the shift towards clean energy.

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!