Gas asli adalah tiang seri ekonomi Eropah.

2020-06-24 • Dikemaskini

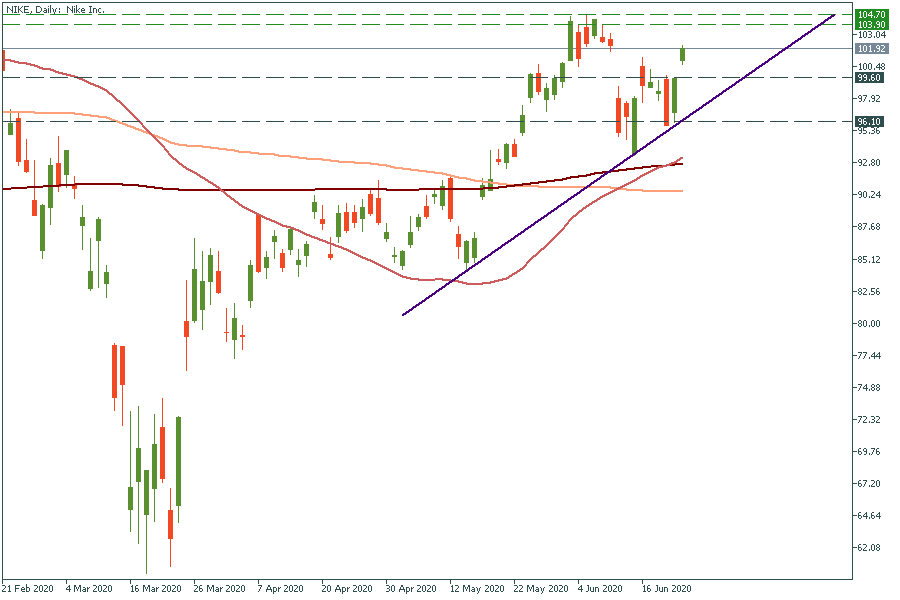

Whether you like to trade stocks or not, we recommend you not to skip this event. Nike, the famous American footwear producer, will publish its earnings report for the fourth quarter fiscal 2020 (March-May period) on Thursday, after the close of the market at 23:15 MT time. Analysts’ optimism about the upcoming data pushed Nike’s stock higher yesterday. Should we see it as “bullish”, too? Let’s find out.

The company has been surviving the pandemic pretty well. Although most of Nike’s stores across the world were closed during the reported period, the demand remained high due to online sales and trends for a healthy lifestyle. The reopening of stores in Greater China, South Korea, European countries, and the United States is a good factor, too. The company has been undertaking safety protocols, including social-distancing and sanitization.

According to the average estimate, EPS reached 0.09 in the fourth quarter, while revenue was at $7,295. Traditionally, higher-than-expected indicators will be bullish for stock’ price. It’s worth mentioning that Nike did not provide any official financial forecasts, so the actual figures may surprise.

Don’t know how to trade on earnings reports? Check this guide!

This week, several analytical companies renewed their forecasts and raised price targets for Nike’s stock.

According to JPMorgan, the stock is overweight. The price target lies at $104. Wells Fargo has a similar view on the stock, targeting it at $99.

UBS thinks that the stock is a “buy” with the price target at $122.

Both Raymond James and Cowen & Co. forecast the stock to outperform with price targets at $115 and $110, accordingly.

The most bullish expectation belongs to Susquehanna, which sees Nike’s stock at $130.

To sum up, we can see that the bullish outlook for this stock dominates among analytical companies. We need to take this fact into account, but don’t consider it as absolute truth.

On Tuesday, the stock gapped towards its all-time high at $103.9-104.7. In case of a bullish scenario, the price of a stock will break these levels and target new highs. Alternatively, we will see the fall towards $99.6. The breakout of this level and a trendline will pull Nike's stock even lower to $96.1.

Trading stocks with FBS is easy. Follow the simple steps described below.

Gas asli adalah tiang seri ekonomi Eropah.

Ya, harga minyak sedang terbakar menyala-nyala sekarang, dan, akibatnya, inflasi semakin memanas di seluruh dunia. Namun begitu, momentum kenaikan harga minyak sedang terancam.

Semakin ramai penganalisis yakin bahawa minyak Brent akan melepasi $100 setong. Jadi sekuat manakah minyak akan menggerakkan pasaran, dan ke manakah arah pergerakan itu? Jom ketahui!

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!