Something big

As mysterious as it sounds, the truth is quite mundane: there will be further recovery upwards or another drop. The only thing that observers are certain about is that no one really knows what it will be. It helps little though. However, it is useful to weigh the factors standing behind the two possible scenarios. Here is what we are looking at.

Counter-strike

People are worried that the stock market recovered really fast after reaching the last low. The logical question is whether it was a true or false bottom.

Dow Jones was at the low of 18,592 on Monday, and the recent level it rose back to when the markets closed last was 21,200: that’s a 14% rise in 3 days.

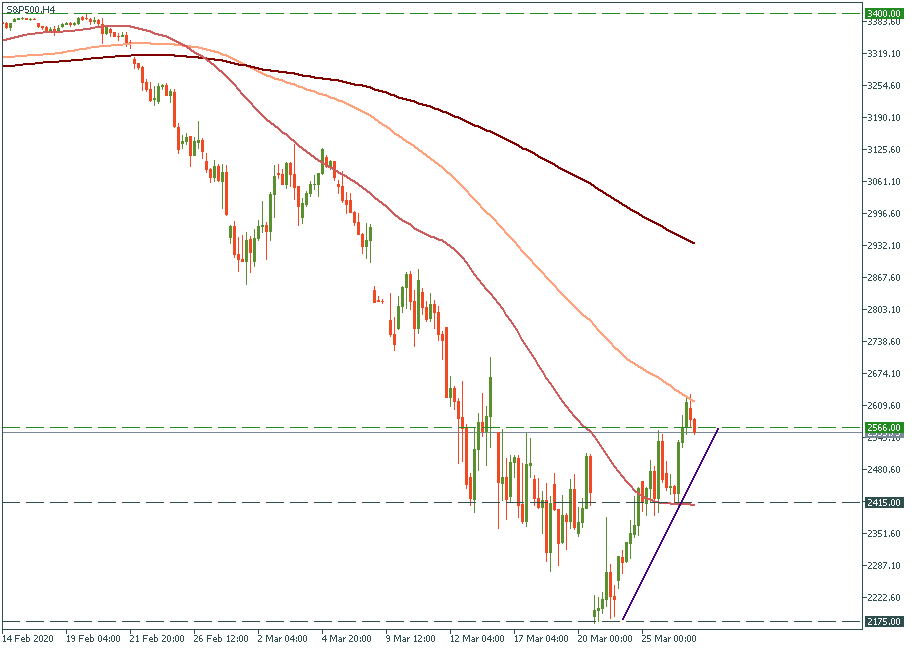

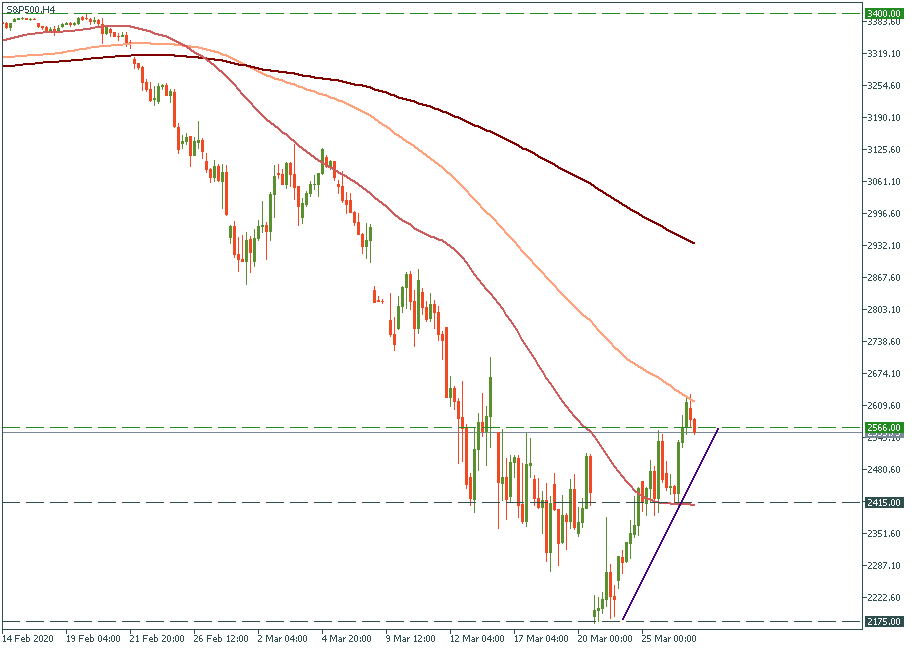

S&P started at 2,175 the same Monday, and made it up to the current 2,566: an 18% recovery up to date!

All of this is more than just impressive – it is unseen. This is what makes people worried.

Why?

Because it would take months or even a year to have a 10% market decline. Also, it takes many more months and approximately 1.5 years to get back up from a 20% drop. That is, based on the observations and approximations of the previous crises. S&P fell from 3,400 to 2,175 – a 35% drop in 6 weeks. Superfast. After, it reconquers a third of that loss in just 3 days – even faster. Market observers just don’t really know what to do with that speed although they understand what is happening and why. Very importantly, they understand that the world economy itself functions within normal boundaries.

So what do we have?

We have a novelty of the current crisis in the fact that most of the previous crises were caused by “internal” economic deficiencies of states. On the contrary, the present one is due to the “externally enforced” depression which is taking place because of the virus rather than purely economic reasons. That is neither good or bad as such, but it definitely adds more uncertainty as the financial authorities and governments essentially have to invent the way out of the situation.

On the other hand, we have a strong commitment and equally strong measures in place from the side of the governments and the central banks. $2trln injected into the American economy is one of the most stunning recent acts taken by the Fed, unprecedented and hopefully as effective, and that is just one example of how state authorities fight the virus consequences, separately and collectively. Therefore, there are many reasons to see the light at the end of the tunnel amid the oddity of the situation.