Western Texas Intermediate (WTI) menguat dari penurunan kemarin dan saat ini diperdagangkan di sekitar level 78,15 pada hari Kamis (29/02/2024). XTIUSD mencoba pulih dan..Sementara OPEC+ yang mempertimbangkan

Diperbarui • 2020-04-28

Oil is the subject of heated debates these days as nobody really knows what to do with the “humiliated” asset. Market traders are scared in the oil markets.

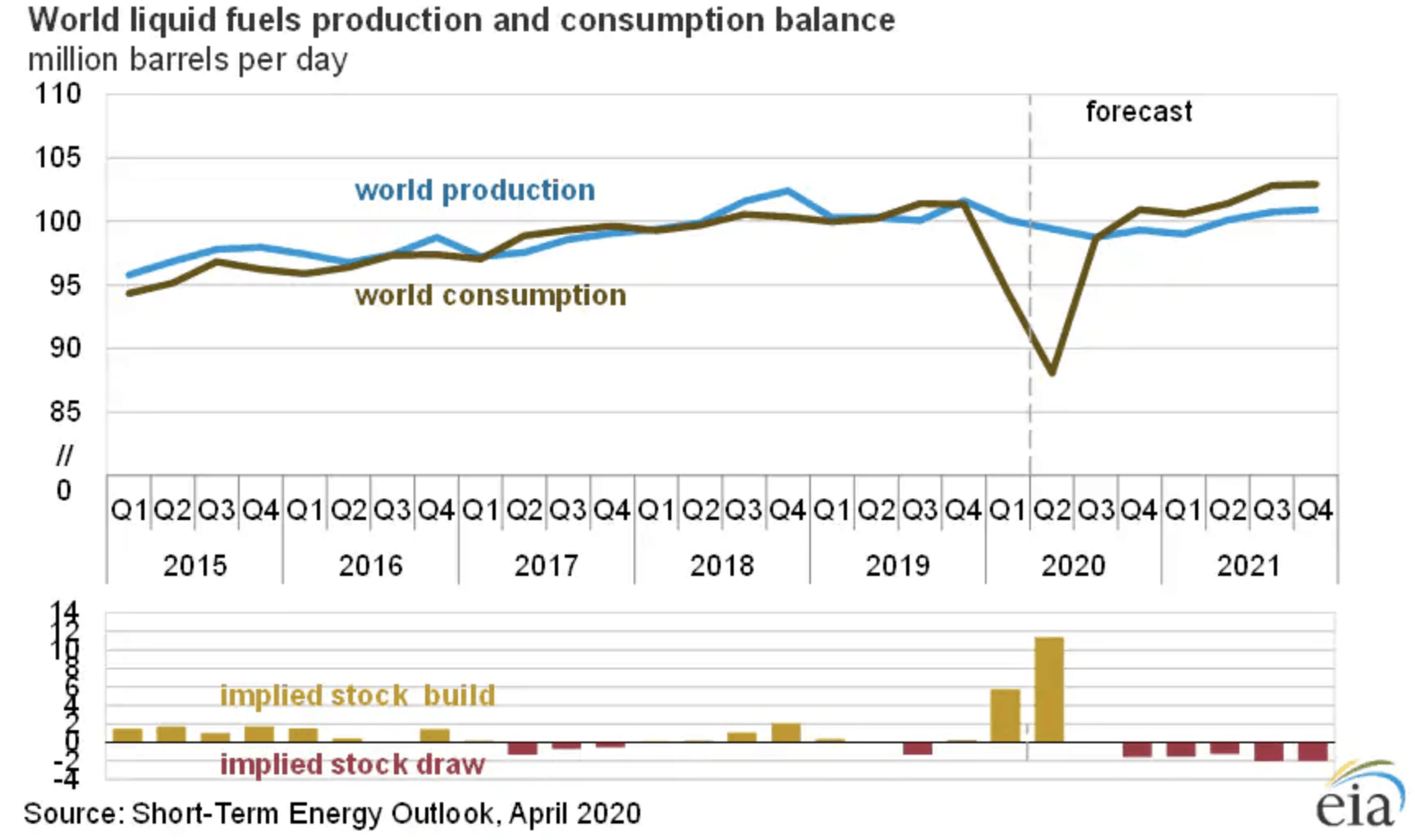

The oil demand declined by 30% because of the coronavirus lockdown. Saudi Arabia and Russia couldn’t agree about the production cut and they started the so-called oil war and supplied as much oil as they want. As a result, the oil glut and reduced demand pushed the oil price deep down.

