Western countries are trying to find other options for oil and gas supplies after a 10th package of sanctions, which will put more pressure on Russian oil and decrease global oil supply. Italy, for example, is in talks with Libya.

Western countries are trying to find other options for oil and gas supplies after a 10th package of sanctions, which will put more pressure on Russian oil and decrease global oil supply. Italy, for example, is in talks with Libya.

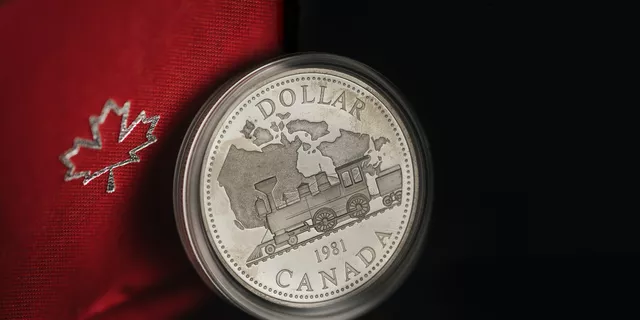

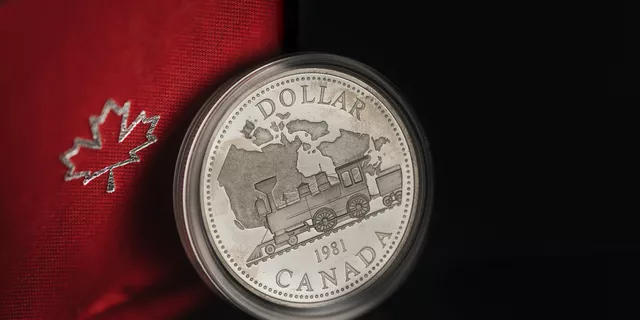

Today, at 5:00 pm (GMT +2), the Bank of Canada will publish the Overnight Rate, which represents short-term interest rates, and is pivotal to the overall pricing of the Canadian Dollar in the global markets. Let's look at how the markets are faring ahead of the BoC rates release.

On January 12, the Bureau of Statistics will publish the Consumer Price Index (CPI) figures, a key index for determining interest rates. While we await the release, experts forecast a decline in the CPI data, a hint at weaker Dollar values in the global markets.

Later today Tiff Macklem, the governor of the BoC (Bank of Canada) is expected to speak at the Riksbank's International Symposium as part of a discussion panel on 'Central Bank Independence'.

The trend in the scenario above is clearly bearish. We have also had a recent break of structure at the marked horizontal arrows, which means we can expect price to react from the supply zone that broke the structure.

The US Dollar has been remarkably sluggish for the past few weeks despite being within a distinct Demand zone…

Hello, my beautiful readers. This week, we continue our critically detailed look at the markets in hopes of getting profitable trading opportunities. As usual, I'll be starting with the DXY (US Dollar Index) since it holds considerable sway over the Major currency pairs.

The most prominent technical factor that jumped at me as soon as I saw the chart though was the wedge I marked above.

If you've followed my analyses closely for a while now you'll already understand why I always look to the price action on the DXY (US Dollar) chart for clarity on how to approach trading the major pairs. Looking at the chart above, we see clearly the descending wedge leading price off right into the PIVOT demand zone

A comparative examination of the strength of the US-Dollar often gives tangible insight into the direction of Gold (XAUUSD). The chart above indicates the expectation of a bullish price reaction from the demand zone.

A comparative examination of the strength of the US-Dollar often gives tangible insight into the direction of Gold (XAUUSD). The chart above indicates the expectation of a bullish price reaction from the demand zone

The US Dollar has been remarkably sluggish for the past few weeks despite being within a distinct Demand zone. My expectation of a springing rebound off the demand zone has not exactly played out yet, however, the zone remains unbroken.

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!