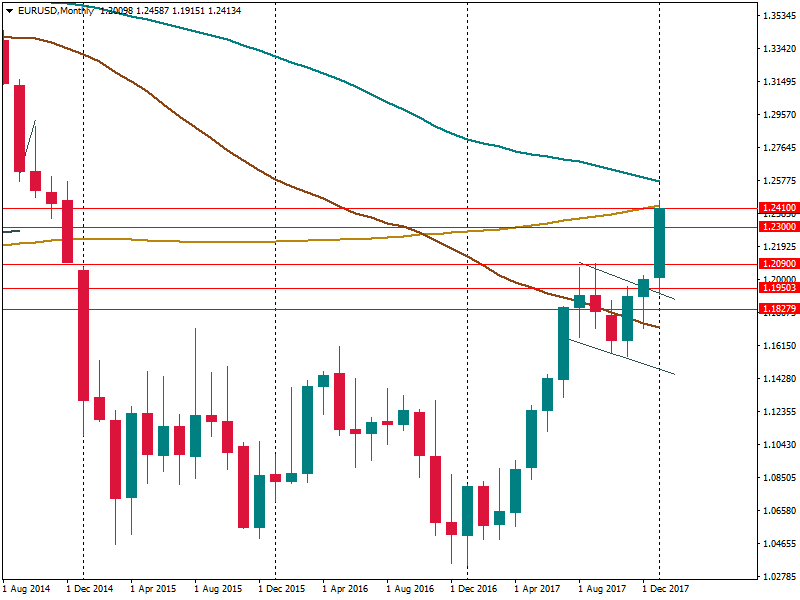

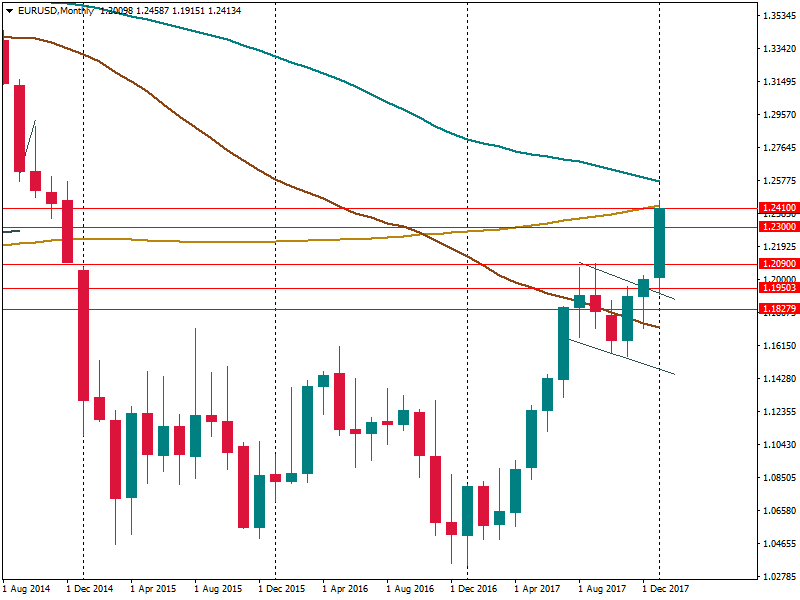

We are seeing the fall of the US dollar since the end of December 2017, but US Treasury secretaries preferred to say little about it until this Wednesday.

The US made the biggest fall since December 2014 when the Treasury Secretary Steven Mnuchin claimed on Wednesday that “a weaker dollar is good for us as it relates to trade”. The Secretary made his comment in Davos, Switzerland during the World Economic Forum, where a lot of people are waiting for the Donald Trump’s address.

What did he really say? Mnuchin said that a cheaper dollar increases export demand. And he is right. Mnuchin claimed that the US wants fair economic competition and reciprocal trade. Tax cuts make the US more attractive for investments. He believes that where the dollar is in short-term reflects a very liquid market, but the long-term level will support the strength of the economy.

However, despite positive comments about the US policy, the market reacted to the confirmation of dollar weakness and the dollar fell losing 0.8% against the Euro.

But we cannot say that Mnuchin’s words were crucial for the USD. We should not forget that overseas economic growth and shifting perceptions of monetary policy have been causing the dollar weakness as well. So the fall was expected but maybe not at such rate.

Summing up the Secretary’s statement, we can suppose that the US will not act to strengthen the dollar now. However, it is important to remember that depreciation adds pressure on inflation. So the Fed will have to take it under control. But if inflation rises, the Fed will have to tighten its monetary policy and it will change the US dollar rate.