-

How to start trading stocks?

To start trading stocks you need to open an MT5 account, download and install this software and login to your account. After that, perform analysis and start making money! Read the article “How to trade stocks with FBS”

-

How to find and trade a growth stock?

Check the stock’s last several years of performance. Don’t get distracted by the fluctuation – they are all volatile. Look at the trend. If the stock has been following an uptrend for the last 24 months, that’s a good candidate. You can find the detailed information about this in the article «How to find growth stocks?”

-

How to open an FBS account?

Click the ‘Open account’ button on our website and proceed to the Personal Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

-

How to trade stocks for beginners?

You can profit from stock trading even if you are a newbie. FBS analysts regularly publish the rating of the best-performing stocks of the previous month and the list of the best stocks to trade this month. Besides, you can keep an eye on the stock market events calendar to find potentially profitable stocks. So, stay tuned and take your chance to earn.

AIG

AIG

American International Group, Inc., also known as AIG, is an American multinational finance and insurance corporation with operations in more than 80 countries and jurisdictions. AIG serves 87% of the Fortune Global 500 and 83% of the Forbes 2000. It is the component for both S&P 100 and S&P 500 indices. On our site, you can check AIG stock live chart and make a trading decision.

The company operates through three core businesses:

- General Insurance, which includes Commercial, Personal Insurance, U.S., and international field operations.

- Life & Retirement with Group Retirement, Individual Retirement, Life, and Institutional Markets in it.

- Technology-enabled subsidiary.

AIG was founded December 19, 1919, and was initially operating in China and Southeast Asia, including Philippines, Indonesia, and Malaysia. In 1926 the company opened its first office in the US and started its expansion on a brand new market. During the financial crisis of 2008, the Federal Reserve bailed the company out for $180 billion and assumed control, with the Financial Crisis Inquiry Commission correlating AIG's failure with the mass sales of unhedged insurance. AIG repaid $205 billion to the United States government in 2012.

How to buy stocks online with FBS?

You can trade contracts for difference (CFDs) on American International Group stock. CFDs reflect the AIG stock price movement. It allows you to trade in both directions. In other words, you can gain from the price going up as well as from it going down.

You can also use leverage. This means that with only a small amount of money you can control much bigger financial positions. Always remember that leverage allows you to multiply your account. On the downside, you may lose a considerable part of it if the market goes against your trades.

What drives the AIG stock price?

The overall income of the company consists of two parts: General Insurance and Life and Retirement (like 401k plan). Income from North America takes up half of the income from the rest of the world. On July 14, 2021, AIG announced a strategic partnership with The Blackstone Group (Blackstone) whereby Blackstone agreed to purchase a 9.9% equity stake in AIG’s Life and Retirement business for $2.2 billion in cash, entered into a strategic asset management relationship to manage certain specified Life and Retirement general account assets in the future and agreed to acquire AIG’s interests in a U.S. affordable housing portfolio for approximately $5.1 billion in cash.

Last year was quite effective for AIG due to investment returns and improving market conditions. AIG’s report of August 5, 2021, showed EPS of $1.52 vs. $1.31 estimates and revenue of $10.7 billion vs. $11.3 billion estimates, which caused a gap and an insane 12% bearish move. Earnings reports offer unique opportunities for traders. Learn how to trade earnings season in order not to miss it.

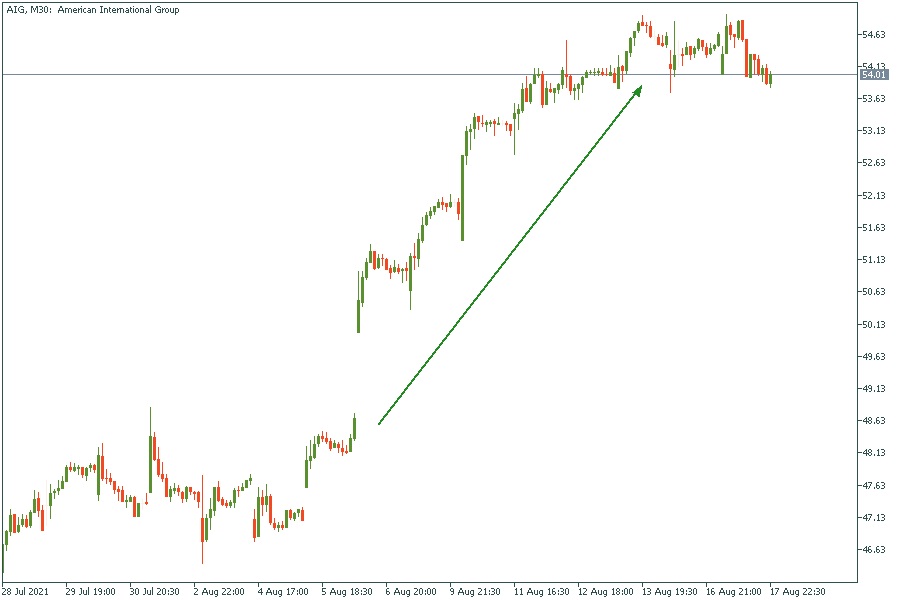

AIG M30 chart

AIG pays dividends to investors from time to time. But from 2008 to 2013 there weren’t any dividends at all, due to the world financial crisis, in which AIG had lost 99% of its stock price! The company has a 2.34% dividend yield as of 2021. On each stock, you will have as much as $1.28 annually (until AIG changes yield once again). Learn how to earn dividends from stocks and trade on the dividend gap! In order not to miss the next AIG dividend, make sure you checked out our dividend calendar.

AIG monthly chart

2024-05-20 • Updated