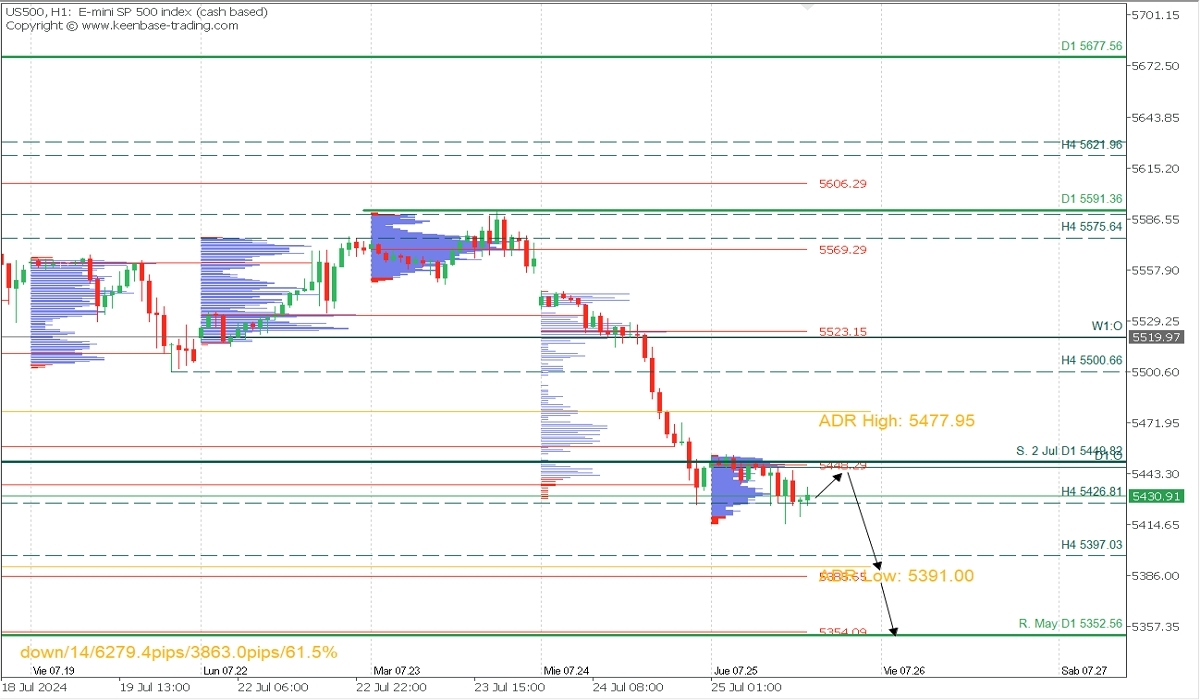

- Bearish Scenario: Sell positions after the next rally below 5448.29 (after forming a PAR*) with TP1 at 5397.03 and extend to 5352.56, with an SL above 5478 or at least 1% of the account capital.

- Bullish Scenario: Buy positions above 5450, targeting 5477, 5500, and extending to 5520. Set SL below 5430 or at least 1% of the account capital. Apply Trailing Stop.

Fundamental Analysis

U.S. stock markets experienced a significant drop on Wednesday, driven by sharp declines in tech stocks. The Nasdaq Composite fell by 3.6%, its largest single-day drop since October 2022, triggered by disappointing earnings from Tesla (-12%) and Alphabet (-5%). The S&P 500 also declined by 2.3%, and the Dow Jones by 1.3%.

Notably, large-cap tech stocks make up approximately 28% of the total market capitalization of the S&P 500 index. Shares of other 'Magnificent 7' companies, including Nvidia, Microsoft, Apple, Meta Platforms, and Amazon, also saw substantial declines.

This sell-off was exacerbated by a shift in investor focus toward small-cap stocks, which are expected to benefit from anticipated Federal Reserve rate cuts.

Additionally, the yield on 10-year Treasuries rose to 4.28%, its highest in two weeks, as markets await economic data to gauge future Fed actions.

Technical Analysis, H2. Intraday and Swing Outlook

S&P500

- Supply Zones (Sells): 5448.29 and 5523.15

- Demand Zones (Buys): 5385.65 and 5354.09

The index continues its intraday bearish trend, challenging the broader macro bullish trend by breaking below the daily support of July 2 at 5449.82. This break suggests a moderate rally back to this volume concentration zone, potentially setting up for further sales towards the 5397.03 support near the average daily bearish range at 5391. However, daily volatility could lower the price, potentially extending to the May daily support at 5352.56. Conversely, a stronger rally above 5450 could indicate a broader correction towards the average daily bullish range at 5477.95, potentially reaching the weekly opening and yesterday's sell zone around 5523.

*POC explained: Point of Control (POC) is the level with the highest volume concentration. It is a resistance or support level based on the previous price movement direction.

@2x.png?quality=90)