Western Texas Intermediate (WTI) menguat dari penurunan kemarin dan saat ini diperdagangkan di sekitar level 78,15 pada hari Kamis (29/02/2024). XTIUSD mencoba pulih dan..Sementara OPEC+ yang mempertimbangkan

Diperbarui • 2022-12-16

December 18 was a remarkable day for the New Zealand dollar in 2020. The kiwi strengthened against the USD, reaching the high of April 2018. Of course, a stimulus-driven USD is the most obvious reason for such market behavior. However, there is another one you don’t probably think about, given to current economic situation across the world. It’s a fact: the New Zealand economy is recovering. And the recovery is very fast. Investors like the kiwi, but some experts are worried about this surge. What are their views on the kiwi in 2021?

The early reaction of New Zealand’s government to the coronavirus outbreak paid off to the country’s economy. After New Zealand’s GDP slumped by 11% in the second quarter, the third quarter’s data signed a V-shaped recovery. The Antipodean economy strengthened by 14%, outperforming market expectations of +12.9%. The Reserve Bank of New Zealand has been playing an important role in the stabilization process. At the start of the pandemic, the regulator has cut its interest rate to the record low of 0.25% and unveiled the stimulus, which has been provided through a Funding for Lending program and large-scale asset purchase. As a result, New Zealand’s economy demonstrated a V-shaped recovery in the third quarter.

The Fed’s easing policies and economic stabilization increased the inflow into the NZD by foreign investors. At the same time, the surging kiwi raised worries in New Zealand’s government. The strength of the Antipodean currency pushed housing prices by 19.8% from NZ$605 000 in October 2019 to NZ$725 000 in October this year. In addition, the threats of negative interest rates exist, that is why New Zealand’s finance minister Grant Robertson has already expressed worries in a letter to the RBNZ board. If the government intervenes in the RBNZ policy of targeting housing prices, this will be a good sign for the NZD.

Still, another risk for the economy of the country is a suffering tourism industry, which froze amid closed borders for foreigners. Due to the new coronavirus strain appeared in the UK, the country may remain shut for visitors for a longer period. Therefore, the risks may affect sentiment in the market and hurt risky currencies, such as the NZD.

Despite all negative factors, the forecasts for the kiwi for 2021 are utterly bullish. According to BMO, NZD/USD will go up to 0.75 (three-year high). Westpac expects the pair to reach 0.72 by year-end. Morgan Stanley sees the New Zealand dollar outperforming its rivals in 2021, and forecast a hawkish surprise by the RBNZ in 2021.

