Weaker recoveries were seen in both the UK manufacturing and service sectors, with the latter recording the greatest loss of momentum since July.

2021-08-03 • Updated

The Bank of England will present a monetary policy statement on Thursday, August 4 at 14:00 MT (GMT+3).

Experts and analysts are confident about the future of UK monetary policy. The market expects the Bank's Monetary Policy Committee (MPC) to vote unanimously to keep the bank rate at 0.10% and the target stock of asset purchases at £895BN.

At the same time, there are several opinions about UK’s currency reaction to the statement. The community is concerned about domestic and global Covid trends which will also determine the direction of the UK currency. The absence of consensus amongst analysts as to how the pound will react might be a signal of an upcoming high volatility period.

The number of new COVID-19 cases was decreasing over the past week. The average of daily new cases dropped to 424 from 702 on July 21. This fact can make consumers and businesses feel positive about the economy’s recovery and rejuvenate that strong economic growth seen earlier in the second quarter.

GBP/USD 4H chart

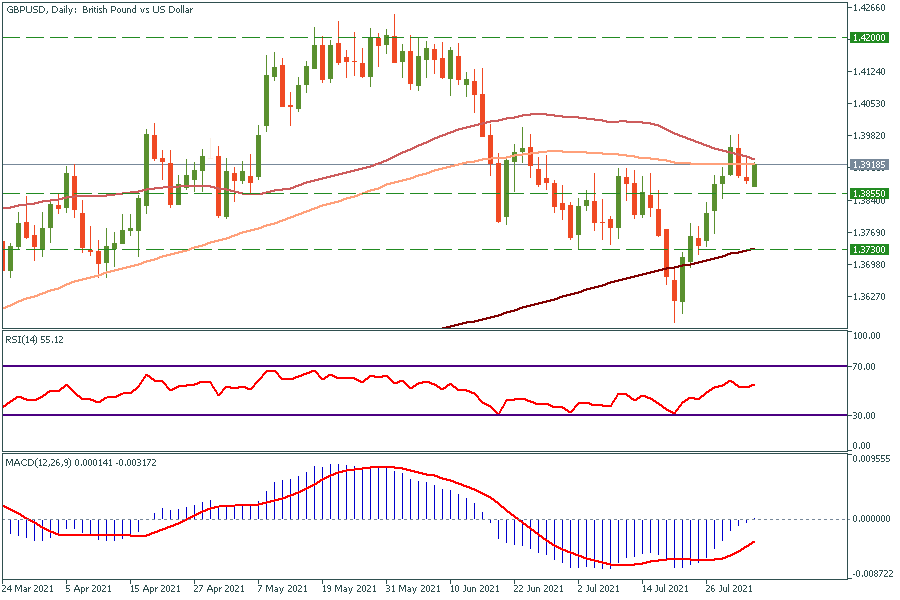

GBP/USD Daily chart

At the moment, the price is trying to break through the crosspoint of 50 and 100-day moving average. If it breaks through, the target will be $1.42. Otherwise, it might cross $1.3855 support and drop down to $1.373, which is the 200-daily moving average.

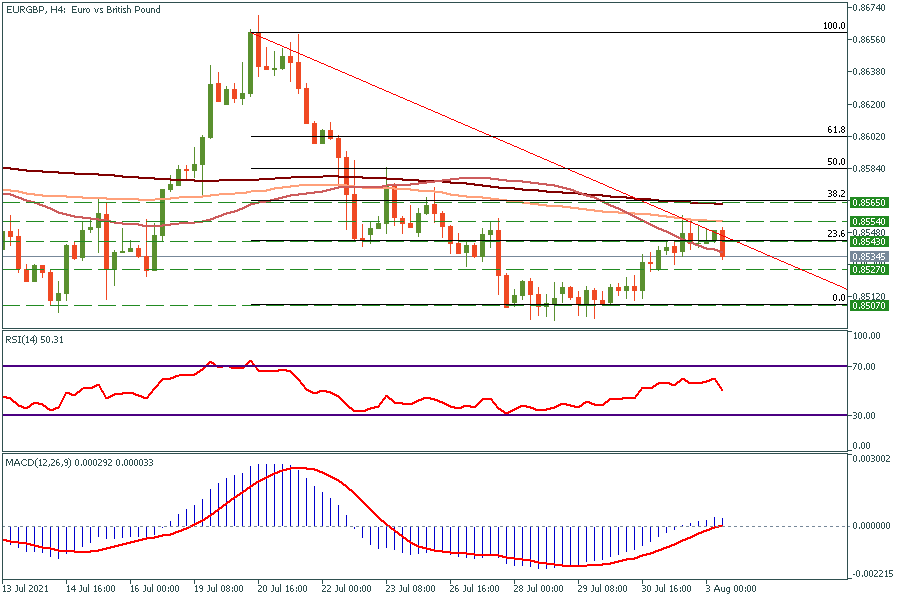

EUR/GBP 4H chart

At the moment, the price is trying to break the 50-period moving average. If it does and sticks under the line, the target will be 0.8507. Otherwise, it will turn around and move towards 0.8543 (23.6 Fibonacci), 0.8554 (the 100-period moving average), and 0.8565 (the crosspoint of the 200-period moving average and 38.2 Fibonacci) support lines.

Weaker recoveries were seen in both the UK manufacturing and service sectors, with the latter recording the greatest loss of momentum since July.

The British pound has advanced in the first half of the year, especially against the euro. Will this trend sustain in the second part of 2021?

Bank of England will make a policy statement on Thursday at 14:00 MT (GMT+3). It’s widely expected that the bank may taper its quantitative easing programme, by cutting asset purchases.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!