Only then OPEC+, made a deal to cut 9.7 million a barrel a day, nearly 13% of global production, on May 1 through June. However, it was too little and too late.

The oil price went below zero by two reasons. Firstly, it was cheaper for producers to pay consumers just to take oil off their hands as they run out of all the storages. Secondly, traders, who hadn’t sold the May futures contract on time, didn’t want a physical delivery of the oil.

The situation is absolutely dire for small shale producers, what corresponds to WTI, while Saudi Arabia and Russia can sustain such low prices. However, the US oil will survive this, but it will take few terrible years for them. US oil producers have started already making deliveries to the nation's emergency stockpile or the strategic petroleum reserve (SPR).

Moreover, the United States Oil Fund claimed it would get rid of its June oil contracts this week and reduce contracts for next months. Instead, the ETF will buy into longer-term oil contracts.

Next time before the expiry of the June contract the oil price will go to zero even faster than it did last time, according to the CEO of the largest tanker company, Nordic American Tanker.

Most analysts believe the oil industry will rebound when the coronavirus pandemic is over. Sooner or later we will see it.

On the 4-hour WTI chart we see a strong downtrend. The price reached the 50-day moving average on April 24 at the 17.50 mark and then went down. Maybe it will touch it again at the 15.15 mark and pull back after that. Resistance line is 20.20. Support line is 10.20.

Western Texas Intermediate (WTI) menguat dari penurunan kemarin dan saat ini diperdagangkan di sekitar level 78,15 pada hari Kamis (29/02/2024). XTIUSD mencoba pulih dan..Sementara OPEC+ yang mempertimbangkan

Harga minyak mentah acuan AS West Texas Intermediate (WTI) masih dalam jalur melanjutkan kenaikan untuk hari ke tujuh secara beruntun, pada Rabu (14/02/2024). Menurut laporan pasar minyak bulanan OPEC, ada kekhawatiran mengenai kepatuhan kelompok ini terhadap pemangkasan produksi

Pasar saham Asia melemah pada perdagangan Selasa (30/01/2024), terseret oleh kasus likuidasi perusahaan raksasa properti China..Kegelisahan investor terhadap meningkatnya ketegangan di Timur Tengah telah mengendalikan sentimen risiko.

Yen Jepang gagal memikat para investor pada perdagangan Selasa (02/04/2024) meski ada peluang atas kemungkinan intervensi dan..Sentimen penghindaran risiko masih berpotensi memberikan kekuatan pada safe-haven

XAUUSD naik ke rekor tertinggi baru pada perdagangan Senin (01/04/2024), di tengah meningkatnya spekulasi penurunan suku bunga..melanjutkan kenaikan kuat minggu lalu hingga membentuk level puncak baru sepanjang masa

Pasar saham Asia sebagian masih libur dan sebagian lagi menguat pada perdagangan Senin (01/04/2024), karena optimisme data pabrikan Tiongkok mendukung..potensi intervensi otoritas Jepang terhadap yen Jepang diperkirakan berada di zona 152 – 155 yen.

FBS menyimpan catatan data Anda untuk menjalankan website ini. Dengan menekan tombol "Setuju", Anda menyetujui kebijakan Privasi kami.

Permintaan Anda diterima.

Manajer kami akan menghubungi Anda

Permintaan panggilan balik berikutnya untuk nomor telepon ini

akan tersedia setelah

Jika Anda memiliki masalah mendesak, silakan hubungi kami melalui

Live chat

Internal error. Silahkan coba lagi

Jangan buang waktu Anda – tetap awasi dampak NFP terhadap dolar dan raup profitnya!