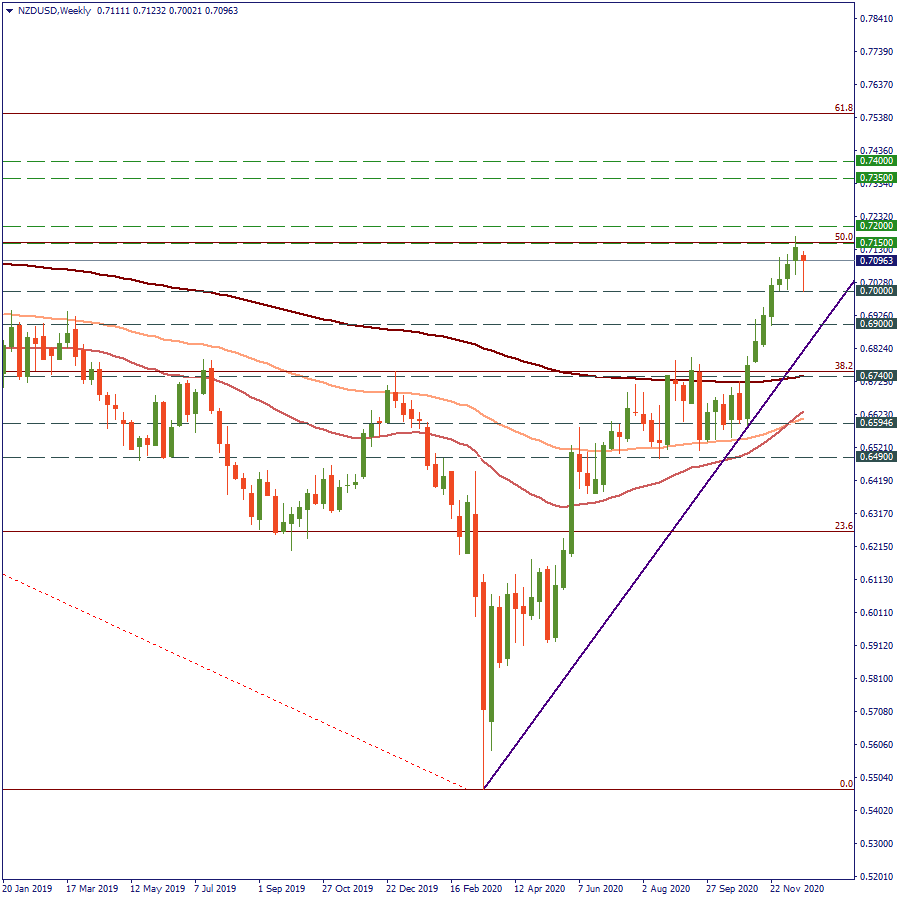

We expect the New Zealand dollar to keep strengthening against a weaker US dollar at least through the beginning of 2021. Its further performance will greatly depend on the situation with Covid-19 cases, vaccines’ distribution, and policy by the Reserve bank of New Zealand. For now, we may see reaching the 0.72 level soon as highly possible. The breakout of 0.7150 (50-Fibo on the monthly chart) will increase the chances of testing the 0.72 level. If buyers overcome the resistance zone formed near the 50-Fibo level, the next resistance will lie at 0.74. The risks of the falls are expected at 0.7 and 0.69 levels.

Western Texas Intermediate (WTI) menguat dari penurunan kemarin dan saat ini diperdagangkan di sekitar level 78,15 pada hari Kamis (29/02/2024). XTIUSD mencoba pulih dan..Sementara OPEC+ yang mempertimbangkan

Harga minyak mentah acuan AS West Texas Intermediate (WTI) masih dalam jalur melanjutkan kenaikan untuk hari ke tujuh secara beruntun, pada Rabu (14/02/2024). Menurut laporan pasar minyak bulanan OPEC, ada kekhawatiran mengenai kepatuhan kelompok ini terhadap pemangkasan produksi

Pasar saham Asia melemah pada perdagangan Selasa (30/01/2024), terseret oleh kasus likuidasi perusahaan raksasa properti China..Kegelisahan investor terhadap meningkatnya ketegangan di Timur Tengah telah mengendalikan sentimen risiko.

Yen Jepang gagal memikat para investor pada perdagangan Selasa (02/04/2024) meski ada peluang atas kemungkinan intervensi dan..Sentimen penghindaran risiko masih berpotensi memberikan kekuatan pada safe-haven

XAUUSD naik ke rekor tertinggi baru pada perdagangan Senin (01/04/2024), di tengah meningkatnya spekulasi penurunan suku bunga..melanjutkan kenaikan kuat minggu lalu hingga membentuk level puncak baru sepanjang masa

Pasar saham Asia sebagian masih libur dan sebagian lagi menguat pada perdagangan Senin (01/04/2024), karena optimisme data pabrikan Tiongkok mendukung..potensi intervensi otoritas Jepang terhadap yen Jepang diperkirakan berada di zona 152 – 155 yen.

FBS menyimpan catatan data Anda untuk menjalankan website ini. Dengan menekan tombol "Setuju", Anda menyetujui kebijakan Privasi kami.

Permintaan Anda diterima.

Manajer kami akan menghubungi Anda

Permintaan panggilan balik berikutnya untuk nomor telepon ini

akan tersedia setelah

Jika Anda memiliki masalah mendesak, silakan hubungi kami melalui

Live chat

Internal error. Silahkan coba lagi

Jangan buang waktu Anda – tetap awasi dampak NFP terhadap dolar dan raup profitnya!