Western Texas Intermediate (WTI) menguat dari penurunan kemarin dan saat ini diperdagangkan di sekitar level 78,15 pada hari Kamis (29/02/2024). XTIUSD mencoba pulih dan..Sementara OPEC+ yang mempertimbangkan

Diperbarui • 2020-02-18

Performance in 2020: +1.6%

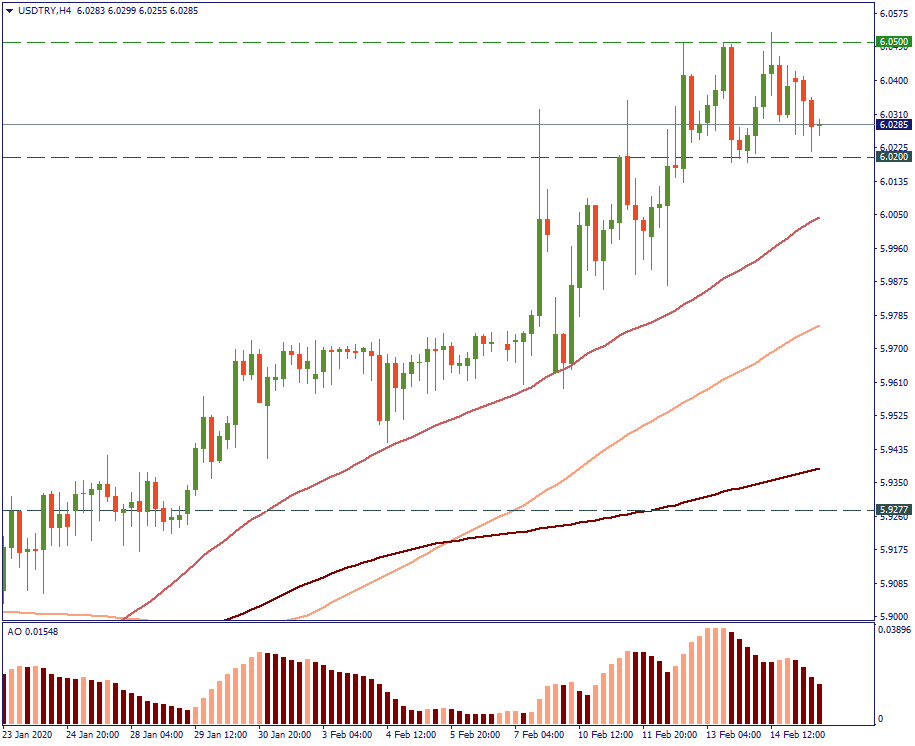

Last day range: 6.0177 – 6.0521

52-week range: 5.2863 – 6.2860

The Turkish lira is depreciating against the US dollar. In fact, that has been the case for more than 10 years, with the exception of the second part of 2018. The main reason for that is that the Turkish authorities are taking risky political and military maneuvers on international stage. That puts a heavy burden on the country’s economy, increases its debt and tarnishes its international image and therefore investing environment. Together, these factors make the Turkish economy slowly sink and fight double-digit inflation.

The Turkish president Recep Tayyip Erdogan is famous for being an enemy of interest rates (among other things). That’s basically why the Turkish Central Bank Governor Murat Uysal keeps slashing the interest rate and is likely to continue doing that. The inflation now is not as high as before, and formally, it gives ground for the monetary authorities to state that they are following a correct course in currency stabilization and disinflation.

However, the true reason in the actions of Mr Uysal seems to be more human than economic. His predecessor in the position of the governor of the Turkish Central Bank, Murat Cetinkaya, was fired by Erdogan for not following the Turkish President’s instructions. Such a thing never happened in the last 40 years since the time of the military coup in Turkey. That tells a lot about the true domestic environment in the country and “how far” things have gone.

In any case, such a policy, even if locally it coincides with certain positive economic factors, will probably inflict more economic damage on Turkish citizens rather than truly control the domestic economic situation. For sure, it will make Turkey lose financial and investment credibility on international scale - Fitch rates it at BB- now.

Not that any analyst was in a position to suggest anything, but it doesn’t take a genius to predict little good for the country where economic authorities prefer bowing to the dictation of political leaders rather than standing truly economic grounds. Probably, to understand the inner working of the Turkish Central Bank, we have to take into account the traditional reluctance of Middle Eastern leaders to follow the path of consultation and deliberation in decision making. Including the economic ones. However, even so, it is unlikely that Mustafa Kemal Ataturk, the founder of the Republic of Turkey (you see him on every banknote of the Turkish lira), would approve pressing on the image of “strong Turkey” on international stage at the cost of long-term economic well-being of his country. In fact, while Ataturk abstained from taking part in any military conflict and got himself busy with building a new republic, Erdogan seems to choose “we’re in” approach in almost every military conflict in the region to boost his image in the eyes of his electorate. You may say "But Trump also does it!". Well, is Turkey as rich as the US to pay for the political games of its country leader? You guess.

Resistance 6.05

Support 6.02

Western Texas Intermediate (WTI) menguat dari penurunan kemarin dan saat ini diperdagangkan di sekitar level 78,15 pada hari Kamis (29/02/2024). XTIUSD mencoba pulih dan..Sementara OPEC+ yang mempertimbangkan

Harga minyak mentah acuan AS West Texas Intermediate (WTI) masih dalam jalur melanjutkan kenaikan untuk hari ke tujuh secara beruntun, pada Rabu (14/02/2024). Menurut laporan pasar minyak bulanan OPEC, ada kekhawatiran mengenai kepatuhan kelompok ini terhadap pemangkasan produksi

Pasar saham Asia melemah pada perdagangan Selasa (30/01/2024), terseret oleh kasus likuidasi perusahaan raksasa properti China..Kegelisahan investor terhadap meningkatnya ketegangan di Timur Tengah telah mengendalikan sentimen risiko.

Yen Jepang gagal memikat para investor pada perdagangan Selasa (02/04/2024) meski ada peluang atas kemungkinan intervensi dan..Sentimen penghindaran risiko masih berpotensi memberikan kekuatan pada safe-haven

XAUUSD naik ke rekor tertinggi baru pada perdagangan Senin (01/04/2024), di tengah meningkatnya spekulasi penurunan suku bunga..melanjutkan kenaikan kuat minggu lalu hingga membentuk level puncak baru sepanjang masa

Pasar saham Asia sebagian masih libur dan sebagian lagi menguat pada perdagangan Senin (01/04/2024), karena optimisme data pabrikan Tiongkok mendukung..potensi intervensi otoritas Jepang terhadap yen Jepang diperkirakan berada di zona 152 – 155 yen.

FBS menyimpan catatan data Anda untuk menjalankan website ini. Dengan menekan tombol "Setuju", Anda menyetujui kebijakan Privasi kami.

Permintaan Anda diterima.

Manajer kami akan menghubungi Anda

Permintaan panggilan balik berikutnya untuk nomor telepon ini

akan tersedia setelah

Jika Anda memiliki masalah mendesak, silakan hubungi kami melalui

Live chat

Internal error. Silahkan coba lagi

Jangan buang waktu Anda – tetap awasi dampak NFP terhadap dolar dan raup profitnya!