Last week marked the consolidation for the most active assets of March 1-15 (which is oil and gold). But next week has a lot to show, be ready to take part!

2020-02-28 • Updated

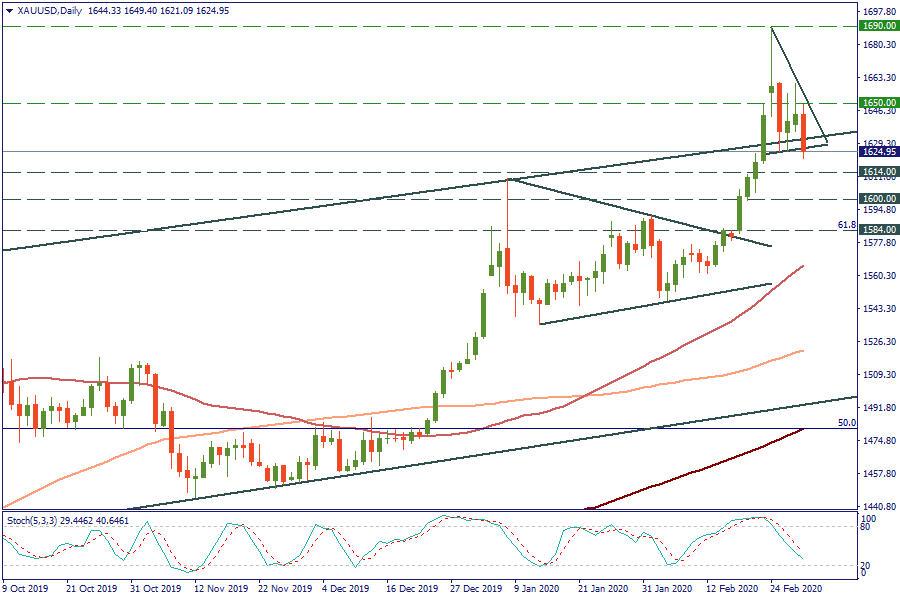

XAU/USD is consolidating after spiking to the 7-year high at $1,689. If we compare the current price action on the D1 with what was seen in January (the price spiked up and then consolidated without declining much), we’ll see that there are more candlesticks with long upper shadows – a sign that there are sellers of gold in the $1,650 area.

Technically, there is a big chance of a correction to the downside: gold simply rose too fast, too far. Market players are probably taking profit in gold to offset losses in other markets, so they are closing the previous buy positions in XAU/USD.

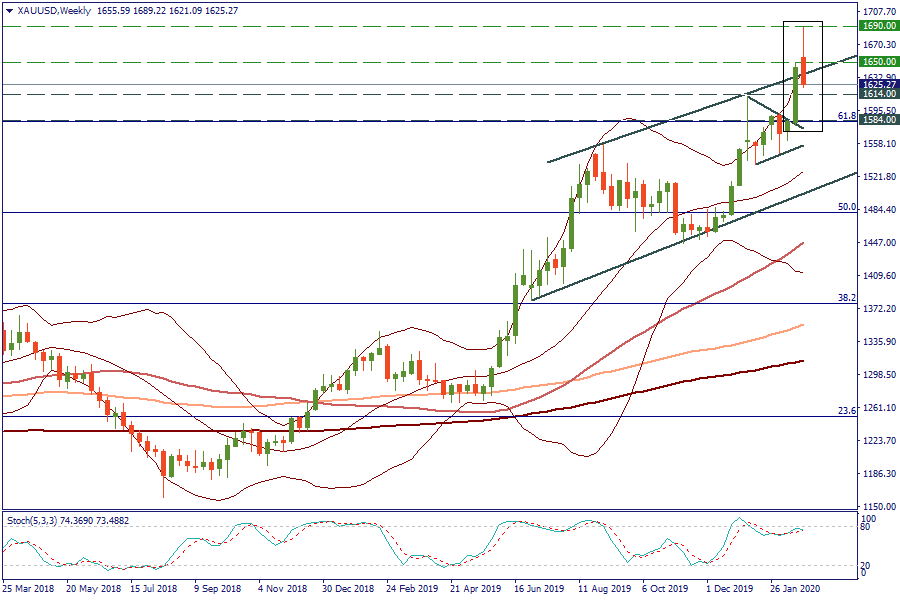

On the W1, there was a bullish gap after the previous big green candlestick. The current candlestick is at the upper Bollinger band and far away from the Moving Averages. For the general outlook to stay positive, the current weekly candlestick has to close above $1,614 (the middle of the previous candlestick). A close below this level will lead to the formation of the “Dark cloud cover” pattern and a more substantial retracement to the downside.

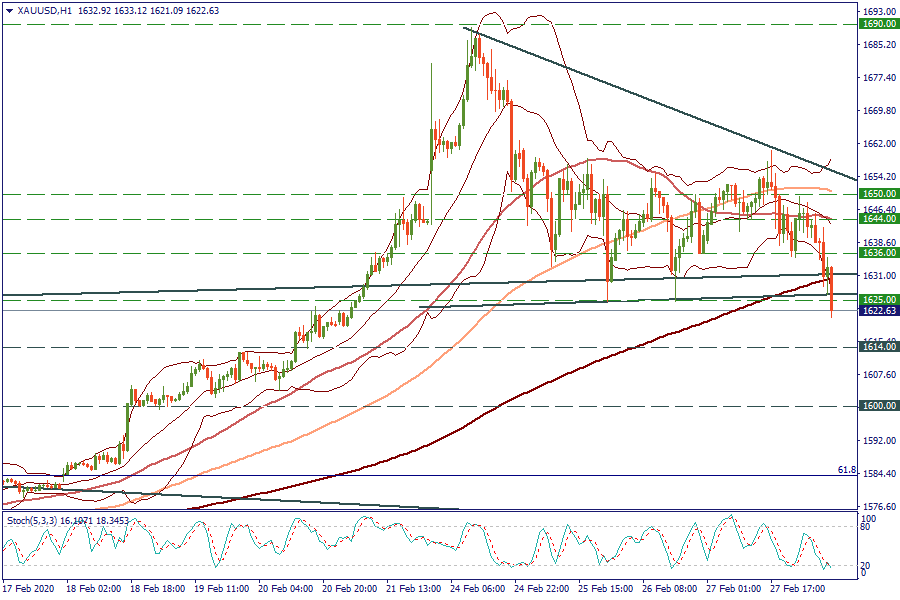

On the H1, the price is at the lower Bollinger band and the Stochastic Oscillator is at the oversold area. Still, that doesn’t mean that the decline is over. An advance above $1,636 is needed to open the way up to $1,644 and $1,650.

The price is testing support in the $1,625 zone. The next support levels lie at $1,613, $1,600 and $1,584. It will be logical to look for buying opportunities at these levels.

Keep in mind the idea that apart from this short-term profit taking, there are fundamental reasons to buy gold: it’s a safe haven in a world hit by a coronavirus. As Deutsche Bank strategists put it, “Until the virus data says otherwise, the trading strategies should probably still err (towards safety). Buy gold, short oil”.

Last week marked the consolidation for the most active assets of March 1-15 (which is oil and gold). But next week has a lot to show, be ready to take part!

What will happen? FOMC press conference is among the primary methods the Fed uses to communicate with investors regarding monetary policy…

US stock market corrects, gold recovers and the crypto market drops hard! Best trade opportunities during this week in the article! Let’s check the charts and set some goals! NASDAQ (US100) US100 index plunges as the US dollar strengthens…

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!